The worth of Ethereum seemed to be again on its technique to restoration, reclaiming the psychological $2,000 stage earlier within the week. Nonetheless, the altcoin was among the many crypto property closely impacted by the newest inflation information in the USA, returning beneath $2,000.

This newest correction highlights the struggles of the Ethereum value over the previous few months, underperforming even within the midst of a market-wide bull run. Curiously, a outstanding indicator has flashed the imminence of a backside for the second-largest cryptocurrency.

Is ETH Prepared For A Rebound?

In a March 28 submit on the X platform, Chartered Market Technician (CMT) Tony Severino shared {that a} essential indicator for the Ethereum value is at 2018 bear market ranges. The crypto skilled steered that the altcoin may very well be gearing up for a rebound from its latest lows.

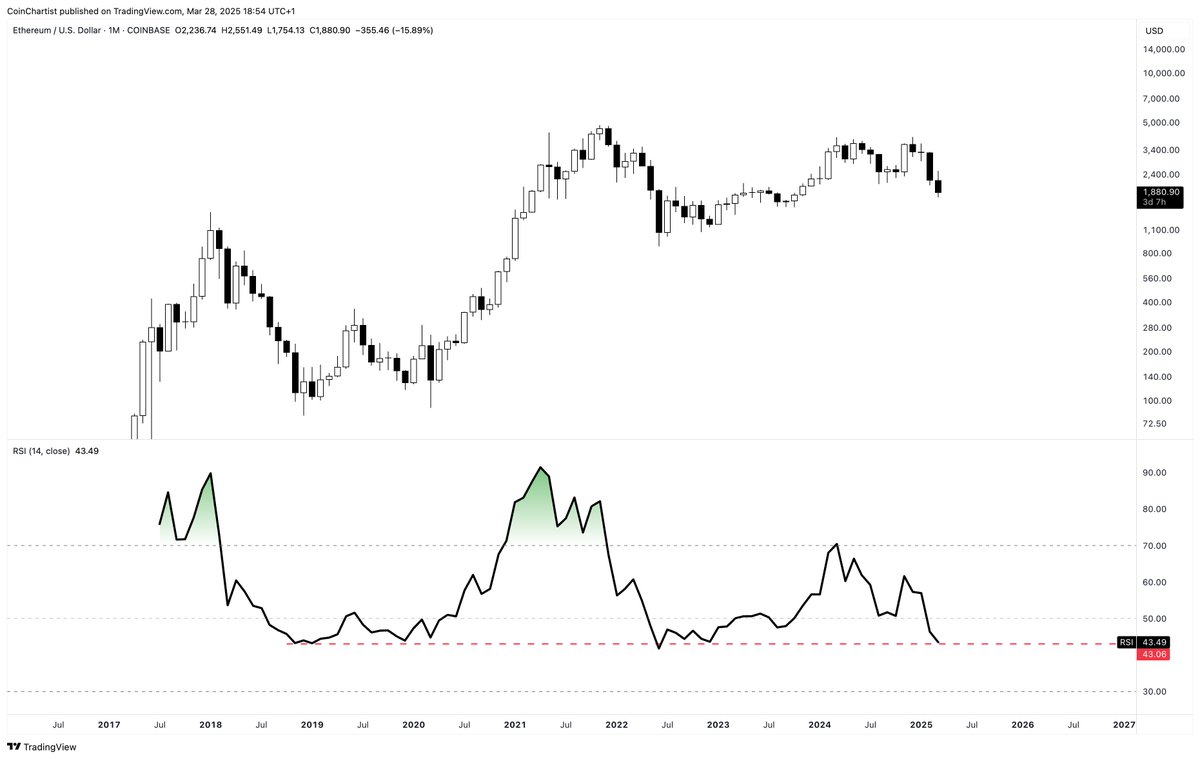

This evaluation is predicated on latest modifications within the 1-month relative energy index (RSI) indicator on the Ethereum month-to-month chart. The relative energy index is a momentum indicator utilized in technical evaluation to measure the pace and magnitude of an asset’s value modifications.

The RSI oscillator is used to detect whether or not an asset is being overbought or oversold, indicating the tendency of a development/value reversal. Sometimes, an RSI studying of over 70 alerts an overbought market situation, whereas a relative energy index worth beneath 30 suggests an oversold situation.

In keeping with Severino, the month-to-month Ethereum RSI indicator is presently at a worth final seen in the course of the bear market in 2018. As noticed within the chart beneath, the indicator additionally reached this backside following the crypto market capitulation occasions in Might and November 2022.

Supply: @tonythebullBTC on X

After reaching this stage, the relative energy index and value of ETH are inclined to bounce again to new highs. Within the 2018 cycle, the Ethereum value surged by practically 4,000% from round $120 to the present all-time excessive of $4,878.

In the meantime, the altcoin returned to round this record-high value in early 2024 after reaching this RSI backside in 2022. If historical past have been to repeat itself, the worth of ETH could bounce back from its present level to a brand new excessive.

Nonetheless, Severino highlighted in his submit that the month-to-month Ethereum RSI backside in 2018 got here after the worth dropped roughly 94% from its then all-time excessive. The worth of ETH is simply 56% adrift from the native excessive and 63% from its present document excessive. Therefore, it stays to be seen whether or not the Ethereum value is liable to additional decline.

Ethereum Worth At A Look

As of this writing, the worth of ETH is round $1,880, reflecting an nearly 7% decline prior to now 24 hours.

The worth of ETH on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.