Understanding Cryptocurrency Exchanges

In navigating the world of cryptocurrency, understanding the kinds of exchanges obtainable is significant. Every sort serves totally different wants and preferences for cryptocurrency merchants and buyers.

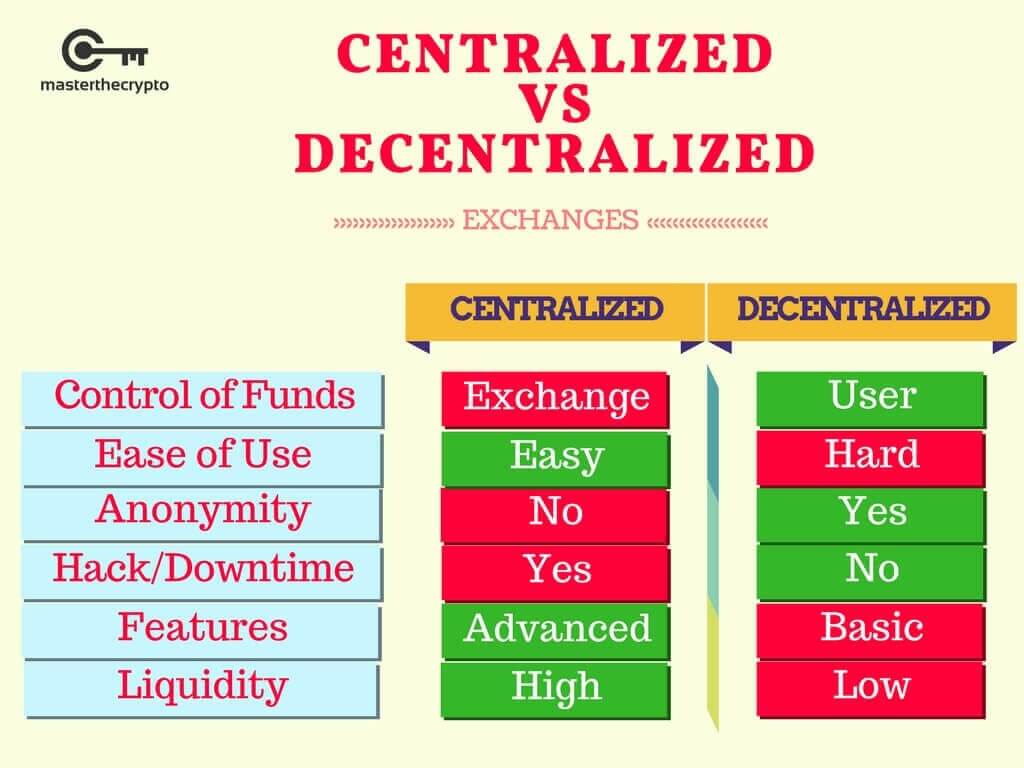

Centralized vs. Decentralized Exchanges

Centralized exchanges (CEXs) like Coinbase and Binance act as intermediaries for customers, facilitating the buying and selling course of. These platforms usually provide user-friendly interfaces, making it straightforward to purchase and promote cryptocurrencies, particularly for rookies. Nevertheless, there’s a big caveat: customers should not have direct entry to their non-public keys when storing cryptocurrency on these platforms, which might expose them to dangers comparable to hacks and bankruptcies.

Then again, decentralized cryptocurrency exchanges (DEXs) permit for peer-to-peer buying and selling with out the necessity for a intermediary. They make the most of sensible contracts on blockchain networks, enabling direct transactions between customers’ wallets (SoluLab). Whereas DEXs uphold the ideas of decentralization and consumer autonomy, they could lack the benefit of use and buyer help options usually present in centralized exchanges.

| Function | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| Management of Non-public Keys | No | Sure |

| Consumer Interface | Consumer-friendly | Typically much less intuitive |

| Safety Danger | Excessive (dangers of hacks/chapter) | Decrease (however susceptible to sensible contract points) |

| Regulatory Compliance | Sure | Varies |

| Buyer Assist | Sure | Restricted or absent |

Significance of Non-public Keys

Non-public keys are an important element of anybody’s cryptocurrency buying and selling journey. These distinctive keys grant entry to 1’s digital property. In centralized exchanges, for the reason that platform holds the non-public keys, customers relinquish direct management over their property. This could result in important points if an change turns into compromised or faces operational challenges (CoinLedger).

Decentralized exchanges empower customers by making certain they maintain their non-public keys, permitting for full management over their cryptocurrency. This independence is interesting to many seasoned merchants who prioritize safety and management. Nevertheless, managing non-public keys comes with its tasks, as shedding a non-public key usually leads to the irreversible lack of entry to property.

The choice to decide on between centralized or decentralized exchanges hinges on particular person preferences and danger tolerance. These leaning towards user-friendly experiences could want centralized platforms, whereas people targeted on safety and management could go for decentralized choices. For extra comparisons of assorted exchanges, try our cryptocurrency exchange comparison and cryptocurrency exchange reviews.

Decentralized Trade Options

Decentralized cryptocurrency exchanges (DEXs) provide distinctive options that set them other than conventional exchanges. Understanding these options can assist people make knowledgeable selections when buying and selling.

Peer-to-Peer Buying and selling

Some of the important benefits of DEXs is the power to have interaction in peer-to-peer buying and selling with out the necessity for a intermediary or centralized authority. That is achieved by way of the usage of sensible contracts on blockchain networks, enabling direct transactions between customers’ wallets (SoluLab).

Here’s a fast comparability of the peer-to-peer buying and selling course of versus conventional exchanges:

| Function | Peer-to-Peer Buying and selling (DEX) | Conventional Exchanges |

|---|---|---|

| Mediator | No | Sure |

| Transaction Pace | Instantaneous | Varies |

| Management of Funds | Consumer retention | Held by the change |

| Privateness Stage | Excessive | Low |

This direct buying and selling mechanism not solely offers extra management over funds but additionally enhances privateness, as customers can commerce with out disclosing private data.

Liquidity and Transaction Instances

Liquidity refers back to the ease with which an asset may be purchased or offered out there with out affecting its value. DEXs typically expertise different liquidity ranges relying on the buying and selling pairs obtainable and the quantity of merchants. Since many DEXs have decrease charges in comparison with centralized exchanges, they entice frequent merchants, which might enhance liquidity (SoluLab).

Transaction instances on DEXs may be swift however may additionally depend upon the blockchain community’s site visitors. For example, Ethereum-based DEXs like Uniswap face fuel charges that may typically enhance transaction instances and prices (Coinbase). It’s important to think about the next data relating to transaction effectivity:

| Trade Sort | Transaction Time | Typical Charges |

|---|---|---|

| DEX | Typically sooner | 0.3% on Uniswap |

| Centralized | Varies, might be delayed | Increased charges |

Total, some great benefits of peer-to-peer buying and selling and potential for decrease charges make decentralized exchanges an interesting possibility for these seeking to make investments or commerce in cryptocurrency. Exploring DEX choices additional can assist people discover the very best platform to swimsuit their buying and selling wants. For an in depth comparability of various platforms, go to our cryptocurrency exchange comparison.

Advantages of Decentralized Exchanges

Decentralized cryptocurrency exchanges (DEXs) provide a number of benefits that may improve the buying and selling expertise for customers. Two important advantages are enhanced safety and consumer privateness, in addition to a discount in counterparty dangers.

Safety and Consumer Privateness

Some of the interesting options of DEXs is the elevated safety they supply. Since these exchanges function in a decentralized method, customers retain management over their non-public keys. Which means I should not have to deposit my cryptocurrency into an change account, which is usually a potential goal for hackers. As an alternative, I can interact in peer-to-peer buying and selling immediately between wallets, lowering the danger of shedding my funds on account of a breach on the change.

Moreover, DEXs prioritize consumer privateness. Not like centralized exchanges, which normally require customers to supply private data for verification, DEXs permit me to commerce with no need to reveal delicate data. This anonymity may be notably interesting for many who wish to preserve their privateness whereas buying and selling.

| Function | Decentralized Exchanges | Centralized Exchanges |

|---|---|---|

| Management over non-public keys | Sure | No |

| Consumer privateness | Excessive | Low |

| Danger of hacks | Decrease | Increased |

Decreased Counterparty Dangers

DEXs considerably decrease counterparty dangers. In conventional exchanges, there’s at all times a chance of default from the opposite get together concerned within the commerce. Nevertheless, on decentralized exchanges, trades happen immediately between wallets. This direct interplay reduces my publicity to the default danger of a counterparty (SoluLab).

Moreover, DEXs can usually provide decrease charges on account of their lack of intermediaries. As a frequent dealer, this cost-effectiveness is engaging, permitting me to maximise my returns with out incurring excessive transaction prices. For a comparability of assorted choices, you possibly can test our cryptocurrency exchange comparison web page.

The mix of enhanced safety, consumer privateness, and diminished counterparty dangers makes decentralized cryptocurrency exchanges an interesting selection for a lot of customers within the crypto house.

Standard Decentralized Exchanges

Decentralized cryptocurrency exchanges (DEXs) present a singular buying and selling surroundings by permitting me to work together immediately with different customers with no need a government. Two of the most well-liked DEXs presently obtainable are Uniswap and PancakeSwap.

Uniswap and Ethereum

Uniswap is the biggest decentralized change constructed on the Ethereum blockchain. It boasts a complete worth locked (TVL) of greater than $4 billion, making it a frontrunner amongst DEXs. Uniswap facilitates the swapping of assorted cryptocurrency tokens, notably Ethereum and ERC-20 tokens, and has excessive liquidity and low slippage (Koinly).

One notable facet of Uniswap is its transaction charges. It sometimes prices a 0.3% charge on trades, which is distributed amongst liquidity suppliers. Extra charges could apply sooner or later, and it’s additionally vital to think about the fuel charges related to Ethereum transactions, which might typically overshadow the DEX’s charges (Coinbase).

| Function | Particulars |

|---|---|

| Whole Worth Locked | $4 billion |

| Payment Construction | 0.3% per transaction |

| Platform | Ethereum and helps a number of blockchains like BNB Good Chain and Polygon |

PancakeSwap for Binance Good Chain

PancakeSwap is the most well-liked decentralized change on the Binance Good Chain, with a TVL of $2.13 billion. It permits me to swap BEP-20 tokens simply and presents varied options for incomes rewards, comparable to farms, staking, and lotteries (Koinly).

The user-friendly interface and decrease transaction charges in comparison with Ethereum-based exchanges make PancakeSwap a lovely possibility for these seeking to interact in decentralized buying and selling. Its DEX mannequin permits me to commerce tokens immediately from my pockets with no need to register or confirm my identification.

| Function | Particulars |

|---|---|

| Whole Worth Locked | $2.13 billion |

| Token Compatibility | BEP-20 tokens |

| Further Options | Farms, Staking, Lotteries |

Each Uniswap and PancakeSwap play important roles within the quickly evolving panorama of decentralized exchanges, enabling customers to commerce with out a intermediary whereas offering distinctive options tailor-made for particular blockchain architectures. To be taught extra about how these DEX platforms function, test our article on cryptocurrency exchange comparison.

Exploring DEX Choices

When contemplating decentralized cryptocurrency exchanges (DEXs), it’s important to guage particular platforms that cater to numerous buying and selling wants. Two notable choices are Curve, designed for stablecoin buying and selling, and dYdX, which focuses on perpetual choices buying and selling.

Curve for Stablecoin Buying and selling

Curve is a widely known DEX that focuses on the safe buying and selling of stablecoins and pegged cryptocurrencies. With a Whole Worth Locked (TVL) of $4.22 billion, it persistently ranks among the many prime platforms within the decentralized finance house.

Curve excels in making certain low slippage and minimal charges when buying and selling stablecoins, making it very best for customers who search effectivity of their transactions. The platform’s algorithm is particularly optimized for swapping property that preserve a steady worth, which is especially useful for stablecoin merchants. Right here’s a short view of how Curve operates:

| Function | Description |

|---|---|

| Sort | Stablecoin DEX |

| TVL | $4.22 billion |

| Slippage | Low |

| Charges | Minimal |

For these thinking about evaluating varied platforms, you possibly can test our complete cryptocurrency exchange comparison.

dYdX for Perpetual Choices

dYdX is one other pioneering DEX, primarily targeted on perpetual buying and selling choices. Supporting over 35 cryptocurrencies, it presents customers the power to commerce with leverage of as much as 20X. The platform boasts a TVL of $352 million and permits contributors to earn rewards by way of buying and selling and staking DYDX tokens.

dYdX offers a sturdy platform for these seeking to interact in derivatives buying and selling with out sacrificing the decentralization advantages. Customers can entry options like margin buying and selling and superior buying and selling instruments that rival centralized exchanges.

| Function | Description |

|---|---|

| Sort | Perpetual choices DEX |

| TVL | $352 million |

| Leverage | As much as 20X |

| Rewards | Earn by buying and selling and staking DYDX tokens |

For customers thinking about evaluating safety features and functionalities, I like to recommend checking the record of the most secure crypto exchanges in addition to studying detailed cryptocurrency exchange reviews to make knowledgeable selections.

Choosing the proper DEX is essential for efficient buying and selling methods and may considerably affect the general buying and selling expertise.

DEX Operational Particulars

Exploring the operational mechanisms of decentralized exchanges (DEXs) is essential for understanding how they operate. Two key areas of focus are the charges related to buying and selling and the modern fashions platforms like Balancer provide.

Charges and Rewards

When partaking with decentralized cryptocurrency exchanges, it’s vital to concentrate on the charges concerned. Totally different DEXs have various charge buildings, which might affect my buying and selling selections. Typically, transaction charges are paid within the cryptocurrency I’m buying and selling, and these prices can depend upon community congestion and the precise DEX getting used.

Under is a desk summarizing widespread charge varieties related to DEXs:

| Payment Sort | Description | Instance DEX |

|---|---|---|

| Buying and selling Charges | A share of the commerce quantity that goes to liquidity suppliers. | Uniswap |

| Fuel Charges | Charges required to course of transactions on the blockchain, paid to miners. | Ethereum Community |

| Withdrawal Charges | Charges charged for withdrawing funds from the change. | PancakeSwap |

As I navigate by way of totally different platforms, understanding these charges will assist to estimate the entire prices of transactions and the potential rewards from collaborating in liquidity swimming pools.

Index Fund Mannequin with Balancer

Balancer stands out amongst decentralized exchanges on account of its distinctive index fund mannequin. With a complete worth locked (TVL) of $1.1 billion, it permits customers to create diversified portfolios by way of liquidity swimming pools that may embrace as much as eight totally different cryptocurrencies (Koinly). This construction reduces the danger of impermanent loss for liquidity suppliers, which is a standard concern within the decentralized finance (DeFi) house.

A key good thing about Balancer is that it permits me to spend money on a diversified method with no need to handle every asset individually. This may be notably interesting for these simply beginning in cryptocurrency buying and selling, because it simplifies the funding course of.

To place it into perspective, right here is how Balancer’s liquidity swimming pools may be structured:

| Pool Identify | Allotted Property | Proportion (%) |

|---|---|---|

| Stablecoin Pool | USDC, DAI, Tether, BUSD | 25% every |

| Governance Token Pool | Uni, AAVE, MKR, SNX, COMP | 20% every |

| Multi-Asset Pool | ETH, BTC, LINK, LTC, DOT, SOL | 15% every |

By investing in diversified liquidity swimming pools on Balancer, I can mitigate dangers related to value volatility whereas nonetheless doubtlessly incomes rewards by way of transaction charges. This makes Balancer an intriguing possibility for these seeking to enterprise into the world of decentralized exchanges.

For extra data on learn how to navigate totally different exchanges, take into account testing our cryptocurrency exchange comparison or studying cryptocurrency exchange reviews.

Components Influencing Trade Alternative

When selecting a cryptocurrency change, a number of components come into play, notably consumer expertise and regulatory compliance. Understanding these issues can assist me make knowledgeable selections whereas navigating the world of decentralized cryptocurrency exchanges.

Consumer Expertise Concerns

Consumer expertise is an important facet when choosing an change for buying and selling cryptocurrencies. Centralized exchanges like Coinbase are well-known for his or her user-friendly interfaces. They sometimes present handy options for purchasing, promoting, and buying and selling cryptocurrencies, making them appropriate for rookies (CoinLedger). Compared, decentralized exchanges could provide fewer help choices and a steeper studying curve.

Listed below are some key consumer expertise components to think about:

| Function | Description |

|---|---|

| Interface | The format and navigation ease of the platform. |

| Buyer Assist | Availability and responsiveness of help companies. |

| Buying and selling Options | Instruments for analyzing trades or executing orders. |

| Academic Sources | Tutorials or guides to assist rookies in understanding the platform. |

| Pace of Transactions | How rapidly orders are executed on the platform. |

As I consider choices, I discover {that a} simple interface and good buyer help could make a big distinction, particularly for these new to buying and selling in cryptocurrency.

Regulatory Compliance Consciousness

Regulatory compliance is one other vital issue to think about when evaluating cryptocurrency exchanges. Centralized exchanges comparable to Coinbase work intently with regulators to make sure adherence to cryptocurrency legal guidelines. They supply options that help regulatory compliance, together with identification verification and buyer help (CoinLedger). This makes them a well-recognized and safe possibility for a lot of customers.

Then again, decentralized exchanges don’t at all times have the identical degree of regulatory oversight. Whereas they provide larger privateness and management over my funds, they could lack buyer help for compliance-related inquiries.

When contemplating regulatory compliance, I mirror on components comparable to:

| Compliance Facet | Centralized Trade | Decentralized Trade |

|---|---|---|

| Regulation | Works intently with regulators | Restricted regulatory oversight |

| Buyer Assist | Accessible for compliance questions | Sometimes minimal help |

| Consumer Familiarity | Excessive, as customers are inclined to belief established manufacturers | Blended, customers usually want to teach themselves |

Deciding whether or not to prioritize consumer expertise or regulatory compliance will depend upon my particular person wants. For individuals who worth ease of use and direct help, centralized exchanges could also be preferable. Nevertheless, if privateness and management are major considerations, a decentralized change could be the higher possibility.

For added insights, I can discover our articles on cryptocurrency exchange reviews and cryptocurrency exchange comparison to collect extra detailed data.

Way forward for DEXs

Progress in Decentralized Buying and selling

The panorama of decentralized cryptocurrency exchanges (DEXs) is repeatedly evolving, displaying important development potential. DEXs have gained immense recognition, notably in growing economies, on account of their options comparable to peer-to-peer lending, speedy transactions, and the promise of anonymity. With only a smartphone and an web connection, anybody can entry these platforms, making them extremely inclusive.

When it comes to buying and selling exercise, decentralized exchanges primarily facilitate trades between cryptocurrency tokens quite than fiat currencies, which aligns with the rising pattern of an all-digital monetary ecosystem. The reliance on sensible contracts and liquidity swimming pools ensures that trades happen effectively, thereby contributing to the general increase in decentralized buying and selling quantity.

| Function | DEXs |

|---|---|

| Peer-to-Peer Buying and selling | Sure |

| Pace | Excessive |

| Anonymity | Sure |

| Fiat Buying and selling | No |

Potential Impression on Conventional Exchanges

Decentralized exchanges pose a singular problem to conventional exchanges. By enabling trades immediately between wallets, DEXs considerably scale back counterparty dangers. This minimization of danger implies that customers could want DEXs over centralized platforms, which are sometimes susceptible to cyberattacks or service outages. Consequently, many merchants could decide to shift to DEXs for his or her transactions, impacting the quantity and income conventional exchanges generate (SoluLab).

Along with diminished dangers, DEXs sometimes provide decrease charges in comparison with centralized exchanges on account of their lack of intermediaries (SoluLab). For frequent merchants, this cost-effectiveness can present a compelling cause to modify. Conventional exchanges could have to adapt by decreasing their charges, enhancing their safety measures, or including options that replicate some great benefits of DEXs to retain their consumer base.

As my understanding deepens, the way forward for DEXs indicators a shift in energy dynamics inside the cryptocurrency ecosystem. I foresee an rising adoption fee amongst customers, which might problem the normal change mannequin. If you happen to’re thinking about evaluating varied platforms, try our cryptocurrency exchange comparison for extra insights.