- Cardano’s worth drop is paired with stagnant consumer engagement and a cooling derivatives market.

- Fading curiosity in ADA indicators declining relevance, because the market shifts towards quicker, newer belongings.

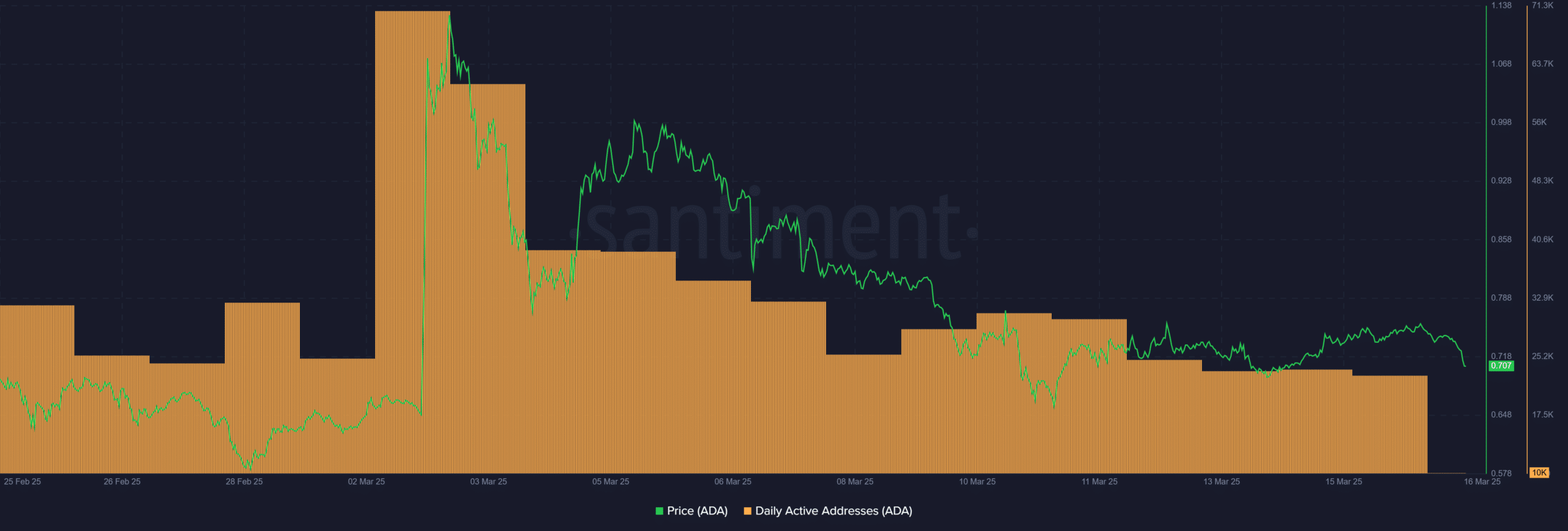

Cardano [ADA] is slipping — and never simply in worth. The community has shed over 9% previously week, however what’s extra telling is the stall in day by day energetic addresses, at the same time as different altcoins present indicators of revival.

With Open Curiosity and Funding Charges providing little momentum, the info factors to a deeper drawback: fading consumer engagement and an absence of conviction from merchants, elevating questions on ADA’s relevance within the evolving Layer 1 panorama.

Cardano’s community use exhibits no indicators of life

Regardless of ADA’s sharp 9% weekly drop, the extra troubling sign lies in Cardano’s on-chain stagnation.

Because the chart exhibits, day by day energetic addresses have hovered close to the 10K mark for the reason that sixth of March — failing to rebound even throughout temporary worth upticks.

This flatline in consumer exercise means that community participation isn’t simply cooling off — it’s plateauing.

Supply: Santiment

In contrast to rival Layer 1s which might be seeing modest recoveries in consumer interplay, Cardano’s engagement metrics stay caught, highlighting an absence of natural demand.

With no seen uptick in new or returning customers, this development raises pink flags about real-world utility and consumer retention.

Open Curiosity drops, bearish bets develop

Supply: Coinglass

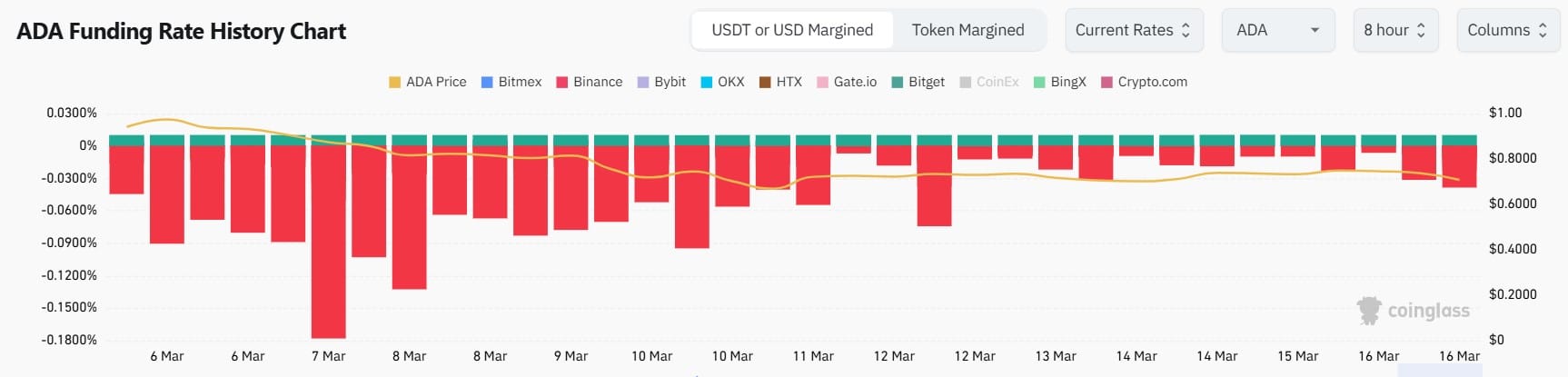

Cardano’s derivatives market is signaling a marked decline in dealer conviction. Open Curiosity in ADA Futures has fallen by practically 30% for the reason that third of March, sliding from over $1.2 billion to beneath $900 million.

This cooling curiosity coincides with a notable dip in ADA’s worth, reflecting merchants’ rising reluctance to tackle leveraged positions.

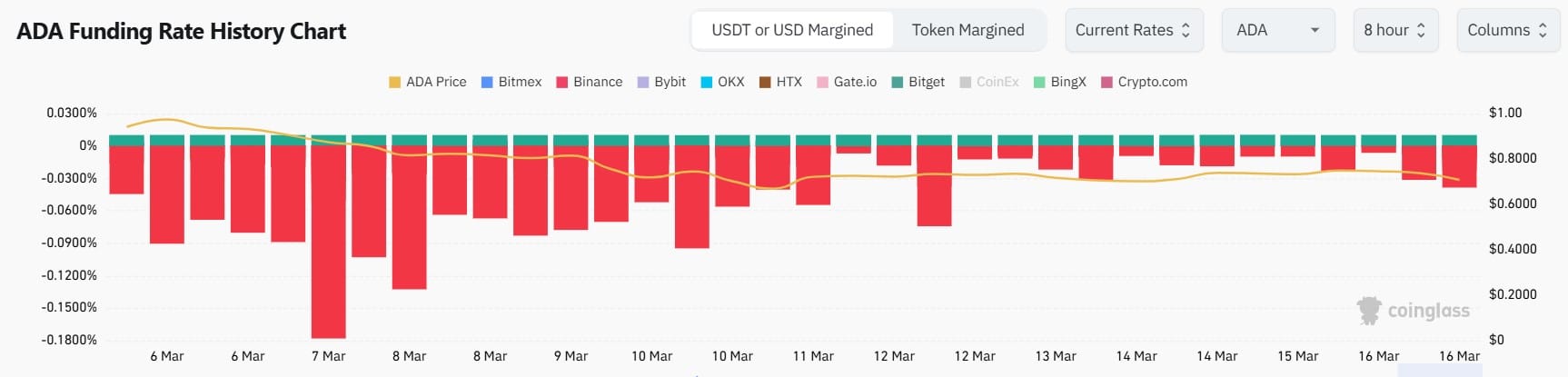

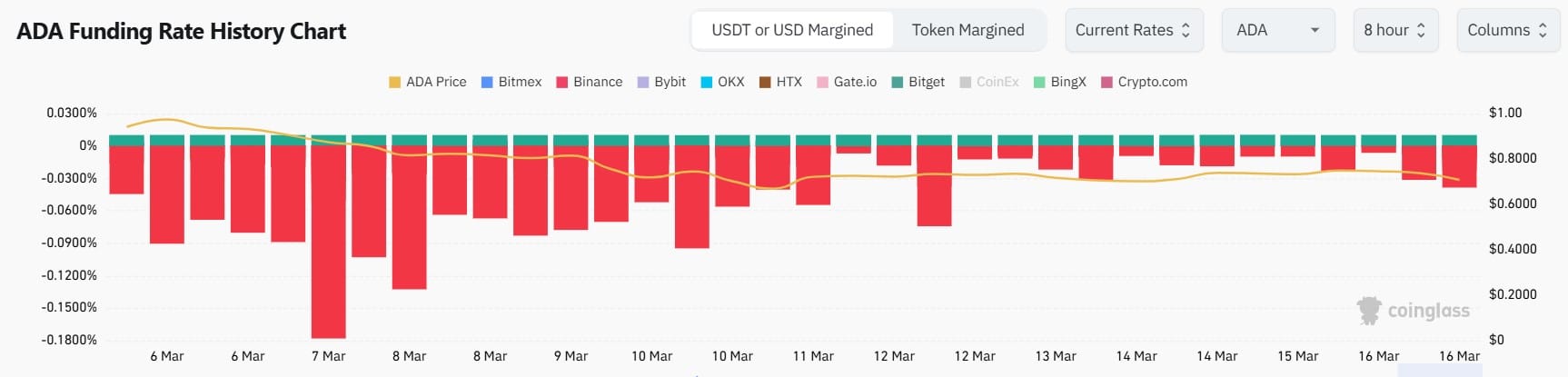

Supply: Coinglass

Extra tellingly, Funding Rates throughout main exchanges like Binance and Bybit have remained persistently destructive, with a number of plunges beneath -0.10%.

This implies brief positions are dominating, as merchants are paying a premium to keep up bearish bets.

Collectively, the drop in Open Curiosity and chronic destructive Funding Charges reveal a market leaning extra towards protection than restoration — casting doubt on ADA’s near-term upside.

Futures information paints a cautious image

Cardano’s derivatives market is flashing indicators of fatigue.

Open Curiosity in ADA Futures has dropped from over $1.2 billion on the third of March to beneath $900 million, whereas Funding Charges throughout Binance and Bybit stay deeply destructive — proof of sustained brief strain.

However this isn’t nearly ADA.

As capital rotates into Base, memecoins, and AI tokens, ADA’s sideways drift feels systemic. Cardano has seen this earlier than: spikes in TVL and consumer exercise that shortly vanish post-hype.

With no main catalyst imminent — apart from the approaching associate chains initiative and gradual DeFi integrations — ADA dangers turning into sidelined.

As soon as a retail darling, it appears to be like like Cardano now occupies the function of a legacy chain struggling to reclaim relevance in a market obsessive about velocity and novelty.

Source link