- Compound had a bearish construction on the 1-day chart.

- Regardless of this, elevated shopping for stress and indicators of accumulation meant a worth transfer upward was doable.

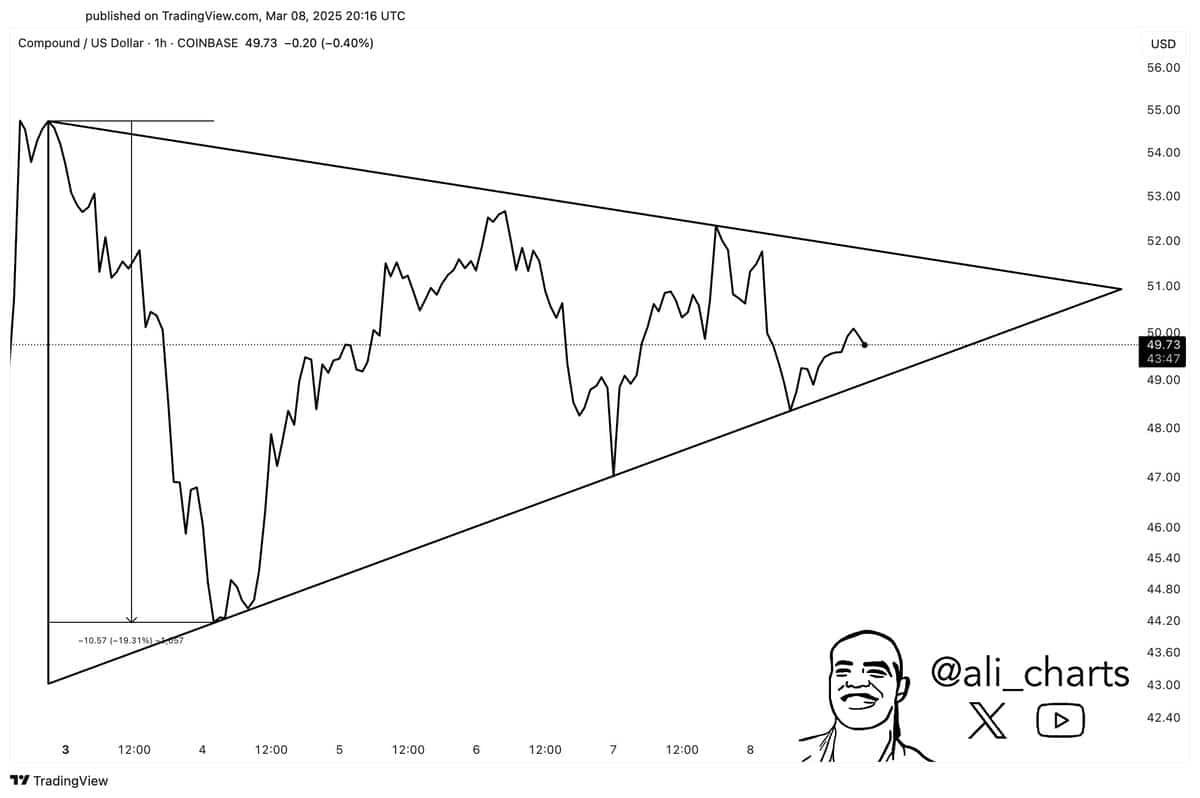

Compound [COMP] fashioned a symmetrical triangle sample, noticed in style crypto analyst Ali Martinez in a post on X (previously Twitter).

This remark was primarily based on the 1-hour chart, and a breakout might see a 20% worth acquire.

Whereas the short-term worth beneficial properties had been promising, the longer-term on-chain metrics would even be of curiosity to traders. Evaluation of the asset on the upper timeframes might additionally present actionable insights for traders.

Promoting stress on Compound in decline

Supply: CryptoQuant

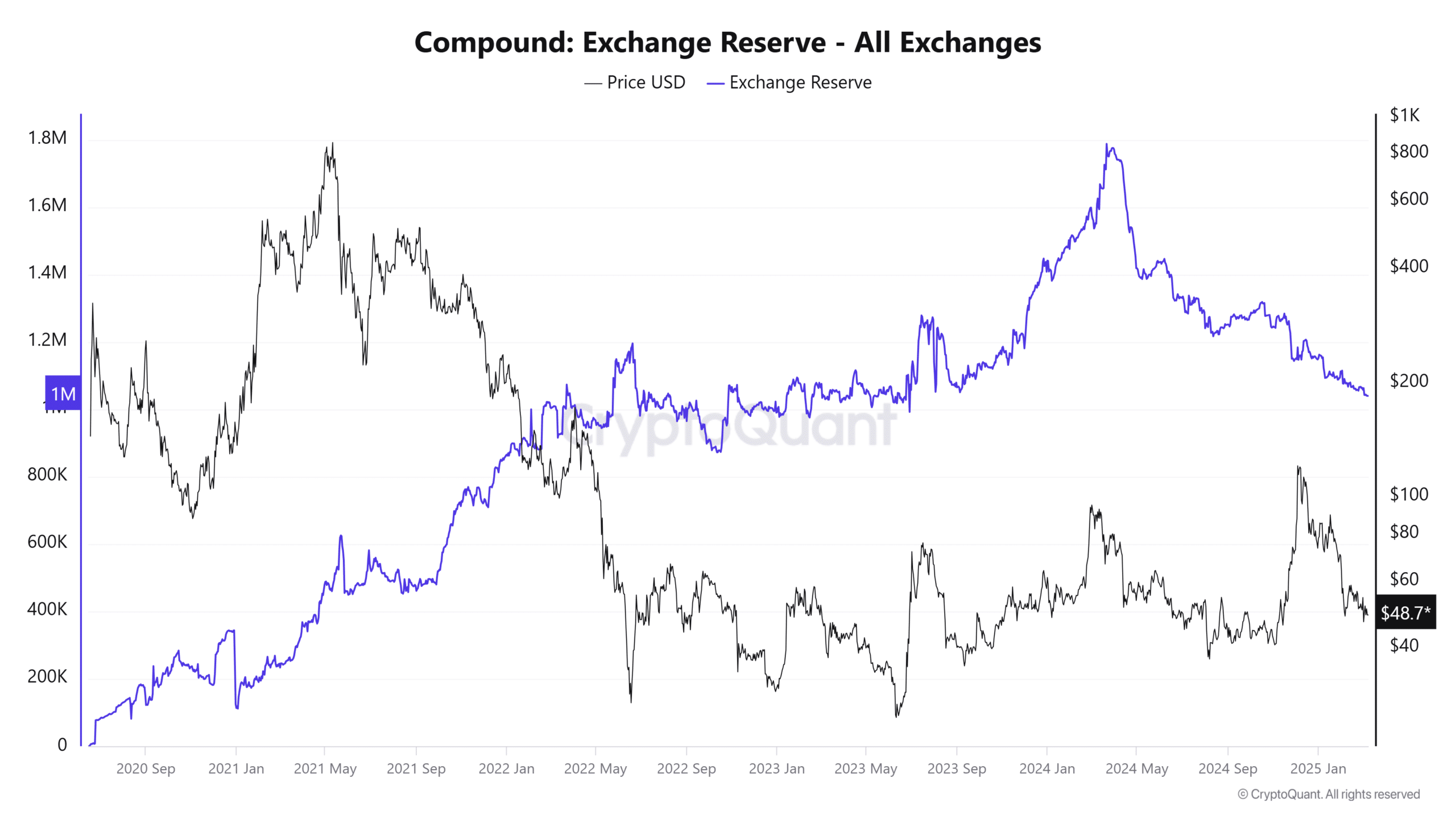

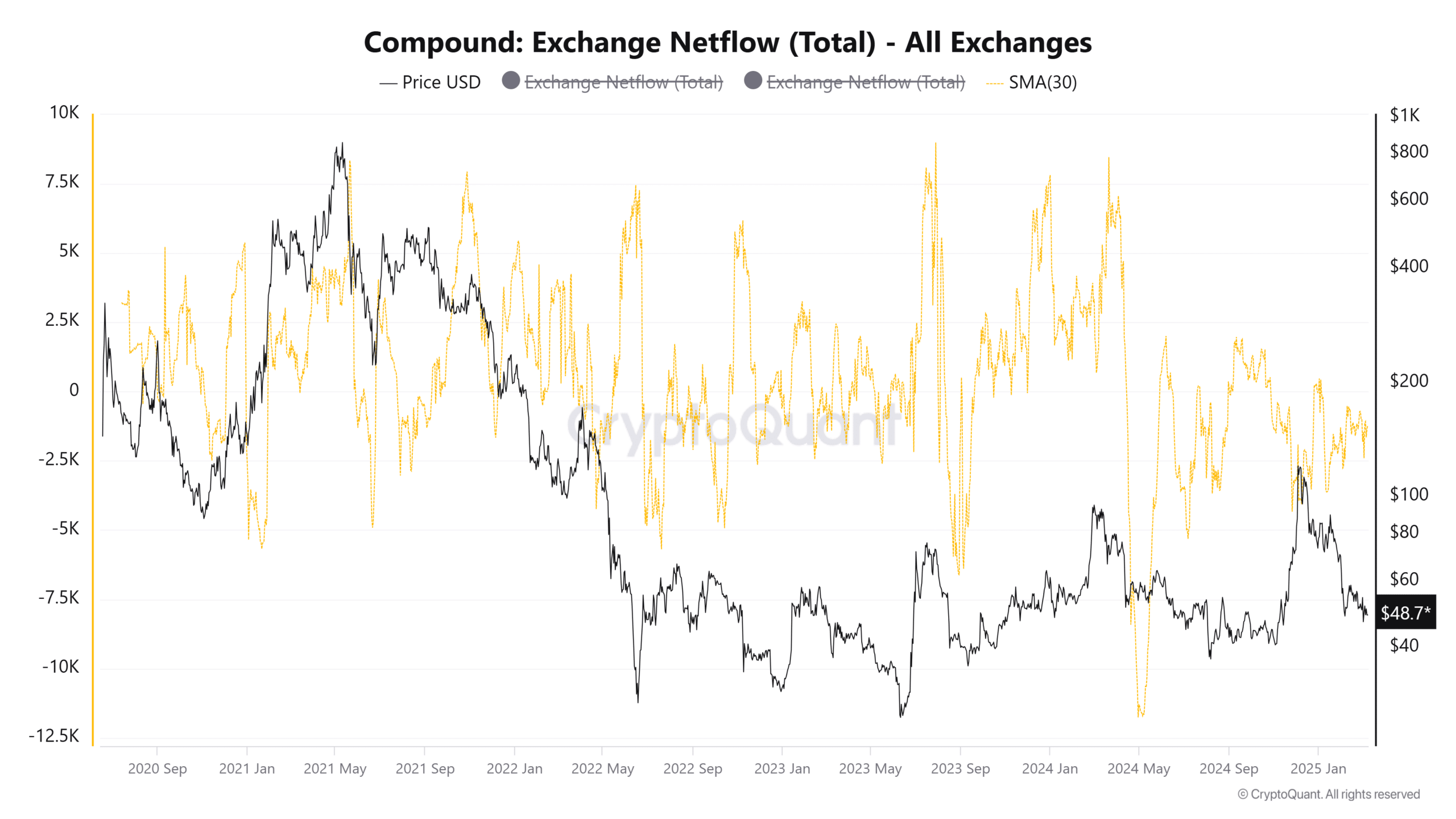

The trade reserve of an asset offers a very good indication of whether or not there may be accumulation or distribution occurring.

Throughout the bear market of 2022 and early 2023, the trade reserves had a sluggish uptrend. It was accompanied by spikes of COMP withdrawal from exchanges.

These withdrawals point out token motion out of exchanges and certain into chilly wallets, which might be a long-term bullish signal. In 2024, the trade reserve of Compound has fallen decrease.

This was a strongly bullish signal. Even through the swift rally in November, the reserves had been falling. They continued to fall over the previous three months as effectively, which might be taken as an indication of accumulation.

Supply: CryptoQuant

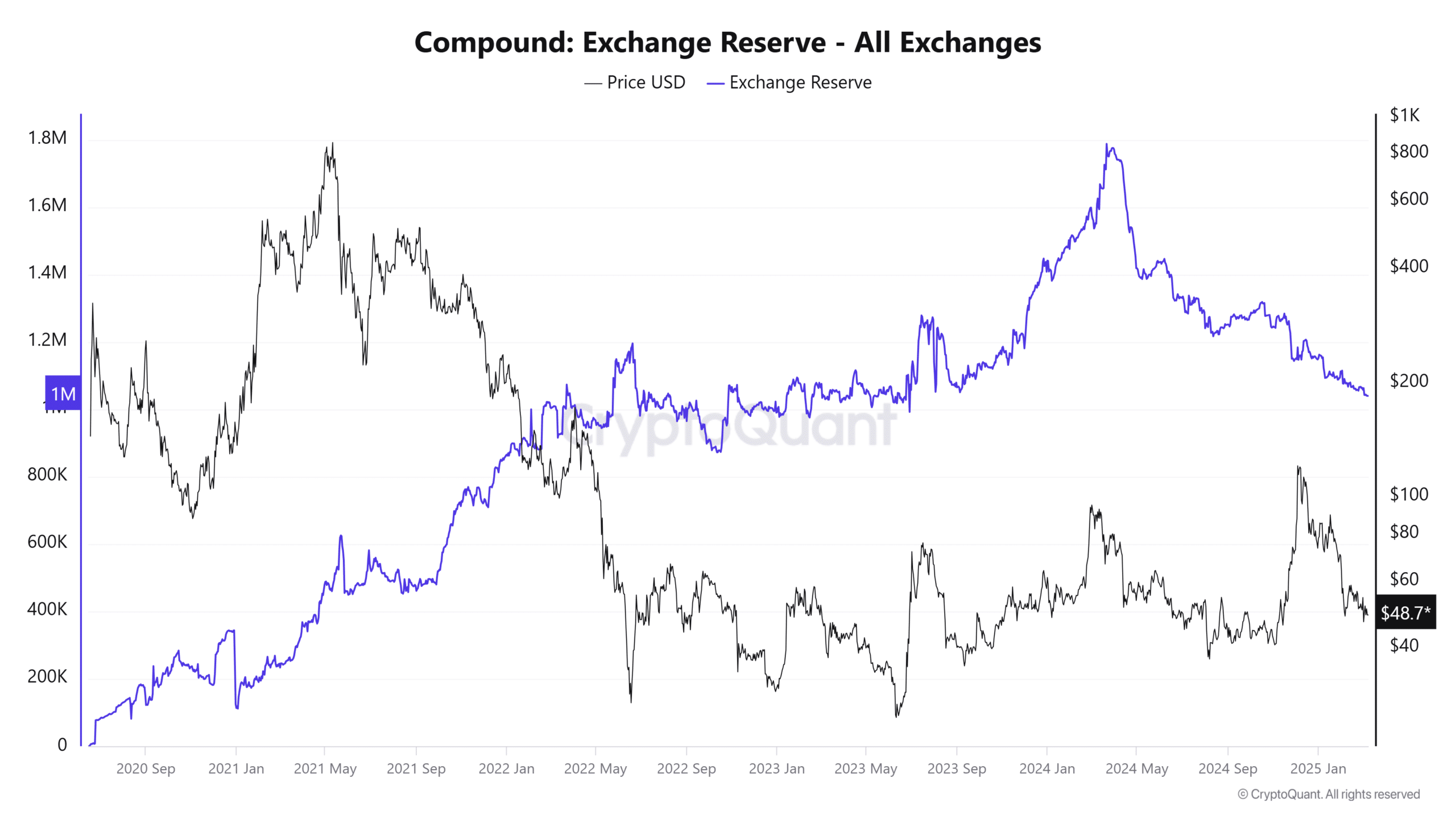

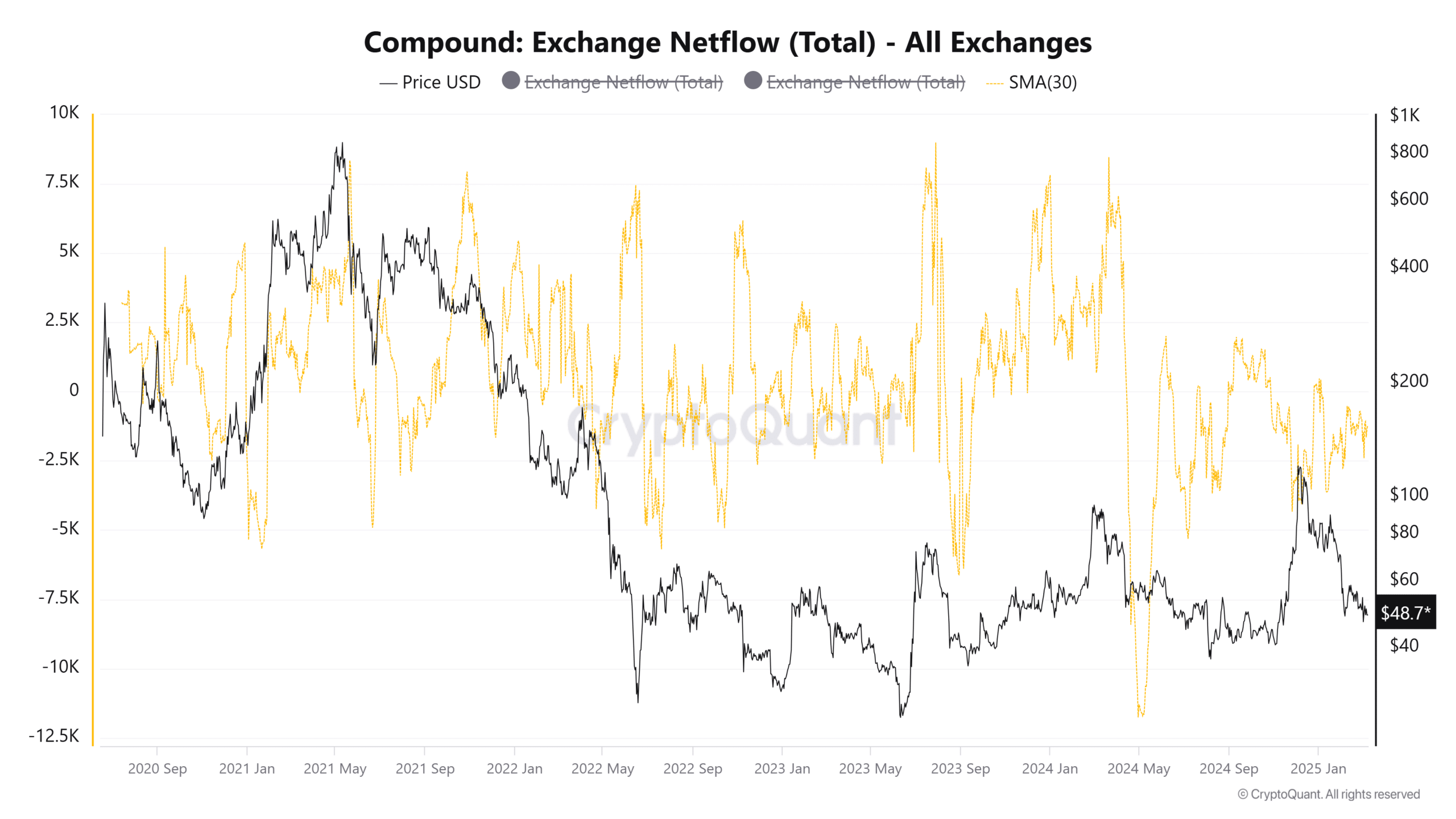

The 30-day SMA of the trade netflows confirmed that September-early November 2024 noticed robust inflows of Compound to exchanges.

This mirrored rising promoting stress, on common, as cash are moved on trade to promote or for use as collateral for coin-margined by-product trades.

Since then, the development has shifted towards outflows. Beginning within the second week of January, the netflows have been detrimental, with most days seeing no less than 1k COMP leaving exchanges.

This corroborates the trade reserves discovering.

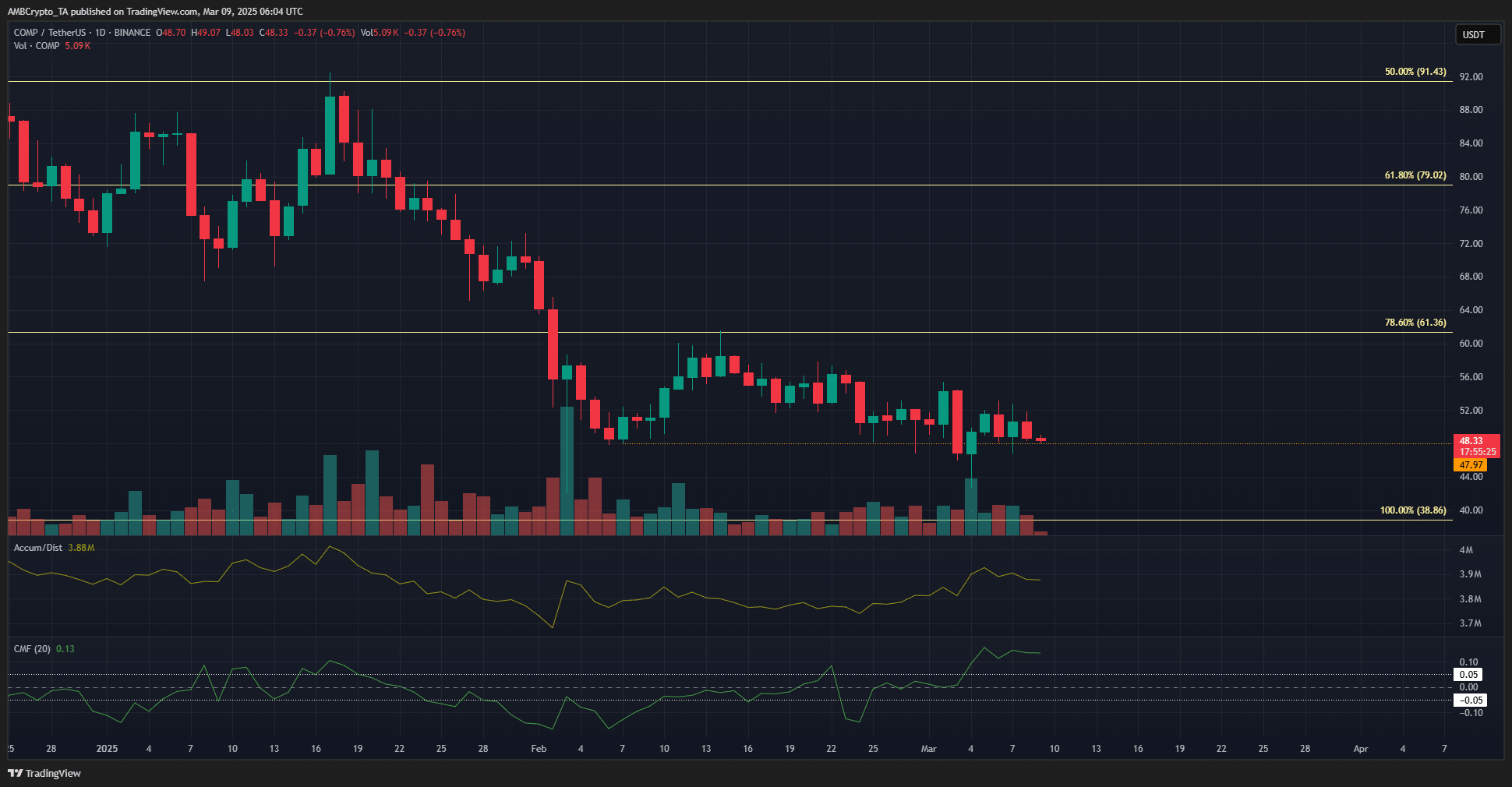

The COMP worth motion on the every day chart mirrored a bearish outlook. The DeFi token has not made a brand new increased excessive since mid-January. At press time, it was buying and selling simply above the $48 assist degree.

A drop beneath $46 would sign an impending bearish transfer.

Nevertheless, the A/D indicator has slowly crept increased over the previous 5 weeks. The CMF burst above +0.05 to indicate important capital inflows over the previous week.

Collectively, the shopping for stress might drive Compound costs increased.