- Dogecoin’s value struggled at $0.18 help—whales and community exercise might sign a breakout.

- MACD and RSI confirmed bearish tendencies—if DOGE fails to interrupt $0.29, additional declines are probably.

Dogecoin [DOGE] has proven blended value motion just lately, following a correction that worn out its earlier good points.

Priced at $0.1681 at press time, Dogecoin has a 24-hour buying and selling quantity of $844 million, reflecting a -0.43% change within the final 24 hours, however a 3.24% improve over the previous week.

Though Dogecoin’s value has just lately declined, there may be cautious optimism that it might rally again to $0.29. This outlook is supported by key technical ranges and market dynamics.

Dogecoin has confronted a number of corrections, retreating from its latest highs. Nevertheless, analysts consider $0.29 could also be achievable within the brief time period.

The prediction hinges on DOGE’s proximity to the 20-day Exponential Transferring Common (EMA), which might act as a help degree for future value motion.

Merchants are intently monitoring this degree for indicators of stability, which could point out a possible rally. Nevertheless, if DOGE fails to interrupt above the EMA, additional declines might comply with.

In line with Igor Bondarenko, if DOGE struggles to achieve momentum at this degree, the value might drop as little as $0.10, presenting a bearish situation for the cryptocurrency.

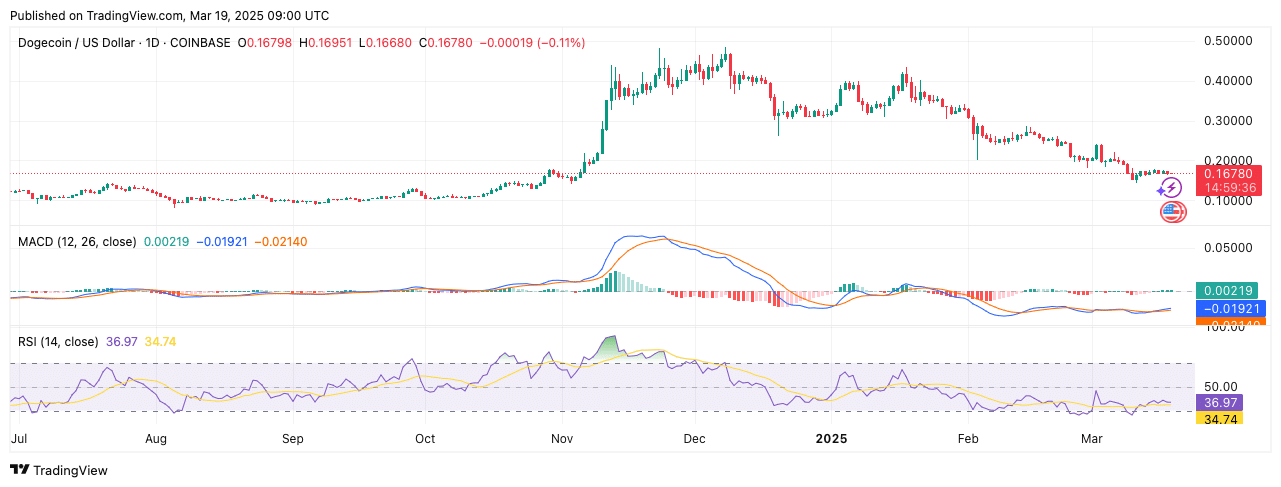

Bearish momentum in MACD and RSI

On the time of writing, the MACD indicator was displaying a bearish pattern for Dogecoin. The MACD line (blue) was under the sign line (orange), suggesting a scarcity of upward momentum.

Moreover, the histogram stays principally adverse, reinforcing the prevailing weak spot out there.

The RSI was at 36.97, just under the impartial 50 mark. This degree means that DOGE is within the oversold area, which could sign additional promoting stress if it continues to drop under 30.

If the RSI stays beneath 40, the market might expertise continued weak spot, probably resulting in additional corrections.

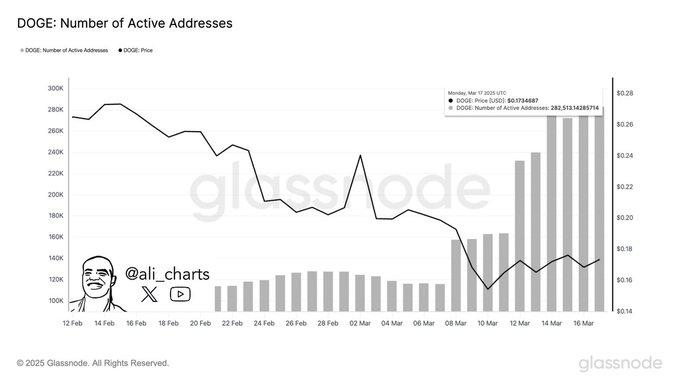

Whale exercise and community participation

Regardless of the bearish alerts, Dogecoin’s community has proven elevated exercise. In line with crypto analyst Ali Martinez, there was a notable surge in lively addresses, rising from 150,000 on the twelfth of March to over 280,000 by the 14th of March.

The spike in exercise coincided with a value improve from $0.16 to $0.26, suggesting that greater community participation drove demand.

Nevertheless, the value later retraced, indicating that the preliminary enthusiasm waned.

Moreover, giant transactions surged as whales purchased over 110 million DOGE inside every week. This inflow of main gamers supported a short-term bullish pattern but additionally hinted that some shopping for stress was non permanent.

The following value retracement means that profit-taking or market corrections might have influenced the downturn.

Resistance and help ranges

As Dogecoin strikes by way of this part of uncertainty, key resistance and help ranges are essential. The worth reached $0.202 on the sixth of March, which stays a robust resistance degree.

A break above this degree might sign a continuation of the bullish trend, however failure to take action might result in additional consolidation or declines.

On the draw back, $0.18 has emerged as a essential help degree for Dogecoin. If the value breaks under this degree, it might recommend a bearish market shift and result in additional draw back stress.

Lastly, because the market stays risky, the approaching days might be essential in figuring out Dogecoin’s subsequent main transfer.