Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

An analytics agency has defined how the information associated to the stablecoins may trace at whether or not the Bitcoin market prime is in or not.

Stablecoins Have Seen Their Market Cap Contact New Highs Not too long ago

In a brand new post on X, the market intelligence platform IntoTheBlock has mentioned in regards to the development within the mixed stablecoin market cap. “Stablecoins” check with cryptocurrencies which might be pegged to a fiat foreign money (with USD being the preferred selection).

Usually, buyers make use of those property after they need to keep away from the volatility related to different cash like Bitcoin. Merchants who make investments into stablecoins, nevertheless, normally achieve this as a result of they plan to enterprise (again) into the risky aspect of the sector.

Associated Studying

As such, the availability of those fiat-tied tokens is commonly thought-about because the accessible ‘dry powder’ for Bitcoin and different cryptocurrencies. Given this placement of the stables within the sector, their market cap could be value maintaining a tally of.

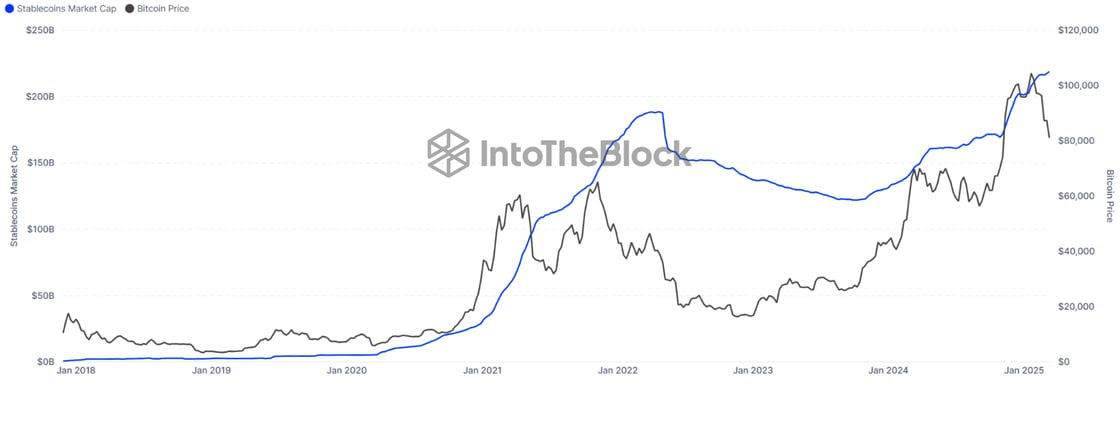

Right here is the chart shared by the analytics agency that exhibits the development within the stablecoin market cap over the previous few years:

As displayed within the above graph, the market cap of the stablecoins has been using an uptrend just lately and exploring new all-time highs (ATHs). Following the most recent continuation to the rise, the metric has hit a whopping $219 billion.

To place issues into perspective, the market cap of Ethereum (ETH), the second largest asset within the sector, is slightly below $233 billion. Thus, the stables are lower than $14 billion away.

IntoTheBlock has identified an attention-grabbing sample associated to this indicator. Within the chart, it’s seen that the metric’s prime final cycle was when it hit $187 billion in April 2022. Evidently, this peak available in the market cap of the stables coincided with the beginning of the bear market.

“Traditionally, stablecoin provide peaks align with cycle highs,” notes the analytics agency. To this point within the present cycle, the indicator has continued to rise, regardless of the decline within the asset’s worth. If the earlier development is something to go by, this might be a sign that Bitcoin and different cash are but to enter a bear market.

That stated, the most recent market circumstances haven’t precisely been totally bullish. Essentially the most constructive situation happens each time each BTC and the stablecoins get pleasure from a rise of their market caps. In such a interval, a web quantity of fresh capital inflows are coming into into the sector.

Associated Studying

At current, although, the stablecoins have been rising whereas Bitcoin and others have been falling. This might probably indicate a rotation of capital has been occurring, reasonably than contemporary inflows.

Throughout the mid-2021 correction, an analogous sample emerged, however the market was capable of finding its footing and the second half of the rally happened. It now stays to be seen whether or not one thing comparable would occur for Bitcoin this time as effectively, or if the market will go the way in which it did in 2022.

Bitcoin Worth

On the time of writing, Bitcoin is buying and selling round $84,700, down over 4% within the final seven days.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com