- Greatest Gainers: Mantra [OM], Kaspa [KAS], and Sonic [S].

- Greatest Losers: Bitget Token [BGB], Onyxcoin [XCN], and Ethena [ENA].

The cryptocurrency market stays a battleground of volatility, with some tokens hovering to new heights whereas others face sharp declines.

This week has been no exception, with notable winners using bullish momentum and struggling belongings succumbing to promoting stress.

Right here’s a complete breakdown of the largest gainers and losers over the previous seven days.

Greatest winners

Mantra [OM]

MANTRA [OM] continues its spectacular rally, securing the highest spot for the third consecutive week with a powerful 26% acquire, as costs surged from $5.90 to $7.54.

The token’s persistent dominance underscores distinctive market power and rising institutional curiosity.

The week began with OM consolidating round $5.90, displaying comparatively quiet value motion till the 14th of February.

Nonetheless, the fifteenth of February marked a turning level as costs exploded upward, breaking a number of resistance ranges to succeed in $7.65.

Buying and selling quantity surged to 549.34K OM, validating the power behind this upward transfer.

From a technical standpoint, OM remained nicely above its 50-day [$5.38] and 200-day [$4.01] transferring averages, sustaining a strong bullish construction.

The numerous hole between its present value and these averages signaled robust momentum, although some warning is warranted for potential overextension.

OM was stabilizing close to $7.54 as of this writing, with a minor -0.57% adjustment as merchants take in latest features.

Its means to prime the weekly gainer record for 3 straight weeks is a rarity within the crypto market, highlighting sustained purchaser conviction.

Key help stood at $7.00, which may act as a stable basis for any short-term retracements.

Kaspa [KAS]

Kaspa [KAS] made an impressive recovery this week, rising 25.6% from $0.087 to $0.109. This rebound is especially important, contemplating final week’s value decline.

KAS discovered preliminary help at $0.087, resulting in a gradual climb. A surge on the eleventh of February pushed costs to $0.105, establishing a brand new help zone.

Whereas mid-week volatility noticed fluctuations close to $0.095, patrons remained in management, sustaining bullish momentum.

At press time, it was consolidating at $0.109, and KAS continues to ascertain greater lows, reinforcing renewed market confidence.

Whereas some profit-taking at this stage is predicted, the regular accumulation and powerful shopping for stress point out the uptrend would possibly persist.

Sonic [S]

Sonic [S], previously FTM, posted a 25.3% acquire, climbing from $0.41 to $0.51. This well-structured restoration follows latest market turbulence.

The week started with sideways motion close to $0.41, earlier than a breakout on the thirteenth of February propelled Sonic to $0.56 amid robust buying and selling exercise.

Though some profit-taking emerged, patrons maintained management of the pattern.

As of this writing, it was round $0.51, with help forming at greater ranges, Sonic’s momentum seems sustainable.

The measured tempo of its advance suggests real accumulation relatively than speculative surges. If shopping for curiosity continues, additional upside potential stays in play.

High 1,000 gainers

Past the highest performers, the broader market noticed notable surges.

Unchain X [UNX] led the highest 1,000 tokens with a 387% acquire, whereas TRUST AI [TRT] and STURDY [STRDY] adopted intently, posting 384% and 113% features, respectively.

Greatest losers

Bitget Token [BGB]

Bitget Token [BGB] suffered a 24.3% decline, dropping from $6.45 to $5.05, as promoting stress dominated all through the week.

The decline accelerated on the twelfth of February, breaking key help ranges and triggering additional sell-offs. Every tried bounce confronted robust resistance, forming a sample of decrease highs and decrease lows.

At the moment struggling round $5.05, any restoration would require reclaiming $5.50 to stabilize. Nonetheless, the sustained promoting stress suggests additional draw back threat.

Onyxcoin [XCN]

Onyxcoin [XCN] was the second-worst performer, dropping 14.6% from $0.026 to $0.023. The privacy-focused token failed to keep up momentum, encountering constant downward stress.

A steep decline on the eleventh and the twelfth of February pushed ONYX to $0.020, earlier than a quick rebound to $0.025. Nonetheless, the dearth of sustained shopping for curiosity brought about the worth to slip again down.

Buying and selling quantity remained regular, suggesting a sustained bearish pattern relatively than panic promoting.

The $0.022 help stage is now important—if breached, one other wave of promoting may happen. Conversely, for any restoration, ONYX should maintain above $0.025.

Ethena [ENA]

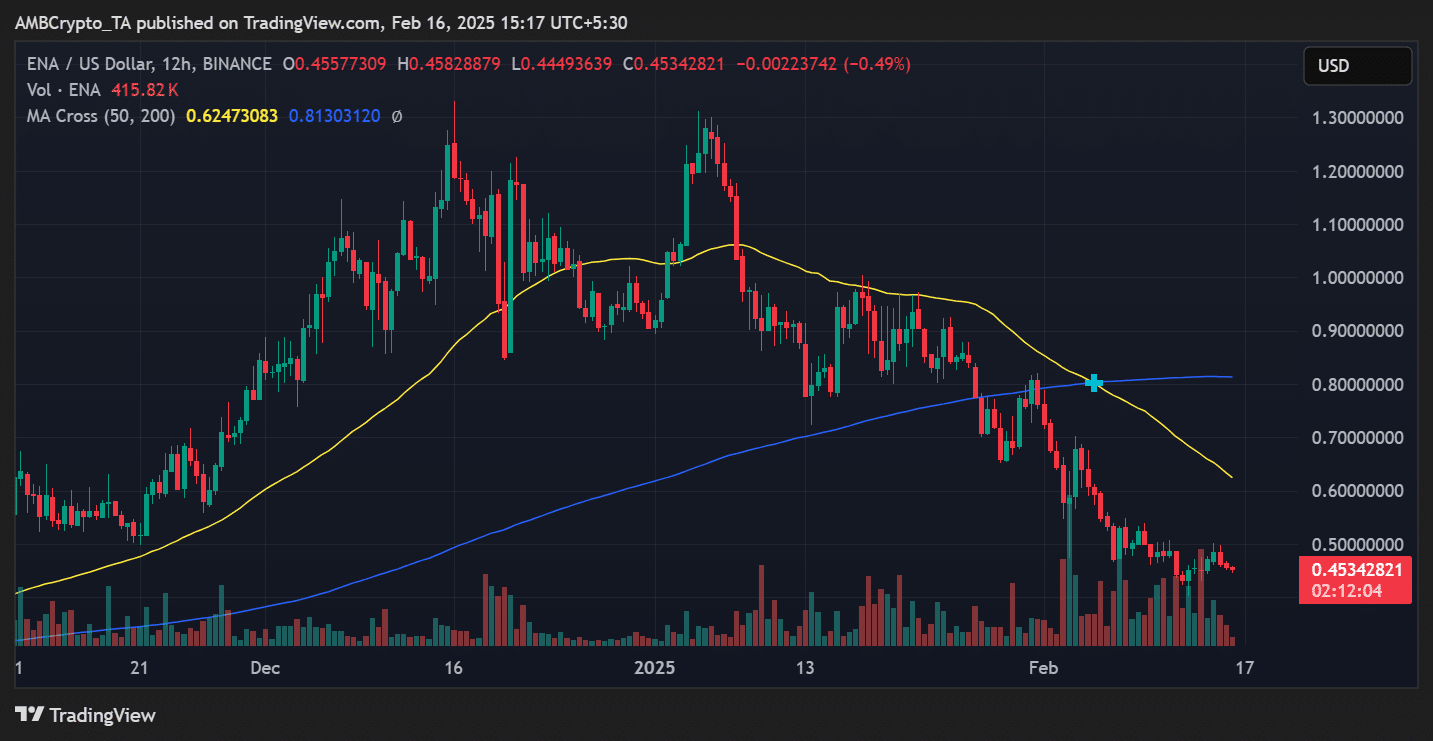

Ethena [ENA] emerged as this week’s third-biggest crypto loser, recording a pointy 11% decline from $0.50 to $0.45.

The protocol’s native token confronted intense promoting stress, significantly following its latest makes an attempt to stabilize above the essential $0.48 mark.

The weekly value motion revealed a regarding technical setup, with ENA’s chart forming a collection of decrease highs and decrease lows.

Essentially the most important breakdown occurred on the twelfth of February, when the token plunged to $0.42, marking the week’s lowest level. Although patrons stepped in to provoke a restoration, the bounce proved short-lived.

A deeper take a look at the technical indicators confirmed the 50-day transferring common crossing under the 200-day MA, forming a bearish crossover that sometimes indicators sustained downward momentum.

Buying and selling quantity has remained notably elevated through the decline, suggesting robust conviction behind the promoting stress.

Whereas ENA managed to stage a quick restoration midweek, climbing again to $0.48 on the 14th of February, the token failed to carry these features.

Sellers rapidly regained management, pushing the worth again right down to the present $0.45 stage. The constant rejection at greater costs factors to important overhead resistance.

The $0.44 stage emerges as a important help zone for merchants eyeing potential entry factors. A break under may set off one other wave of promoting, doubtlessly testing the latest lows.

Conversely, bulls have to reclaim and maintain above $0.48 to point any significant pattern reversal.

High 1,000 losers

Within the broader market, TEST [TST] led the declines with a 78% drop, adopted by 360noscope420balzeit [MLG] and Vine [VINE], which fell 53% and 50%, respectively.

Conclusion

Right here’s the weekly recap of the largest gainers and losers. It’s essential to remember the risky nature of the market, the place costs can shift quickly.

Thus, doing your individual analysis [DYOR] earlier than making funding selections is finest.