Ethereum (ETH) has tumbled to a 4-year low towards Bitcoin (BTC), additional eroding investor confidence within the second-largest cryptocurrency by market cap. The final time ETH was this weak towards BTC was again in December 2020.

Ethereum Continues To Lose Floor To Bitcoin

Ethereum hit a contemporary multi-year low towards the main cryptocurrency, because the ETH/BTC buying and selling pair – also referred to as the ETH/BTC ratio – dropped to 0.02284. The next month-to-month chart illustrates how ETH has been on a constant downtrend towards BTC for the previous 4 consecutive months.

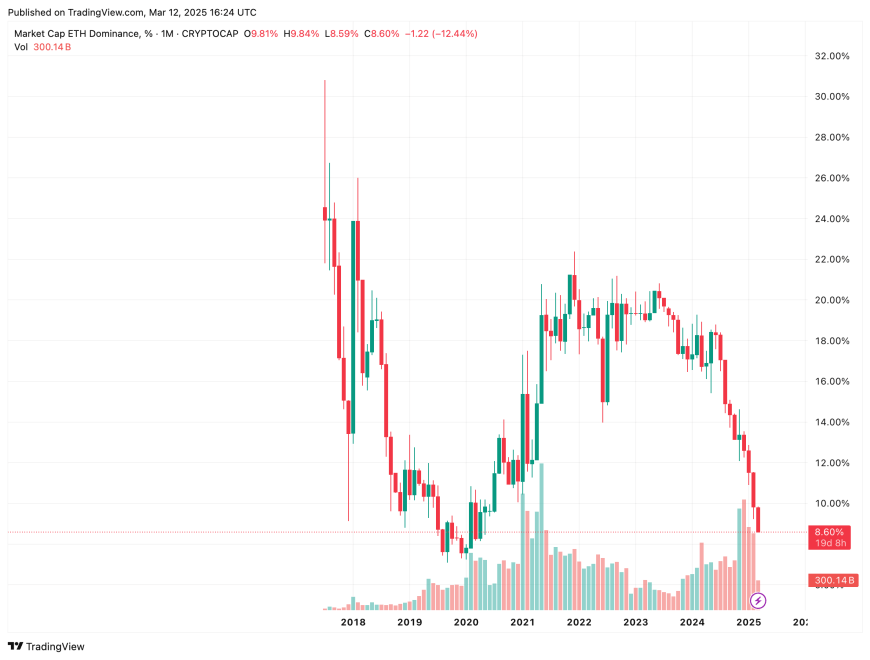

Including to ETH’s struggles is its declining market dominance. On the time of writing, the sensible contract token’s market dominance stands at 8.6%. For context, ETH’s market dominance was hovering barely above 18% in March 2024.

ETH’s persistent underperformance relative to BTC turns into clear when evaluating historic ratios. In 2017, one BTC might buy roughly six ETH. In 2025, one BTC now buys as a lot as 42 ETH.

Data from crypto exchange-traded funds (ETF) tracker SoSoValue additionally reveals that Ethereum ETFs are seeing a pointy decline in curiosity, probably pushed by ETH’s sluggish value efficiency over the previous two to 3 years.

The next chart illustrates how the overall internet asset worth in Ethereum ETFs has plunged from $14.28 billion on December 15, to $6.65 billion as of March 9. In that very same interval, ETH’s value has greater than halved, dropping from $4,043 to only above $1,800 on the time of writing.

As ETH struggles to reclaim the essential $2,000 value degree, seasoned crypto analyst Ali Martinez has recognized key resistance zones. In an X post, Martinez famous that ETH faces heavy resistance between $2,250 and $2,610, the place over 12 million traders bought greater than 65 million ETH.

Can ETH Stage A Comeback?

One other indicator of waning investor confidence is the declining proportion of staked ETH within the community. A current report highlighted that ETH staking has dropped sharply from its November 2024 peak.

Furthermore, value evaluation based mostly on MVRV Pricing Bands suggests that if ETH fails to interrupt above $2,060, it might slide additional, doubtlessly reaching as little as $1,440. Ethereum whales – wallets holding greater than 10,000 ETH – additionally look like losing confidence, with some massive holders offloading their belongings.

Nevertheless, on a brighter word, extreme bearish sentiment round ETH might spark a brief squeeze, doubtlessly propelling the cryptocurrency towards $3,000. At press time, ETH trades at $1,884, down 1.7% up to now 24 hours.

Featured Picture from Unsplash.com, Charts from SoSoValue.com and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.