- BNB Sensible Chain has recorded the best quantity throughout all different chains prior to now month, with its TVL rising.

- Shopping for quantity within the derivatives market noticed a corresponding surge amongst Binance and OKX merchants.

Up to now 24 hours, Binance Coin [BNB] has seen a minimal surge of two.14%, persevering with its bullish streak from the previous week of 10.24%, because it trades at $670.98.

Evaluation of the market situation confirmed that BNB was possible set to proceed its bullish path, as a number of market sentiments remained in favor, together with its development in quantity on-chain and throughout the derivatives market.

New excessive regardless of market downtime

BNB Sensible Chain stays the one chain out there over the previous seven and 30 days to have recorded constructive quantity development, whereas different chains, together with Solana [SOL], Ethereum [ETH], Base, and Arbitrum [ARB] have seen a drop.

On the time of study, DeFiLlama confirmed that weekly quantity development reached 66.63%, reaching $31.194 billion, and prior to now 24 hours, it has climbed to $3.735 billion, the best throughout all chains.

The Complete Worth Locked (TVL), which is used to find out the quantity locked inside protocols on a series, has seen regular development within the case of BSC. Between the third of February and press time, TVL has risen from $4.895 billion to $5.56 billion.

When there’s a big surge equivalent to this—a $665 million enhance in TVL—it suggests rising confidence in BNB, as renewed curiosity tends to result in a worth rally whereas provide throughout exchanges reduces on the similar time.

Shopping for quantity surge on exchanges

There’s been a surge within the shopping for quantity of BNB throughout high cryptocurrency exchanges, Binance and OKX, amongst perpetual market merchants.

This was confirmed with the Taker Purchase Promote Ratio surging considerably above 1 on each exchanges—Binance and OKX—with readings of 1.727 and a couple of.33, respectively.

When the Taker Purchase Promote Ratio is above 1, it suggests there’s extra shopping for quantity out there amongst these perpetual merchants than promoting quantity.

Sometimes, the additional away from 1 it’s, the extra shopping for quantity there’s in comparison with promoting quantity.

The Open Curiosity, which information the quantity of unsettled spinoff contracts out there, has additionally seen a gradual rise, with development of 1.78%, bringing the entire worth of those contracts to $866.70 million.

Resilience regardless of trade circulation will increase

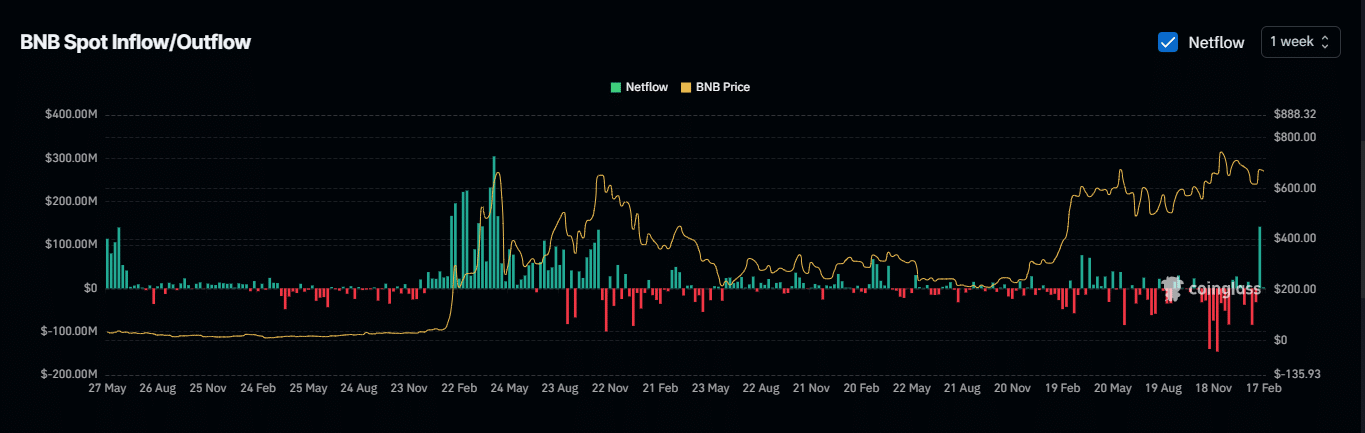

Up to now week, between the tenth to the sixteenth of February, a large surge in trade netflow was recorded, with a studying of roughly $142 million in netflow—the best since Could 2021.

When there’s a surge equivalent to this, it signifies that sellers are shifting their belongings into exchanges with the objective of promoting.

Nevertheless, regardless of this huge promote quantity on the spot market, BNB surged 10%, indicating the presence of demand to accumulate the bought belongings.

Ought to this demand maintain rising, BNB may proceed to surge shifting into the week.