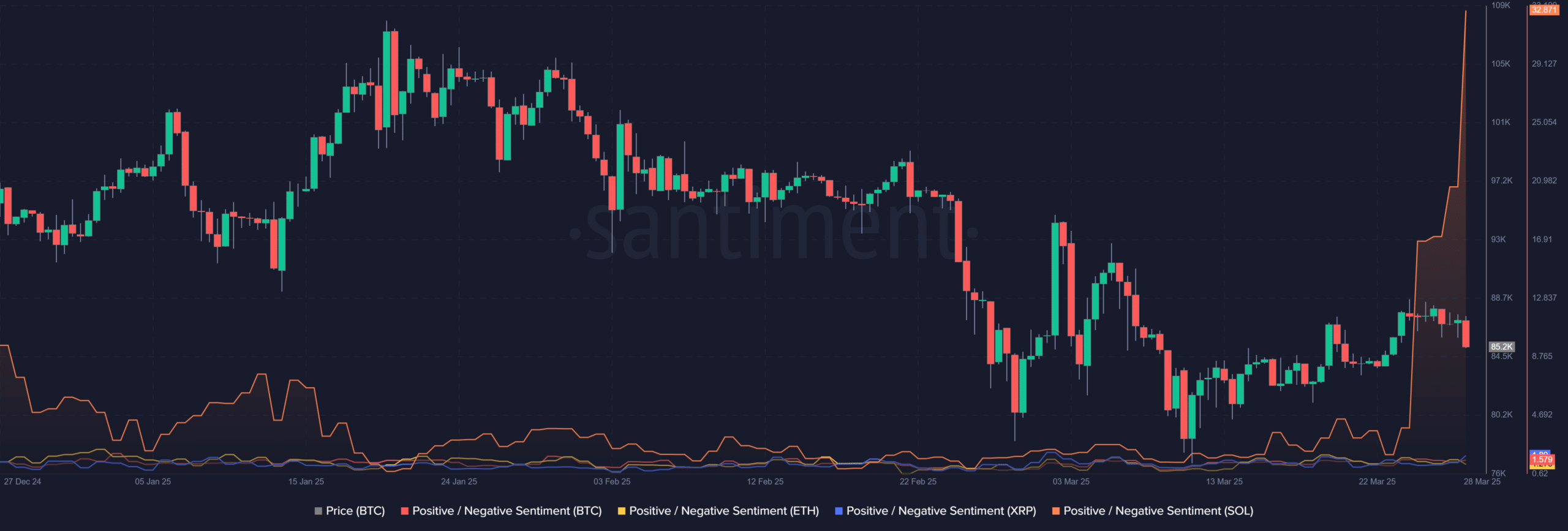

- Solana’s sentiment ratio surged to 32.87, outpacing BTC and ETH.

- Worth remained range-bound close to $132, with resistance at $140.

Solana [SOL] has turn into the focus within the crypto market, driving a contemporary wave of optimism fueled by institutional curiosity.

With BlackRock launching yield-bearing tokenized treasury funds on the community and GameStop integrating Bitcoin by way of Solana’s [SOL] infrastructure, sentiment round SOL has surged to unprecedented ranges.

However will this social momentum translate right into a value breakout?

Sentiment soars as establishments embrace Solana

Information from Santiment reveals a pointy spike in Solana’s Constructive/Detrimental Sentiment Ratio, climbing to 32.87 – far outpacing sentiment ranges round Bitcoin [BTC], Ethereum [ETH], and Ripple[XRP].

This sharp divergence underscores a singular bullish tilt for SOL on social platforms, suggesting rising investor confidence.

The spike coincides with BlackRock’s strategic use of Solana’s infrastructure and GameStop’s broader crypto pivot, each of which have been closely amplified by influencers and neighborhood assist.

This fusion of technological utility and mainstream integration has created the right storm for a sentiment-driven rally.

Worth motion faces resistance regardless of social optimism

Regardless of the sentiment frenzy, Solana’s value motion is flashing warning. On the time of writing, SOL was buying and selling at $132.49, registering a 4.27% intraday dip.

The 50-day Shifting Common (MA) at $133.74 has acted as a key resistance degree, whereas the 200-day MA at $183.04 loomed far above, highlighting how a lot floor SOL must reclaim for a real pattern reversal.

At press time, the Bollinger Bands had been tightening, reflecting contracting volatility.

In the meantime, the Common True Vary (ATR) sat at 6.18, suggesting that SOL stays in a low-volatility regime – a possible prelude to an explosive transfer in both course.

Is the market underestimating Solana?

SOL’s value sample signifies consolidation somewhat than a breakout regardless of the overly bullish sentiment amongst merchants. This disparity suggests a possible disconnect between emotional optimism and technical resistance ranges.

Traditionally, such euphoria may be dangerous, particularly when unsupported by quantity and value motion.

Nonetheless, Solana’s strong developer ecosystem and real-world purposes in tokenized finance, like BlackRock’s current initiative, supply stable fundamentals.

If SOL surpasses the $140 mark and turns its short-term resistance into assist, a fast upward motion may observe, fueled by persistent social sentiment.