- HNT is presently buying and selling inside a bullish triangle sample, focusing on a significant upside transfer.

- Spot merchants might be the catalyst for this rally as they drive the value to a decrease assist degree.

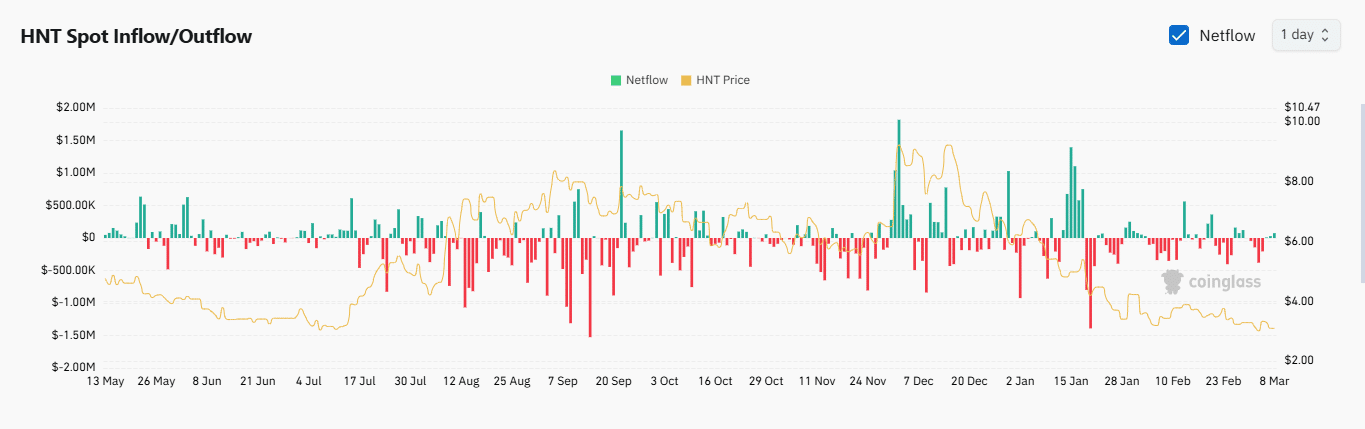

Prior to now 24 hours, Helium [HNT] has declined by 5.42%, dropping to $3.04 as bearish stress mounted. AMBCrypto’s evaluation confirmed that spot merchants have performed a significant position on this value drop.

Nevertheless, market sentiment urged that this transfer by spot merchants may in the end profit HNT, doubtlessly resulting in a big rally within the coming buying and selling classes.

Bullish sample may ignite HNT’s run

At press time, HNT was buying and selling inside a bullish triangle sample, fashioned by a converging descending resistance line and a horizontal assist degree on the 4-hour chart.

A breakout above this sample sometimes triggers a rally, resulting in larger highs and lows.

At press time, HNT was trending downward seeking assist to gas the rally. If it reaches this assist degree and begins trending larger, its bullish transfer may start with a 79.15% upside.

AMBCrypto’s evaluation discovered that spot merchants play a task in driving this downward pattern.

Spot merchants might be the catalyst for development

Spot merchants have persistently bought HNT over the previous three days, contributing to its decline as promoting stress will increase.

Throughout this era, over $116,000 price of HNT has been bought, with greater than $78,000 offloaded previously 24 hours alone. Some cohorts within the derivatives market are additionally contributing to this value drop.

On the time of writing, Open Curiosity has declined by 3.17% to $4.30 million, accompanied by a 17.79% lower in quantity.

A simultaneous drop in each Open Curiosity and quantity means that spinoff merchants are additionally promoting.

The mixed promoting stress will seemingly attain a halt at HNT’s bullish sample assist degree, from which a rally may start.

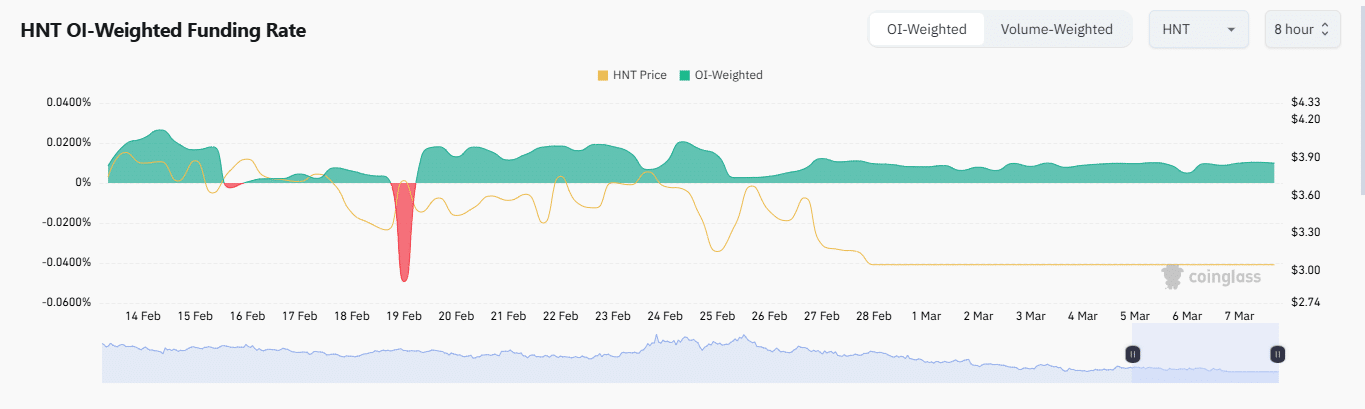

The market stays bullish

Though the promoting stress from each the spot and derivatives markets could seem bearish, bullish metrics point out that regardless of sellers driving the value decrease, HNT stays in a bullish construction.

The Open Curiosity Weighted Funding Price is one such metric.

By analyzing unsettled contracts and the premiums merchants pay to take care of value ranges in each the spot and futures markets, this indicator suggests a bullish outlook.

This metric has remained in bullish territory since February 19, signaling that the continued back-and-forth value motion inside the bullish channel is probably going an accumulation section.

Moreover, 24-hour derivatives buying and selling quantity has been dominated by consumers, as indicated by the Lengthy-to-Brief Ratio, which was 1.021 at press time. A studying above 1 suggests there are extra consumers than sellers out there.

Total, HNT’s present decline is probably going a strategic transfer by merchants to fill extra orders at decrease costs earlier than a significant value swing happens.