- Ethereum’s accumulation zones sign investor confidence regardless of current market volatility.

- Key worth ranges at $2,632 and $3,149 might outline ETH’s subsequent main worth motion.

Ethereum [ETH] has skilled worth turbulence lately, leaving market watchers unsure about what lies forward. Nevertheless, a key indicator factors to regular, even bullish sentiment amongst buyers.

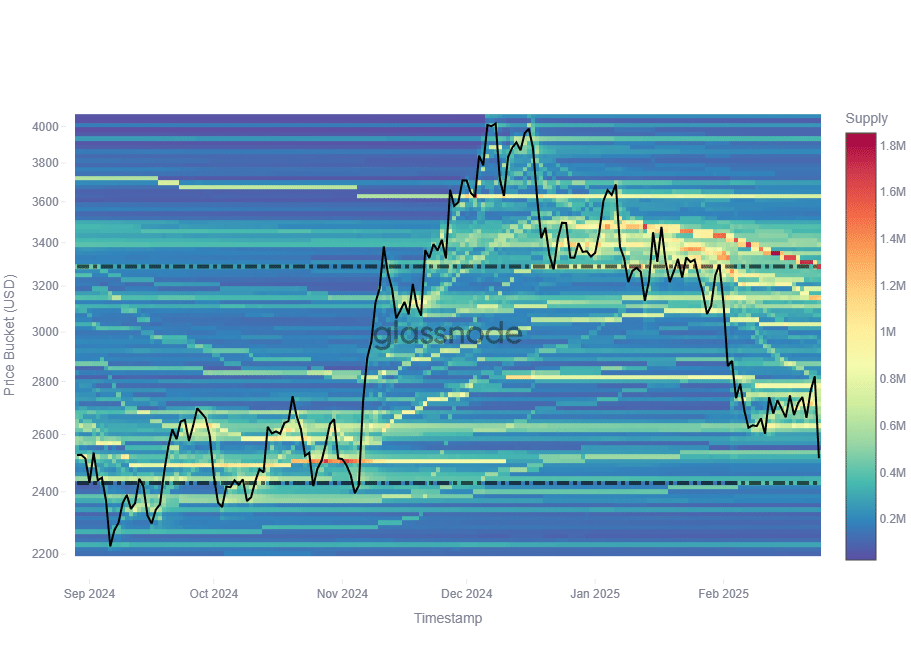

The ETH price foundation distribution reveals a notable pattern of accumulation at lower cost ranges, notably round $2,632 and $3,149.

These zones are making a strong help construction, particularly on the $2,632 mark, which might sign the start of worth stabilization after current downturns.

The query now’s: How will this help maintain up in opposition to broader market dynamics?

What the information reveals

The Value Foundation Distribution (CBD) tracks the value ranges at which buyers acquired their ETH holdings, providing insights into market sentiment and accumulation traits.

A downward shift in price bases means that buyers have been shopping for into dips, reinforcing key worth ranges.

Current Glassnode data reveals a number of price bases transferring decrease, indicating regular accumulation regardless of worth volatility.

This implies that buyers view ETH’s current decline as a shopping for alternative reasonably than a motive to exit. If this pattern continues, it might help worth stabilization.

Accumulation zones

Ethereum’s accumulation zones highlighted key worth ranges the place buyers actively constructed positions. The strongest help zone was at $2,632, the place 786.66K ETH has been gathered.

This stage represented a possible ground, as previous traits confirmed consumers stepping in aggressively round this worth.

On the flip aspect, resistance looms at $3,149, with 1.22M ETH gathered. If ETH rallies, this zone might act as a barrier, triggering sell-offs as buyers take revenue.

Traditionally, robust accumulation ranges have dictated market swings, making these zones important in assessing ETH’s subsequent transfer.

Why this issues for ETH’s future

ETH’s current worth motion pointed to a important second for its future trajectory. The RSI at 33.30 indicated that ETH was nearing oversold territory, which means a possible bounce could possibly be on the horizon.

Nevertheless, it hasn’t but reached excessive lows, suggesting additional draw back danger stays.

The MACD histogram flipping destructive reinforces the bearish momentum, with the MACD and sign traces widening aside — usually an indication of continued promoting strain.

ETH’s worth breaking under $2,500 is critical, because it threatens to check the $2,632 accumulation zone recognized earlier.

If consumers step in at this help, a restoration towards the $3,149 resistance is feasible. However failure to carry might set off a deeper correction, making the subsequent few buying and selling periods essential.