- Ethereum, as the most important altcoin, has a historical past of defying mainstream expectations with sudden surges

- Nonetheless, its deviation from historic quarterly traits now indicators a bearish outlook

Ethereum [ETH] has had a turbulent Q1, going through sturdy resistance and market uncertainty. Nonetheless, with enhancing fundamentals and rising institutional curiosity, might a 60% rally in Q2 push ETH in the direction of $3,200?

Let’s dive into the important thing components that might gasoline this transfer.

Ethereum’s Q1 underperformance in focus

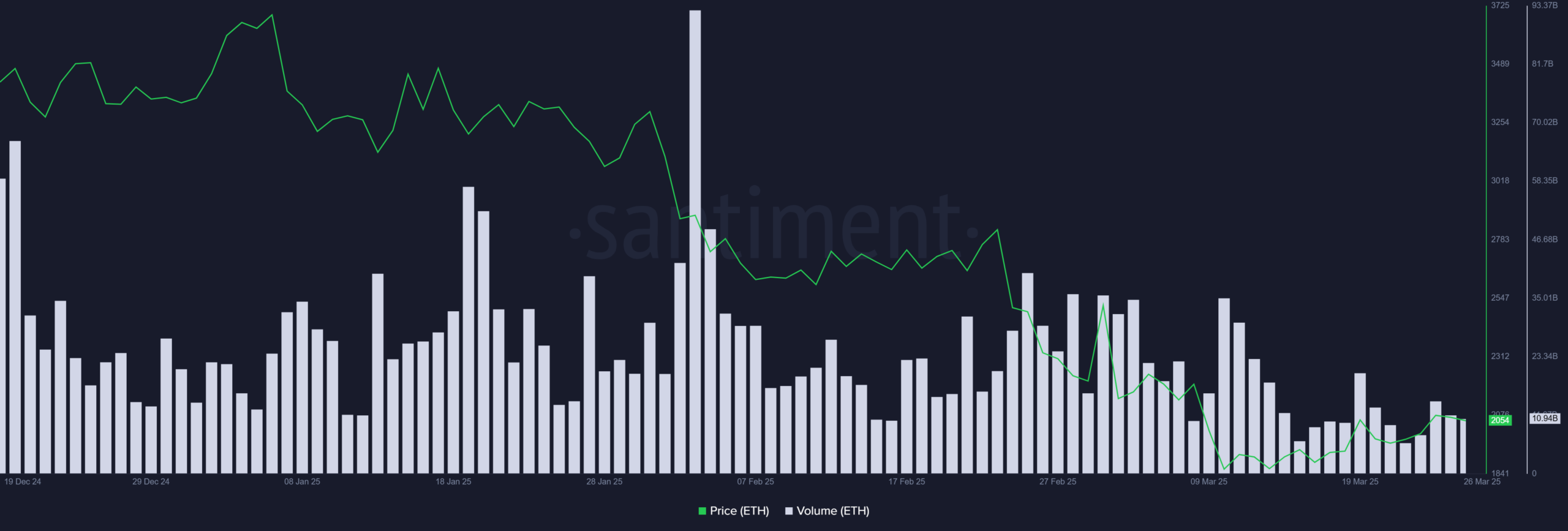

Ethereum opened Q1 at $3,334, nevertheless it has since retraced to $2,053 – Posting a 38% drawdown with solely per week remaining within the quarter.

As compared, ETH’s 2024 Q1 rally noticed it closing at an all-time excessive of $4,081 – An 84% quarterly acquire. This stark divergence raises considerations about Ethereum’s structural weak point, as each liquidity inflows and network activity have remained subdued.

Consequently, the implications prolong past short-term value motion. Actually, analysts have revised year-end targets by almost 60%, citing weak institutional participation.

Compounding this, the ETH/BTC pair not too long ago fell to a five-year low, diverging from its 2024 yearly excessive. Not like earlier cycles, Ethereum has failed to draw capital rotation throughout Bitcoin’s bullish consolidation.

For example, whereas BTC reclaimed $88k following a two-week correction, ETH’s rebound to $2k noticed no important uptick in buying and selling quantity – An indication of weakening demand.

Given this backdrop, a 60% Q2 rally is likely to be unlikely. And but, Ethereum has a observe document of defying expectations.

May this be one other occasion of an sudden breakout?

Can ETH shock the market with a shock rally?

In Q2 2024, Bitcoin closed the quarter 14% under its opening value, whereas Ethereum demonstrated relative power with solely a 5% decline. This outperformance highlighted ETH’s resilience, regardless of broader market corrections.

A possible market shock, due to this fact, would come up if Ethereum replicates this pattern in Q2 2025.

Whereas the ETH/BTC pair stays suppressed, Open Curiosity (OI) and Funding Charges (FR) in Ethereum Futures recommend merchants could also be positioning for another end result.

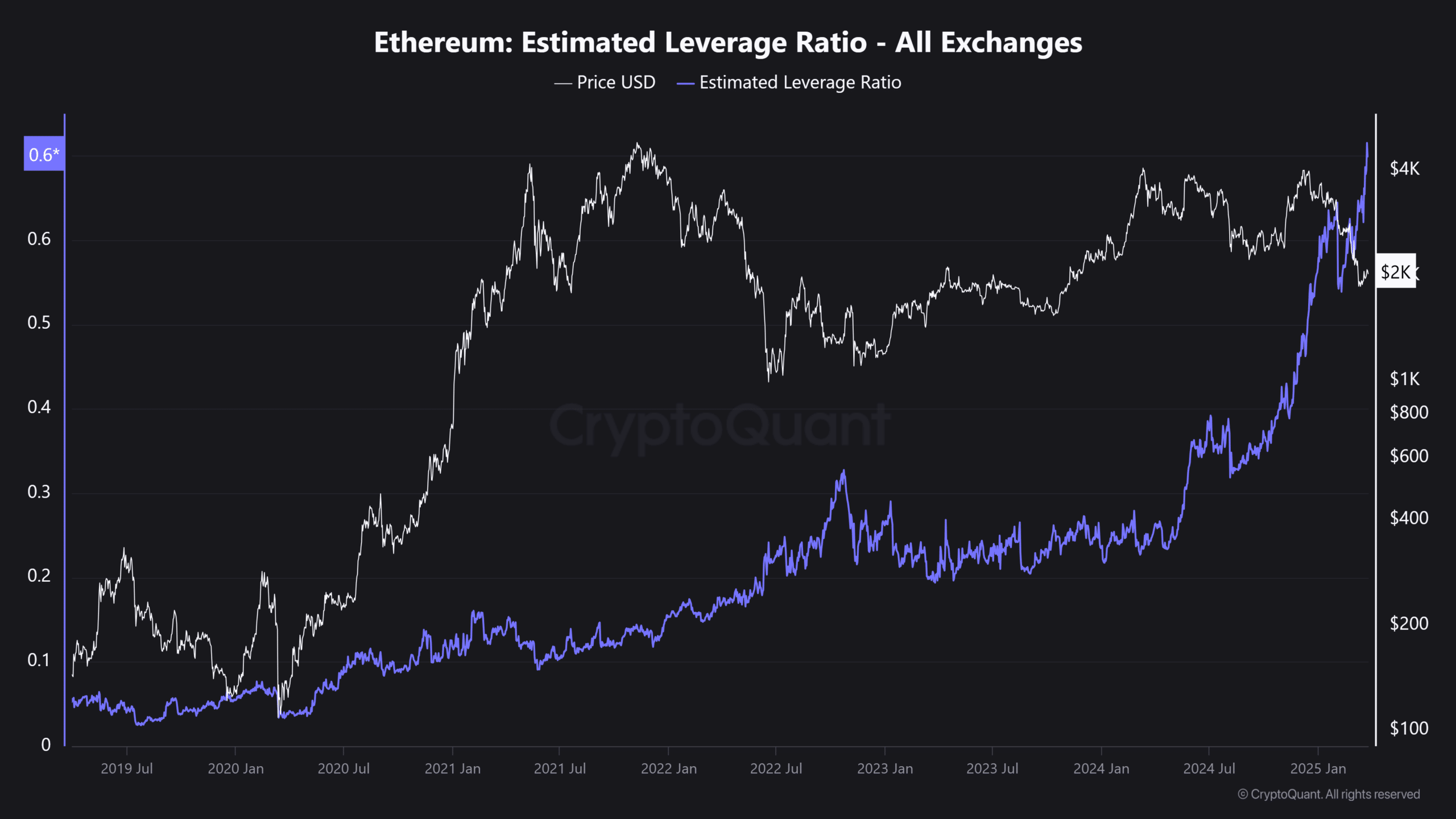

Notably, Ethereum’s Estimated Leverage Ratio (ELR) surged to an all-time excessive – Indicating an inflow of high-risk capital.

Traditionally, such elevated leverage has acted as a double-edged sword — Both fueling a breakout or triggering cascading liquidations.

For Ethereum to capitalize on this leverage buildup, a confluence of things is required – Sustained Bitcoin power, rising spot demand, and a resurgence in institutional inflows.

Ought to these circumstances materialize, the probability of an sudden 60% rally in the direction of $3,200 transitions from speculative optimism to a structurally supported market situation.