- Buyers pulled out $795 million from crypto funds final week

- Solely XRP and multi-asset funds noticed modest demand, whereas the remainder confronted sell-offs

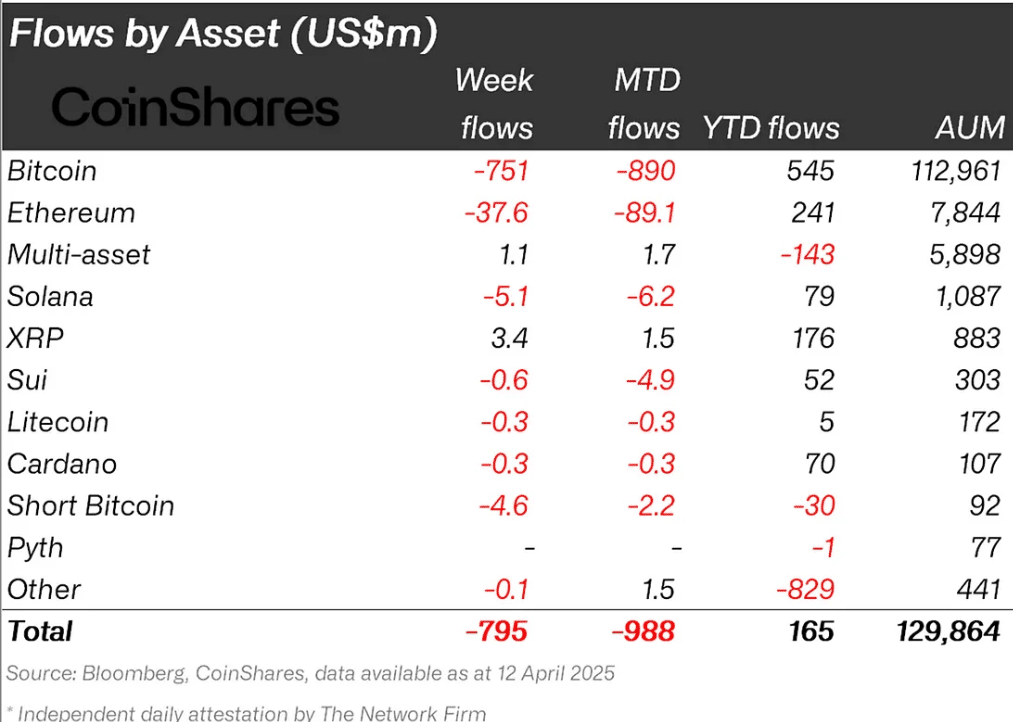

Buyers pulled $795 million from crypto funds final week, marking the third week of sell-offs. In reality, according to CoinShares’ weekly asset flows report, Bitcoin [BTC] led the outflows with $751 million, whereas Ethereum bled $37.6 million. The report linked the prolonged decline to tariff uncertainty.

“Digital asset funding merchandise noticed a third consecutive week of outflows final week, totalling US$795m, as current tariff exercise continues to weigh on sentiment in direction of the asset class.”

Buyers want XRP

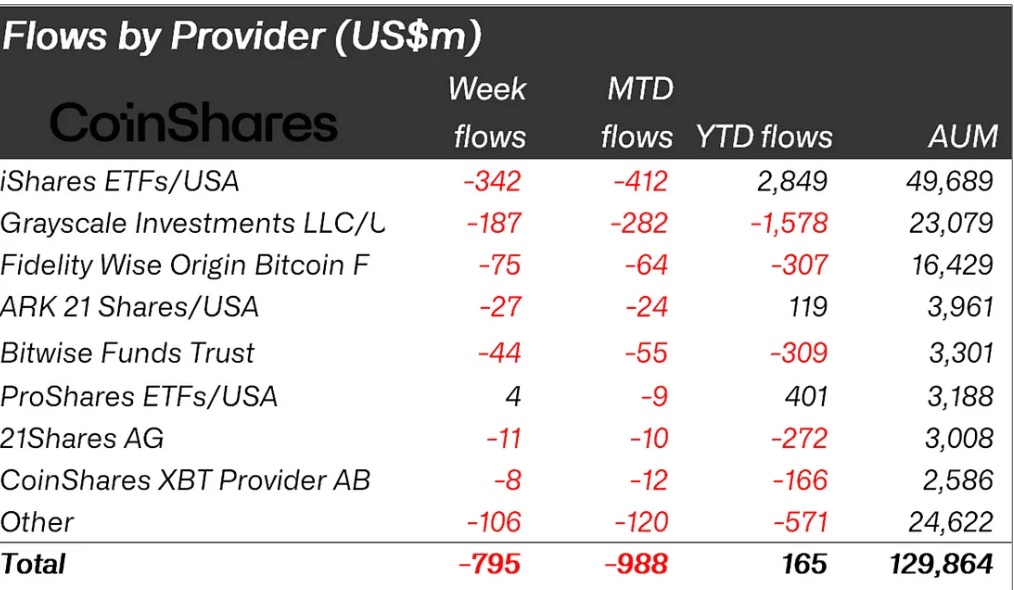

BlackRock’s iShares ETF merchandise recorded the very best investor withdrawals (sell-off). As per the report, iShares’ BTC ETFs and ETH ETFs, collectively, noticed $342 million outflows final week.

From a month-to-date (MTD) perspective, BlackRock bled $412 million, almost half a billion over the previous two weeks alone.

Grayscale merchandise adopted carefully with $187 million outflows, almost half of BlackRock’s dump.

On the altcoins entrance, Solana-based merchandise ranked third after ETH in outflows. The merchandise noticed a $5.1 million sell-off. Surprisingly, XRP-based and multi-asset funds had been the one outliers throughout final week’s decline.

The report famous that XRP noticed $3.4 million inflows final week, and the general MTD flows stood at $1.5 million. Merely put, buyers most popular XRP and multi-asset (crypto index ETFs) to particular person property like BTC or ETH within the first half of April.

Moreover, the aforementioned thought was additional supported by document inflows into the brand new 2x Tecrium XRP ETF.

Price noting, nonetheless, that some macro analysts projected that the decline may proceed. Quinn Thompson, founding father of macro-focused hedge fund Lekker Capital, stated {that a} current speech by Fed chair Jerome Powell might be unhealthy for danger property in Might, together with crypto.

“Barring a collapse in financial knowledge earlier than then, they (Powell and Governor Waller) want persistence amidst the elevated uncertainty. That is good for bonds however unhealthy for danger property.”