- Hedera may rally upwards following days of a downtrend because the short-term SMAs sign “purchase.”

- HBAR may see a possible worth reversal if the shopping for stress holds previous the Ichimoku cloud resistance.

Hedera [HBAR] has surged 3.63% in buying and selling quantity previously 24 hours as the worth oscillated round $0.18 at press time, per CoinMarketCap.

HBAR has been buying and selling in a downtrend for the reason that begin of the month, fueled by a robust bearish momentum.

With the worth sitting at a key help and demand zone, the market wonders if the bulls may take cost, resulting in a bounce again.

HBAR technical setup and demand zone

Wanting on the 4-hour chart, Hedera has been consolidating in a downtrend, forming a descending triangle sample. On the time of writing, HBAR was buying and selling at $0.18396, a key help zone.

The coin has examined the $0.182-$0.185 help zone and bounced off a number of instances, stopping additional downtrend. This implies demand rises at this zone as consumers step in, reversing the development.

In response to TheCryptoExpress on X (previously Twitter), a breakout or breakdown from this sample will verify HBAR’s subsequent route.

Will the bulls step in?

HBAR has did not maintain a big worth uptrend above this demand zone within the final two weeks, as exhaustion follows the worth rebounds.

Nonetheless, merchants anticipate a rally following a breakout or breakdown at this demand zone in its descending triangle construction.

Hedera’s short-term momentum, MACD, and shifting averages sign “purchase” as buying and selling quantity rises, indicating heightened shopping for stress.

With the RSI at 40 (decrease impartial zone), there’s extra shopping for potential, signaling that the bulls are stepping in cautiously.

Open Curiosity rises — Might this result in a development reversal?

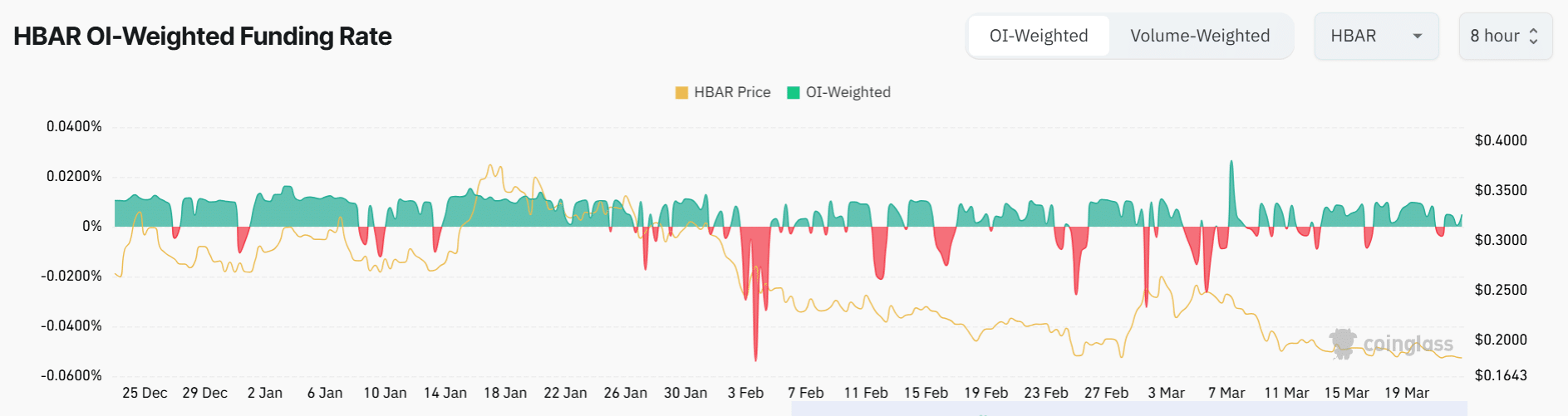

HBAR’s 24-hour Open Curiosity has surged 4.5% because the Open Curiosity (OI) Funding Charge turned optimistic previously 48 hours until press time, per Coinglass information.

This signaled renewed curiosity and dealer optimism on the key help zone.

At press time, the 24-hour Lengthy/Quick Ratio stood at 1.7 and had risen to 1.9 within the decrease timeframe, suggesting elevated demand, per Coinalyze.

So, what subsequent?

The market appeared to attend for Hedera’s affirmation on the $0.18 key help zone. A development reversal is feasible if the coin breaks above its descending trendline and overcomes the Ichimoku cloud resistance.

With robust shopping for stress, HBAR’s probabilities of sustaining an uptrend within the mid-term may shift from reasonable to excessive. One ought to be careful for the subsequent transfer on this sample formation for additional insights.