- Ethereum ETF outflows bounce 39%, however BlackRock’s $1.8B ETH guess indicators long-term conviction.

- Normal Chartered predicts XRP could surpass Ethereum by 2028, intensifying the race for the second spot.

As Ethereum [ETH] faces mounting stress, ETF outflows have surged 39% in only one week, signaling shaken investor sentiment.

But, in a present of confidence, BlackRock has doubled with an enormous $1.8 billion ETH place, reinforcing institutional religion in Ethereum’s long-term potential.

Simply because the mud settles, Normal Chartered has stirred the pot, forecasting that Ripple [XRP] may overtake Ethereum inside the subsequent three years.

With market dynamics shifting, the race for crypto’s second spot is coming into what appears to be like like a high-stakes battle zone.

ETH ETF outflows soar amid worth stress

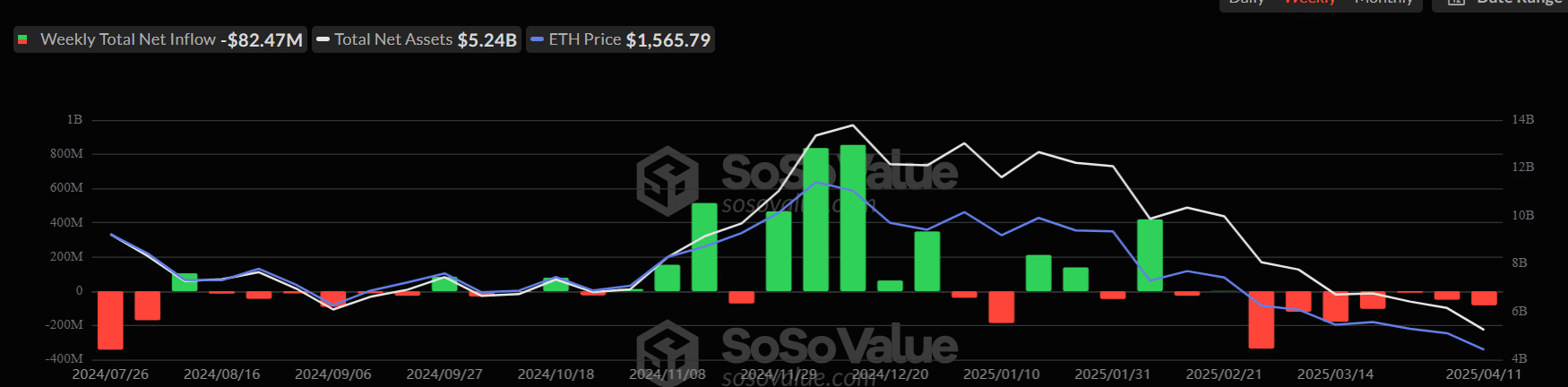

Ethereum ETFs recorded weekly web outflows of $82.47 million – marking the most important drawdown in current months. The chart reveals a transparent pattern: constant outflows since mid-February, aligning with Ethereum’s worth drop to $1.5K.

Whole web property have additionally steadily declined, now at $5.24 billion, down from a peak above $12 billion in late 2024.

This implies waning short-term investor confidence, whilst macro conviction stays robust – evidenced by massive establishments like BlackRock growing publicity.

The disconnect hints at a pivotal second for Ethereum’s market narrative.

BlackRock’s $1.8B ETH guess vs. XRP’s daring ascent

Regardless of mounting ETF outflows, BlackRock has solidified its conviction in Ethereum with a $1.8 billion ETH place. The portfolio exhibits regular accumulation via 2024, signaling a long-term perception in Ethereum’s worth proposition.

Nevertheless, a stunning twist enters the body: Normal Chartered’s newest report forecasts XRP overtaking Ethereum in market cap by 2028. Geoffrey Kendrick, Head of Digital Property Analysis, sees XRP rising to turn out to be the second-largest non-stablecoin asset, establishing a high-stakes rivalry.

The result’s an enchanting divergence in institutional outlooks — one doubling down on ETH, the opposite betting huge on XRP. The combined indicators reveal simply how unsure and dynamic the highway forward for crypto’s prime contenders really is.

Ethereum worth outlook

Ethereum’s worth hit $1,603 at press time, following a 2.47% day by day drop. The broader pattern since early 2025 has been decisively bearish, with ETH shedding vital worth from above $3,000 ranges earlier within the 12 months.

The RSI hovered close to 39, indicating oversold territory however not but signaling a robust reversal.

In the meantime, the MACD line sat slightly below the sign line, suggesting ongoing bearish momentum — though the hole is narrowing, hinting at potential bullish divergence.

Regardless of BlackRock’s conviction, technicals recommend ETH continues to be struggling to search out stable footing.

Any short-term reduction rally may face resistance close to the $1,800 zone, whereas a drop under $1,550 may intensify promoting stress.