- ETH has declined by 19% over the previous month.

- Though Ethereum was experiencing robust downward strain, an analyst eyes a historic rally.

Since hitting a neighborhood excessive of $3.4k every week in the past, Ethereum [ETH] has skilled robust downward strain. After the market crash that noticed the altcoin dip to $2.1k, it has did not reclaim a better resistance degree.

On the time of writing, Ethereum was buying and selling at $2,695, marking a 5.05% drop in each day charts. The altcoin has additionally dropped on weekly and month-to-month charts by 16.51% and 19.11% respectively.

With the latest value drop, key stakeholders have shared each optimistic and pessimistic views of ETH in equal measures.

Some of the optimistic people is fashionable crypto analyst Ali Martinez, who has instructed a significant transfer for ETH.

Market sentiment evaluation

In his evaluation, Martinez posited that Ethereum is presently gearing up for a significant transfer to the upside. In response to him, the prevailing circumstances positions ETH for a possible breakout above $4,000.

This evaluation observes that if the altcoin manages to breach this resistance, it would pave the best way for a parabolic rally.

Due to this fact, ETH would rally towards $7.4k, $10k, and hit a historic $14k. Nonetheless, it’s important to notice that, these ranges are long-term and extremely unlikely to happen within the brief time period.

May Ethereum see a robust rally?

Whereas the evaluation offered above by Martinez presents a promising outlook, AMBCrypto’s evaluation tells a special story.

In response to AMBCrypto’s evaluation, Ethereum was experiencing robust downward strain, particularly within the brief time period.

For instance, Ethereum’s Sharpe Ratio (90 days) has been declining hitting detrimental territory.

At press time, this metric stood at -0.266. Such a sustained decline implies {that a} risk-adjusted return over the previous 90 days is worse than a risk-free asset.

Due to this fact, ETH is failing to compensate merchants for the dangers they take thus making the crypto much less enticing to traders.

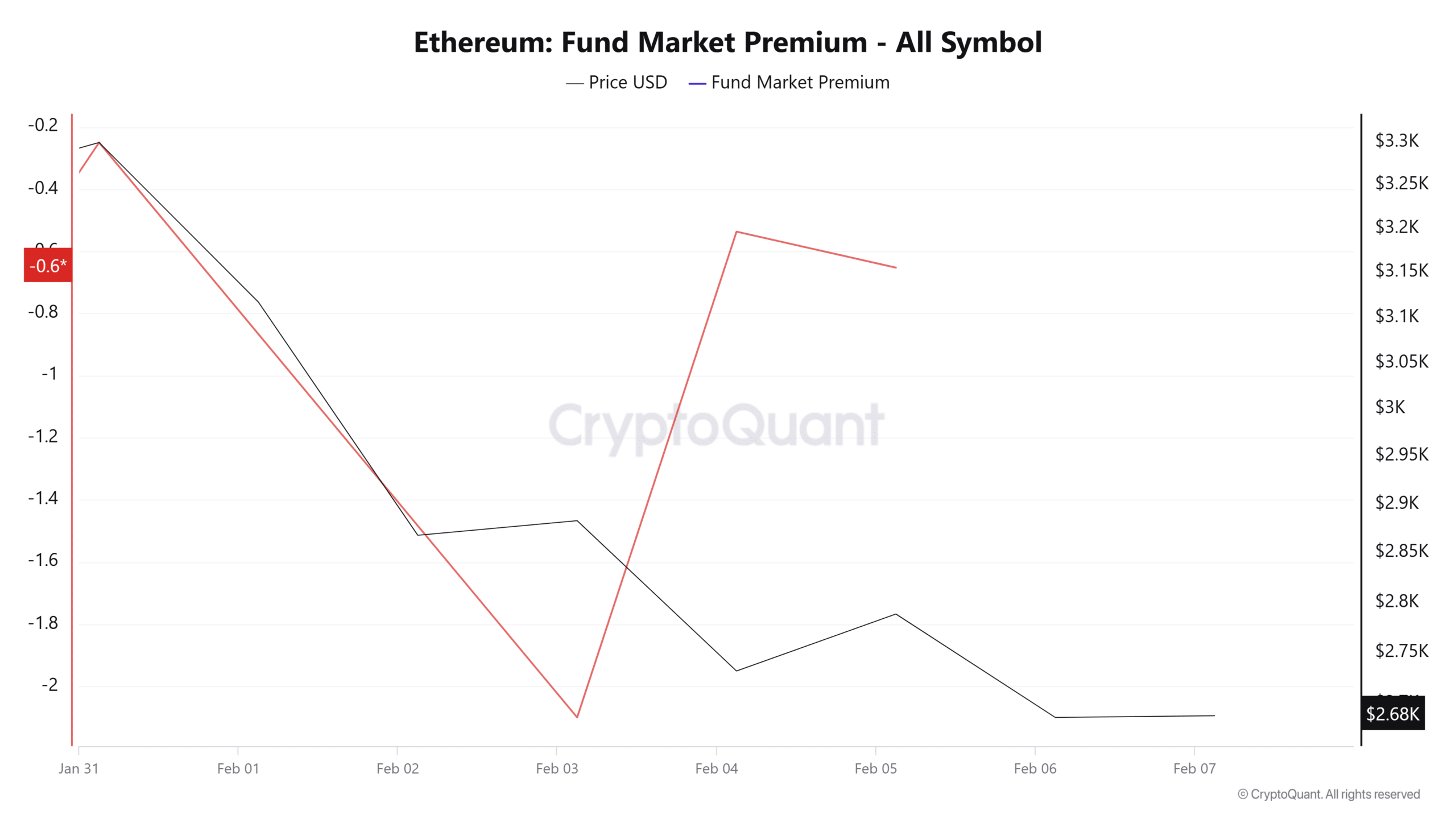

Moreover, Ethereum is experiencing robust bearish sentiment as evidenced by a detrimental Fund market premium.

This has remained detrimental all through the week implying that almost all traders are taking brief positions and anticipate costs to drop.

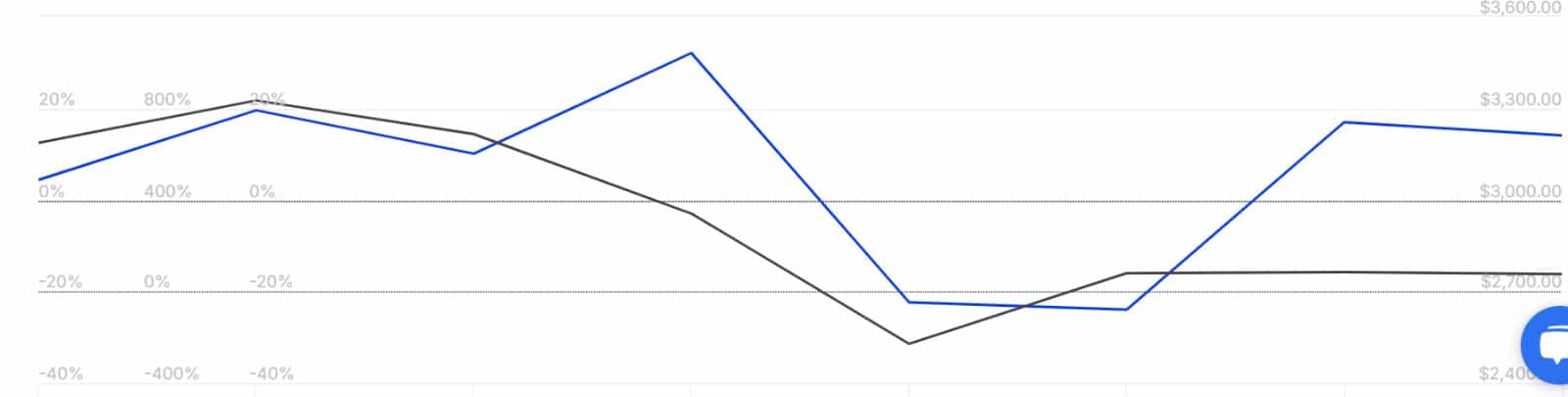

Supply: IntoTheBlock

Lastly, whales have turned bearish as they improve their deposits into exchanges. The Massive Holders Netflow to Change Netflow Ratio has risen to 14.09% from -23.91.

With extra massive holders transferring their belongings to exchanges, it causes promoting strain, additional pushing costs down.

What’s forward for ETH?

Merely put, Ethereum is experiencing short-term downward strain and will see extra losses earlier than a rebound.

Is your portfolio inexperienced? Verify the Ethereum Profit Calculator

If the present circumstances proceed, and ETH breaches its vital assist of $2.7k, it might additional drop to $2500.

Nonetheless, a development reversal will see the altcoin reclaim $2710 and try a run to $3000. The rally predicted by Martinez is unlikely within the brief time period, however in the long term, ETH will hit these ranges.