- Cardano confronted a important take a look at at $0.80–$0.66, with volatility maintaining merchants on edge.

- Giant transactions have been declining, signaling decreased whale curiosity—Will ADA regain momentum?

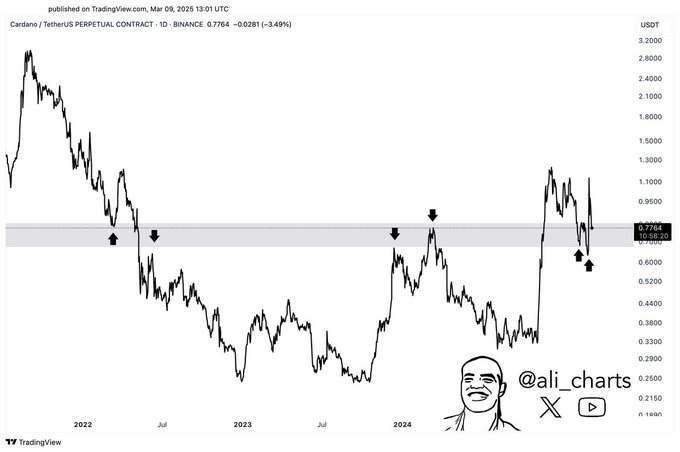

Cardano [ADA] is buying and selling inside an important help zone between $0.80 and $0.66, a stage that has traditionally performed a serious function in value actions.

The crypto market continues to indicate volatility, with ADA recording a 2.65% decline prior to now 24 hours and a 20.20% drop over the previous week.

ADA’s key help and resistance ranges

ADA’s value has returned to the $0.80–$0.66 help vary, a stage that has beforehand served as each resistance and help throughout previous market cycles.

In keeping with crypto analyst Ali Martinez, sustaining this stage might be essential in figuring out ADA’s subsequent transfer.

Historic tendencies reveal that in mid-2022, Cardano failed to carry this vary and skilled a considerable decline. In 2023, it confronted rejection at this stage earlier than lastly breaking above it in early 2024.

Now, the value has as soon as once more returned to check this important help vary.

A profitable maintain might spark a restoration, however a drop beneath $0.66 might open the door to lower cost ranges.

Technical indicators sign uncertainty

Market indicators present blended indicators for ADA. The Bollinger Bands point out that ADA is at the moment close to the decrease band at $0.5386, suggesting potential oversold situations.

The center band at $0.7871 is appearing as speedy resistance, whereas the higher band at $1.0356 stays a key breakout stage.

At press time, the Relative Energy Index (RSI) stood at 47.04, reflecting impartial situations. If the RSI strikes above 50, it might point out rising shopping for stress. Nevertheless, a drop beneath 40 might sign rising promoting exercise.

Moreover, the MACD confirmed a bearish crossover, with the MACD line at -0.0018 beneath the sign line at 0.0019, pointing to a possible continuation of the downtrend until momentum shifts.

Market exercise and investor sentiment

In keeping with Coinglass information, ADA’s buying and selling quantity has surged by 66.40% to $3.53 billion, indicating heightened market participation.

Nevertheless, Open Curiosity has dropped by 9.49% to $831.18 million, suggesting merchants are closing positions amid uncertainty. In the meantime, choices quantity has declined by 92.94% to $6.59K, exhibiting decreased speculative curiosity.

Handle exercise has seen a rise, as IntoTheBlock information studies a 7-day rise in energetic addresses (+11.99%), new addresses (+4.79%), and zero-balance addresses (+12.26%). This implies renewed community engagement, regardless of ADA buying and selling far beneath its all-time excessive of over $3.00 in 2021.

Declining massive transactions raises issues

Whale exercise has been on a downward development, as proven within the massive transactions chart. On the tenth of December, transactions peaked at 12K, however the quantity has since fallen to 4.73K within the final 24 hours.

This decline in massive transactions suggests decreased curiosity from large traders, which can restrict upward price movement.

On the time of writing, ADA was buying and selling between $0.80 and $0.90, and its capacity to remain above key help ranges will decide whether or not it might probably regain momentum.

A rebound above $0.80 might set off a transfer towards $1.00, whereas failure to carry $0.66 might push the value decrease. As volatility stays excessive, merchants will probably be watching carefully to see if ADA can stabilize or if one other downturn is on the horizon.