- DeFi dominance is underneath 3%, doubtlessly signaling a shopping for alternative for undervalued tokens.

- Regardless of challenges, revolutionary DeFi initiatives proceed to draw funding and present resilience.

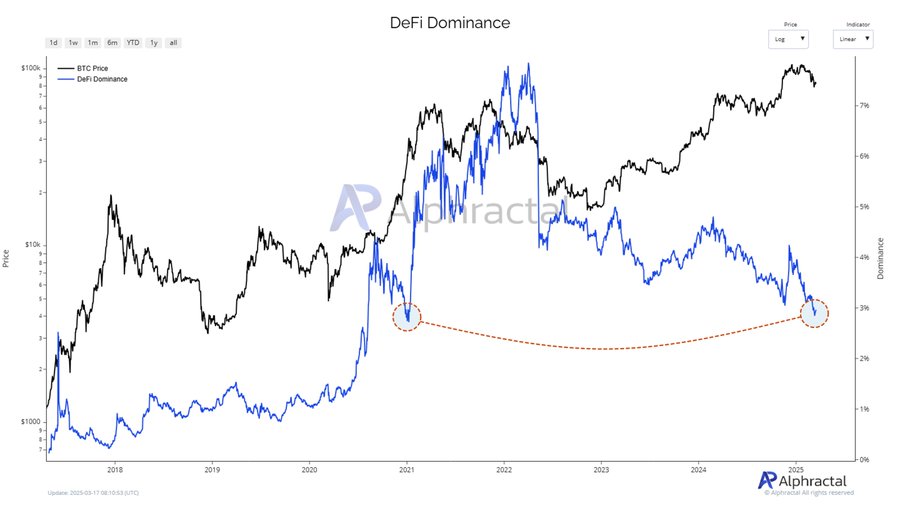

DeFi’s share of the market has quietly slipped to a historic low — underneath 3% — however that decline could also be masking a chance.

As capital continues to pay attention in Bitcoin [BTC] and Ethereum [ETH], a rising variety of traders are eyeing undervalued DeFi tokens which were left behind within the broader downturn.

Names like Chainlink [LINK], Hedera [HBAR], Avalanche [AVAX], Uniswap [UNI], and Aave [AAVE] have maintained sturdy fundamentals regardless of fading hype.

With market consideration elsewhere, this may very well be a pivotal accumulation part for high-conviction performs within the DeFi ecosystem.

DeFi dominance hits historic lows, however…

Recent data from Alphractal exhibits DeFi dominance falling beneath 3% — ranges final seen through the early 2021 cycle backside.

Notably, that earlier dip marked the beginning of a major DeFi resurgence as capital rotated out of Bitcoin into undervalued altcoins.

The present setup mirrors that historic development, with BTC buying and selling close to native highs whereas DeFi tokens lag behind.

This sharp divergence might sign a cyclical pivot level. Buyers who positioned early through the 2021 dominance trough noticed outsized returns — and the identical setup could also be unfolding now.

As broader market sentiment stays cautious, this dip in DeFi share would possibly simply be the chance affected person accumulators have been ready for.

Sector shakedown or undervaluation?

With DeFi dominance falling beneath 3%, the sector faces a pivotal second. Latest occasions have compounded uncertainty — like AAVE’s unstable value motion tied to its payment swap proposal, which raised manipulation considerations.

In the meantime, February introduced regulatory readability when the SEC dropped its enchantment in opposition to a ruling that exempted DeFi platforms from securities legal guidelines.

Nonetheless, the harm from prior enforcement fears lingers. Broader market jitters — equivalent to 17 straight days of Bitcoin ETF outflows – have additionally pushed traders towards safer belongings.

But, traditionally, related DeFi lows preceded main rebounds.

DeFi initiatives are quietly performing

Regardless of a decline in DeFi dominance, a number of initiatives proceed to reveal resilience and innovation.

Hemi Labs lately launched its mainnet with a TVL of $440 million, aiming to combine Bitcoin and Ethereum right into a unified community.

Equally, Converge, developed by Ethena and Securitize, is ready to debut in Q2 as an Ethereum-compatible blockchain that includes native KYC and custody options, focusing on institutional adoption.

Compared to different crypto sectors, DeFi’s decreased market share contrasts with the expansion noticed in different areas.

For example, World Liberty Finance, a DeFi initiative backed by former President Donald Trump, lately secured $550 million in token gross sales, indicating sustained investor curiosity.

Moreover, platforms like INFINIT are enhancing person experiences by introducing instruments such because the INFINIT Terminal, which simplifies interactions with DeFi protocols via personalised, text-based brokers.

Whereas DeFi faces challenges, these developments counsel that revolutionary initiatives proceed to draw consideration and funding, doubtlessly signaling a interval of undervaluation reasonably than a sector-wide decline.