Ethereum has been shifting inside a decent vary, caught between the 100-day MA at $3.2K and the $3.5K resistance.

This consolidation part, accompanied by heightened volatility, suggests {that a} decisive breakout is on the horizon, which might result in a brand new pattern.

Technical Evaluation

By Shayan

The Each day Chart

ETH is at present consolidating in a slender vary outlined by the 100-day shifting common at $3.2K and the important resistance zone at $3.5K. The latter additionally aligns with the higher boundary of a bullish flag formation, reinforcing its significance as a provide zone. A profitable breakout above $3.5K would doubtless set off a sustained bullish rally, concentrating on the $4K swing excessive.

Conversely, failure to interrupt this stage could end in a bearish downturn, with a possible drop under the 100-day MA resulting in long-liquidation occasions. Because the market stays on this vary, heightened volatility signifies {that a} decisive breakout is impending and can dictate Ethereum’s subsequent course.

The 4-Hour Chart

On the shorter timeframe, Ethereum is consolidating inside a descending wedge sample. The value just lately discovered help on the wedge’s decrease boundary close to $3K, prompting a bounce towards the higher boundary.

Nevertheless, the surge encountered resistance at $3.5K, resulting in elevated volatility and a pullback. Ethereum is now oscillating between the 0.5 Fibonacci retracement stage at $3.2K and the wedge’s higher boundary, reflecting market indecision.

This equilibrium state between patrons and sellers underscores the necessity for a breakout from the wedge and the present vary. A bullish breakout stays probably the most possible end result within the mid-term, contingent on purchaser momentum and market circumstances.

Onchain Evaluation

By Shayan

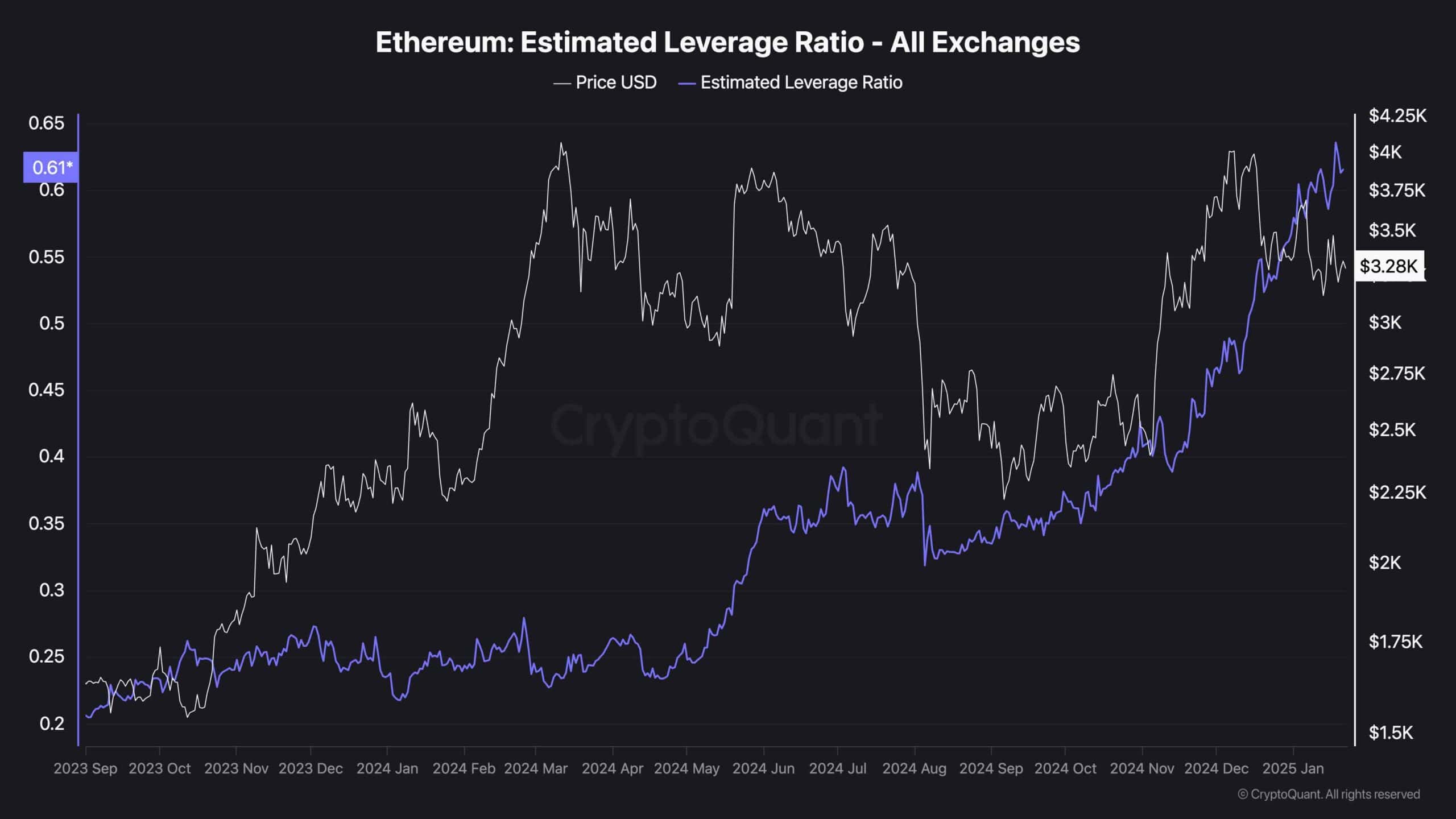

The Estimated Leverage Ratio metric, which tracks the typical leverage employed by futures market contributors, reveals essential insights into ETH’s market dynamics.

Ethereum’s Estimated Leverage Ratio has been steadily climbing over latest months, reflecting a rising urge for food for high-leverage positions within the derivatives market. This pattern coincides with the cryptocurrency’s latest bullish worth actions, indicating an overheated market. The present elevated ranges of leverage heighten the danger of a brief or long-squeeze occasion, which might end in sharp worth swings.

The asset stays trapped between the $3.2K help and the $3.5K resistance zone, a spread that has outlined Ethereum’s consolidation part. The approaching breakout from this vary, pushed by the high-leverage setting, is anticipated to set off a major and impulsive worth transfer.

Given the prevailing market sentiment, a bullish breakout seems extra possible. Nevertheless, merchants ought to monitor the leverage ratio carefully, as any abrupt change might result in sudden volatility and liquidations.

The submit Ethereum Price Analysis: Is ETH Ready to Escape Consolidation? appeared first on CryptoPotato.