Bitcoin [BTC] could also be on the point of a crucial turning level, with current market indicators suggesting a possible shift in momentum.

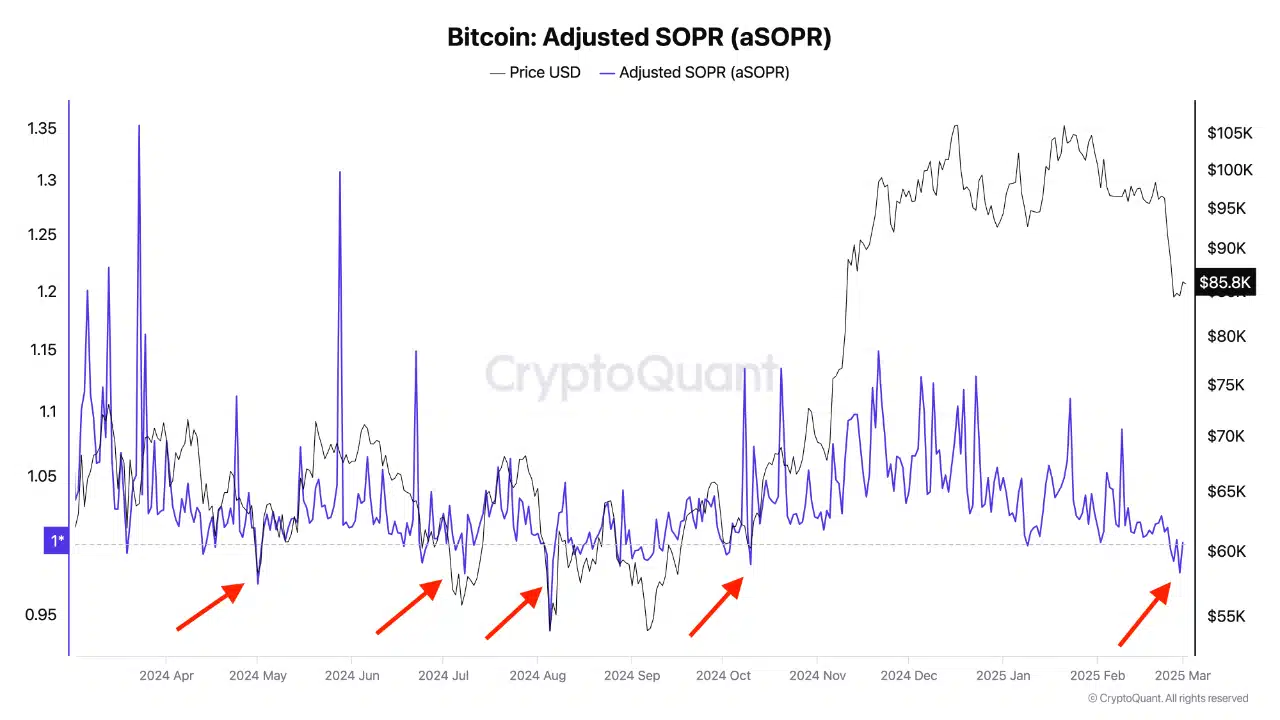

The Adjusted Spent Output Revenue Ratio (aSOPR) has remained persistently under 1, signaling that many buyers are promoting at a loss — an indicator typically linked to market capitulation.

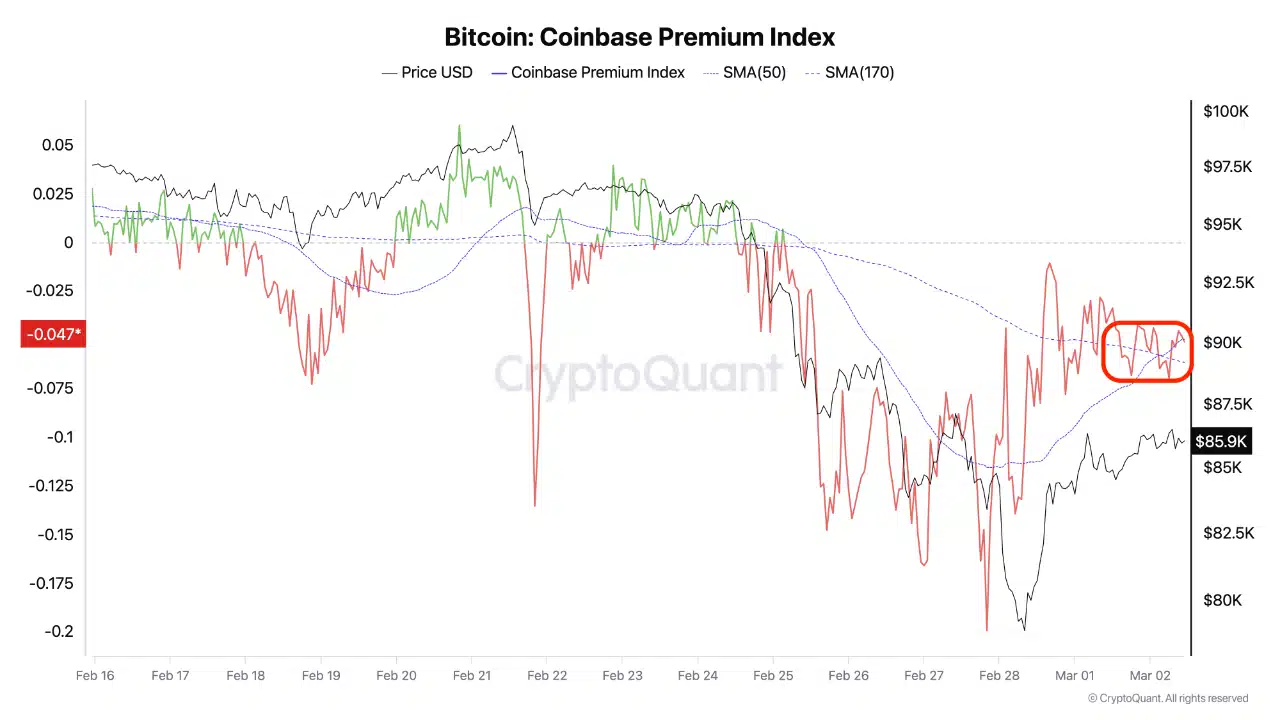

On the identical time, the Coinbase Premium Index is exhibiting indicators of restoration, pointing to a possible easing of promoting strain regardless of current outflows and typical weekend slowdowns.

Is Bitcoin nearing a market backside, or is there extra volatility forward?

aSOPR and market backside indicators

aSOPR measures whether or not Bitcoin buyers are promoting at a revenue or a loss. A studying under 1 signifies that the typical vendor is exiting at a loss, typically aligning with capitulation phases and market bottoms.

Traditionally, when aSOPR dips under 1 for an prolonged interval after which recovers, it has signaled a shift in pattern.

Within the chart, crimson arrows spotlight earlier situations the place aSOPR fell under 1, aligning with native value bottoms earlier than Bitcoin rebounded.

The newest drop in early 2025 suggests an analogous sample, elevating the query whether or not Bitcoin is nearing one other turning level.

If promoting strain eases and demand strengthens, historical past could repeat with one other restoration.