- Whale accumulation and bullish chart patterns trace at a possible 35% breakout.

- On-chain metrics and declining change reserves strengthen LINK’s bullish outlook.

A significant Chainlink [LINK] whale has re-entered the market, spending $2 million to accumulate 139,860 LINK at $14.3. This pockets now holds a complete of 147,553 LINK, marking a big accumulation transfer.

Apparently, this similar whale beforehand realized $161K in revenue from earlier trades, indicating a excessive stage of conviction.

The dimensions and timing of this funding recommend a strategic buildup forward of a probably risky market section, particularly as LINK reveals indicators of technical compression.

A technical breakout or one other rejection?

On the time of writing, LINK traded at $13.43, down 4.27% over the past 24 hours. The worth was compressing inside a symmetrical triangle and descending wedge, exhibiting clear indicators of buildup earlier than a significant transfer.

A breakout above the $15.68 resistance might unlock a goal round $18.18, translating to a 35% surge.

Nonetheless, persistent rejections close to the whale’s entry zone at $14.3 steered that bulls nonetheless confronted sturdy overhead stress.

A breakdown beneath the $12.57 assist would invalidate the bullish setup and certain set off a deeper correction. Due to this fact, this zone stays important for LINK’s subsequent pattern.

Does the low MVRV Ratio favor extra upside?

The MVRV Z-score for LINK was at 3.09 at press time, considerably decrease than the overheated ranges above 7 seen in late 2024.

This metric displays that almost all holders should not sitting on extreme unrealized earnings, lowering the possibility of mass profit-taking.

Traditionally, Z-scores within the 2–3 vary have offered sturdy accumulation zones and sometimes marked the early phases of value rallies. Due to this fact, the present MVRV stage signifies a good risk-reward setup.

Nonetheless, it additionally means LINK should appeal to recent demand to flee this accumulation section and construct momentum towards greater value targets.

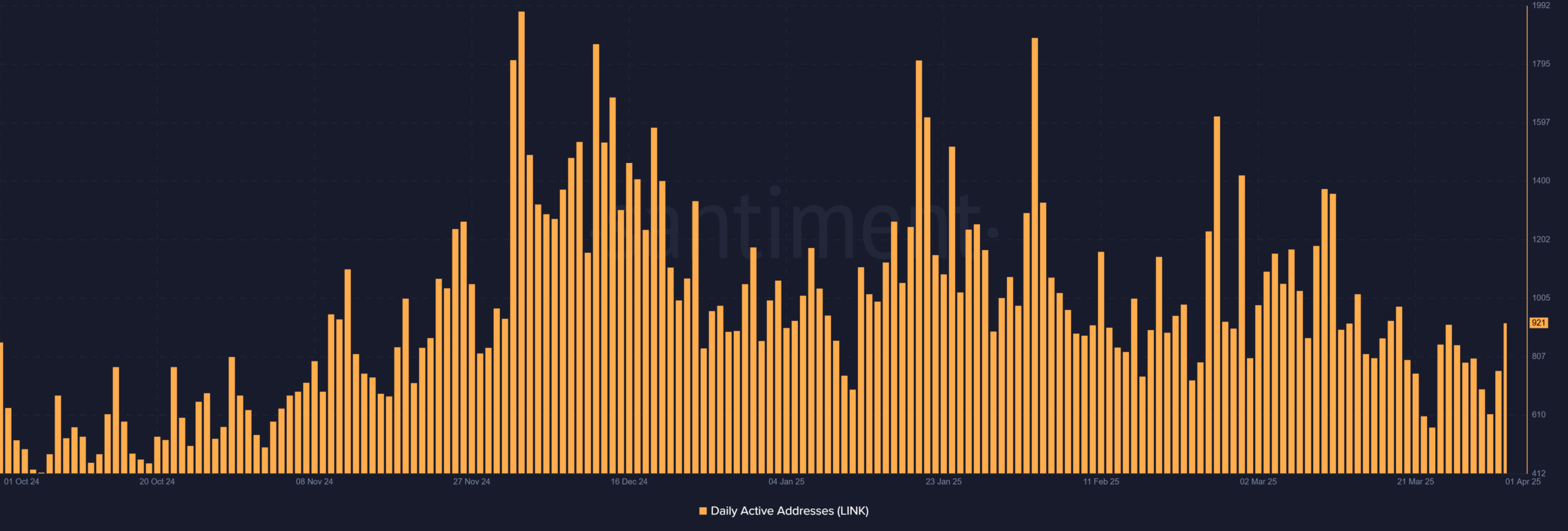

Are customers slowly returning to the community?

Each day lively addresses have proven a reasonable enhance, with 921 recorded on the time of writing. That is nonetheless beneath the high-activity intervals seen in late 2024, but it surely represents a gentle restoration from March lows.

A constant rise in lively addresses typically displays rising participation and community utilization, each of that are essential for sustaining value strikes.

Moreover, renewed person exercise can assist bullish narratives, particularly when paired with favorable technical setups. This uptick suggests renewed curiosity in LINK, even when it’s not but at peak depth.

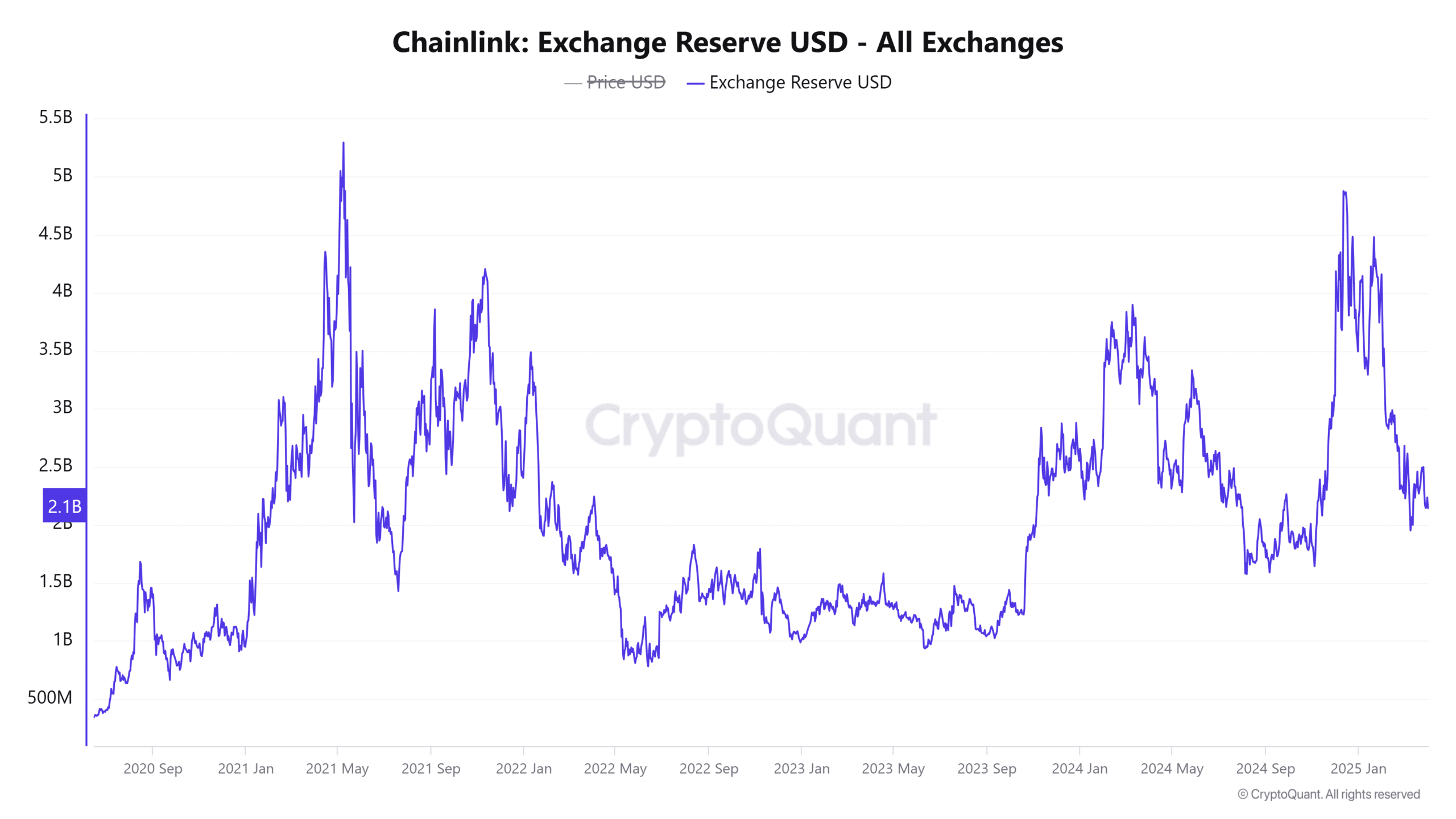

Are change reserves confirming accumulation?

Alternate reserve information reveals a 3.11% drop, with the entire reserve worth now at $2.15 billion. This lower signifies traders are withdrawing LINK from exchanges, which generally indicators intent to carry fairly than promote.

Moreover, declining reserves scale back quick promote stress and sometimes precede value rallies.

Mixed with whale accumulation and enhancing on-chain sentiment, this pattern strengthens the bullish case. Due to this fact, change habits aligns properly with a long-term accumulation section.

Conclusion

If LINK breaks above $15.68 with sturdy quantity, the 35% rally to $18.18 turns into doubtless. Whale accumulation, low MVRV danger, reducing change reserves, and regular person exercise all assist this end result.

Nonetheless, failure to carry above $12.57 might flip the narrative. Due to this fact, LINK’s breakout zone stays the final word set off for its subsequent large transfer.