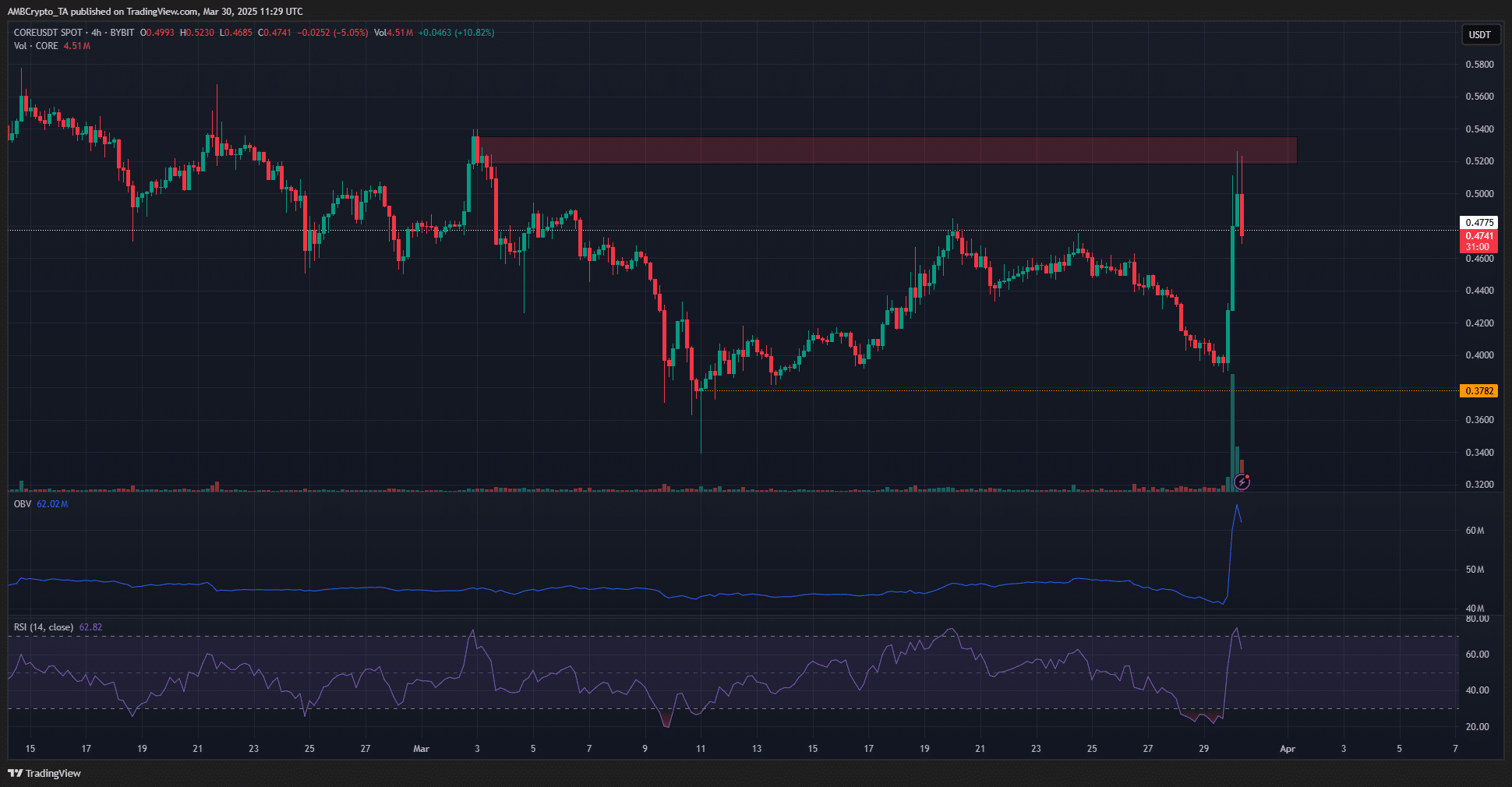

- CORE rallied past the $0.4775 resistance earlier.

- The rally was unlikely to final, regardless of the surge in buying and selling quantity.

Core [CORE] rallied 33% in 11 hours from the low on the twenty ninth of March at $0.39 to $0.52 on the thirtieth of March. This introduced many speculative merchants to the CORE markets.

Information from Coinalyze confirmed that the Open Curiosity behind the token rose 116% up to now 24 hours.

Whether or not this rally can final was unclear. The upper timeframe charts remained firmly bearish. Normally, such sturdy rallies over a weekend indicate a liquidity hunt.

Why CORE bulls would wrestle

On the 1-day chart, CORE was obstinately bearish. Its latest rally retested the $0.4775 resistance degree. This degree served as a assist in February, and earlier than that, in February 2024 as properly.

The bearish retest of this long-term S/R degree meant it was possible that the Core DAO token value would fall decrease within the coming days. Nevertheless, its buying and selling quantity was extraordinarily excessive over the weekend.

This induced the OBV to surge towards the December highs.

In the meantime, the RSI was on the verge of closing a day by day session above impartial 50. This might be one other sign of a shift in momentum, nevertheless it won’t imply an uptrend was imminent.

The upper timeframe pattern should be revered, and traders would possible be higher off being suspicious of this rally than giving in to FOMO.

On the H4 chart, a clear rejection from the bearish order block from earlier in March at $0.52 was seen. The worth was retesting the $0.4775 degree as assist, nevertheless it won’t maintain out.

Fast positive aspects over the weekend, when buying and selling volumes are normally low, meant the value motion was extra inclined to the actions of bigger market individuals.

The $0.378 was the following assist degree to observe. A transfer past $0.52 would give CORE bulls some extra meals for thought.

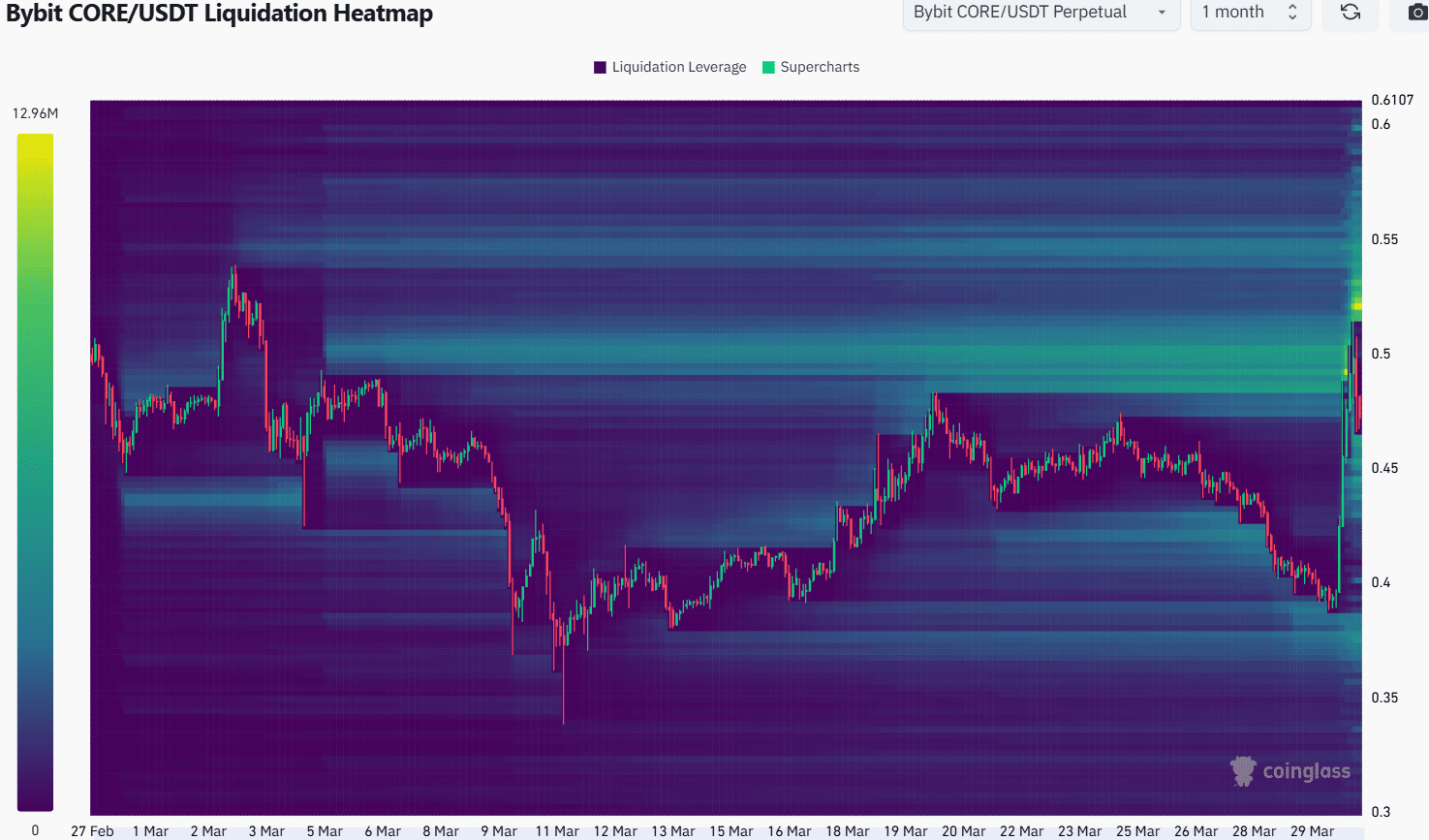

Supply: Coinglass

The liquidation heatmap highlighted the $0.5 area as a magnetic zone over the previous month. The latest value motion noticed this liquidity pocket swept.

Within the course of, a stronger magnetic zone full of quick liquidations cropped up at $0.52.

Subsequently, it was possible that CORE would see extra volatility within the coming days. One other take a look at of the $0.52-$0.53 space would possible supply a possibility to short-sell CORE.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion