- Cardano wants a 1,960% surge to hit the $10 mark, mirroring its previous exponential rallies. Can historical past repeat itself?

- Lively addresses have dropped considerably—will ADA’s community exercise get better in time to gasoline a serious value breakout?

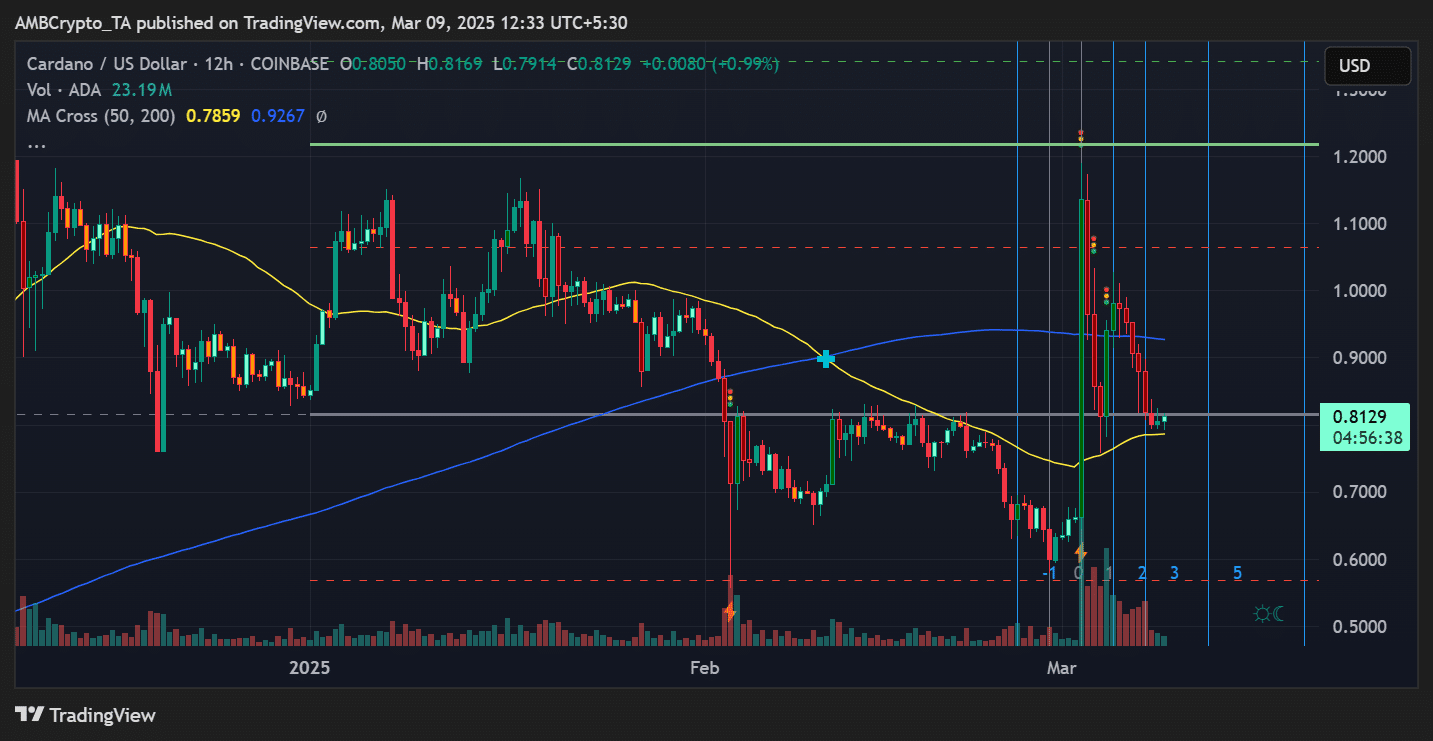

Cardano [ADA] has been exhibiting indicators of a possible breakout, with analysts eyeing a surge towards the $10 value mark. The asset has maintained assist above $0.80 and is testing the important resistance at $1.20.

If it efficiently clears this barrier, a considerable rally may comply with. Nevertheless, reaching this formidable goal would require a big value improve.

To evaluate the feasibility of such a transfer, on-chain information and historic tendencies should be thought-about.

Key value ranges for ADA’s potential rally

The present construction of Cardano’s value motion suggests a historic fractal formation, mirroring previous bullish cycles.

The weekly chart signifies that ADA has beforehand skilled exponential surges as soon as it broke previous main resistance zones.

If this sample repeats, the subsequent leg of the rally may push Cardano towards the projected $10 value vary.

Within the brief time period, ADA faces important resistance at $1.20, a degree that has acted as each assist and resistance in previous cycles. Past this, $1.50, $2.20, and $3.00 stay key psychological ranges.

Breaking by means of these may set the stage for additional features.

Nevertheless, ADA should keep its place above $0.80, which presently serves as a vital assist zone. A failure to carry this degree may invalidate the bullish outlook, resulting in a deeper retracement.

On-chain metrics: Does the information assist a rally?

Analyzing Every day Lively Addresses, a big drop has been famous in consumer exercise.

The newest on-chain information exhibits a pointy decline within the variety of energetic addresses interacting with the community, suggesting decreased community engagement.

Traditionally, a rise in energetic addresses has preceded main value rallies, that means that ADA may want a surge in community participation to assist its upward motion.

Moreover, buying and selling quantity and liquidity are necessary components to observe. The latest quantity information suggests that purchasing strain stays regular, however has but to point out the explosive progress seen in earlier breakouts.

If quantity spikes alongside a value breakout, it might sign sturdy market confidence.

Historic comparability: How a lot would ADA want to realize?

A have a look at ADA’s previous bull runs supplies a reference level for its potential upside. In the course of the 2021 cycle, ADA noticed a 2,600% improve inside the same timeframe.

If the same sample have been to emerge, ADA would require an roughly 1,960% surge to succeed in the $10 goal.

Whereas such a transfer just isn’t unprecedented, it might require a mix of sturdy market sentiment, elevated adoption, and total crypto market momentum.

Will ADA get away or face rejection?

The subsequent few weeks might be important in figuring out whether or not Cardano can maintain its bullish trajectory. If ADA clears the $1.20 resistance, a transfer towards $2.20 and past turns into more and more believable.

Nevertheless, failure to interrupt this degree may result in additional consolidation, delaying the anticipated rally.

Buyers ought to monitor on-chain exercise, buying and selling quantity, and macroeconomic components influencing the broader market.

Whereas ADA’s previous efficiency suggests the potential for a serious rally, its means to succeed in $10 is dependent upon sustained momentum and elevated investor participation.

At its present value, ADA stays at a vital level. Whether or not it surges to new highs or faces resistance, merchants might be intently looking forward to the subsequent main transfer.