- LSK has the bottom rating in Whale vs. Retail delta, signaling excessive retail dominance.

- LSK lengthy positions aligned with the Whale vs. Retail evaluation, the place retail merchants take excessively bullish stances.

The cryptocurrency market operates below a variety of metrics that provide useful insights into market sentiment and value tendencies.

One notable metric highlighting LSK [Lisk] is its rating within the Whale vs. Retail delta, the place it confirmed the bottom place which signaled sturdy retail dominance.

The affect of retail dominance

Evaluation from HyblockCapital revealed that LSK ranked on the first percentile within the Whale vs. Retail delta on the histogram, marking a extremely atypical situation.

Traditionally, excessive retail dominance has been adopted by value declines, suggesting an overinflated retail market sentiment.

This dynamic is clear within the Whale vs. Retail Delta metric, the place retail merchants maintain a bigger proportion of lengthy positions in comparison with whales.

This disparity usually alerts that retail merchants are excessively optimistic, which might result in a correction when the market adjusts. Thus, the charts visually affirm this habits.

Lastly, value evaluation confirms that after durations of excessive retail dominance, LSK’s value tends to drop.

This pattern implies retail buyers enter at much less favorable market circumstances, inflicting value declines as their positions are liquidated. The mixture of those indicators means that retail-driven value spikes could also be short-lived.

This might result in downward corrections as market expectations fail to align with actuality.

Crucial value ranges: The place LSK may face stress

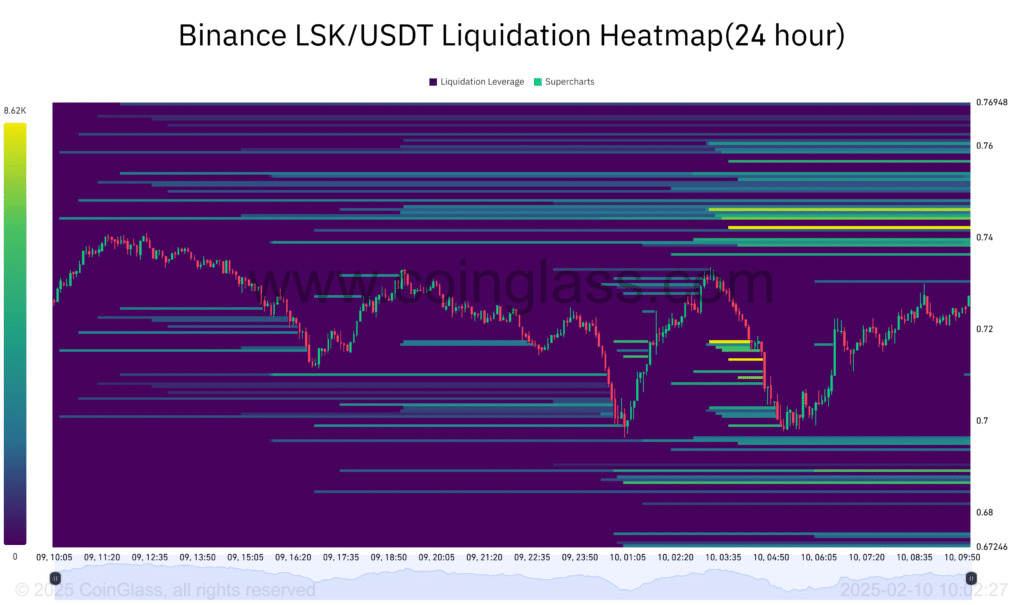

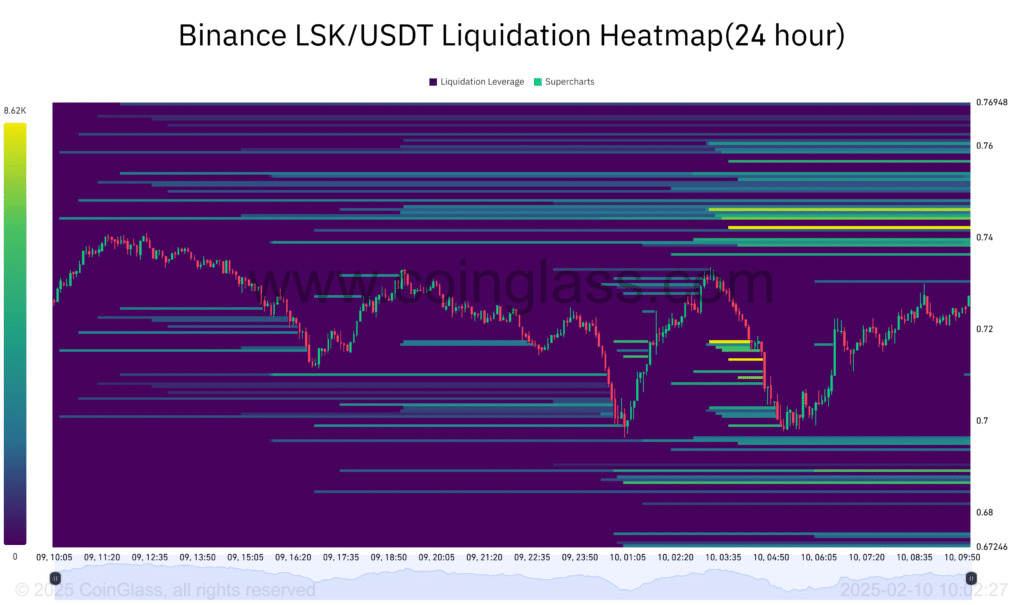

Alternatively, the liquidation heatmap for LSK has proven vital value ranges the place liquidation occasions are more likely to happen.

Supply: Coinglass

On the time of writing, there was a dense focus of liquidations across the $0.74 and $0.72 ranges. These ranges act as psychological value factors the place vital purchase and promote orders may emerge as a result of compelled liquidations.

As LSK’s value approaches these ranges, the market could expertise resistance or help, exacerbating value actions—notably in a downward pattern the place excessive retail dominance is current.

Retail buyers, particularly these utilizing leverage, are extra weak to liquidation at these ranges, which can have a cascading impact on LSK’s value.

Is LSK overbought?

The Lengthy/Quick Ratio, then again, highlights the quantity and account distribution between lengthy and brief positions. The information reveals that lengthy positions usually peak earlier than a value downturn.

This peak in lengthy positions aligns with the Whale vs Retail evaluation, the place retail merchants take excessively bullish stances, finally main to cost corrections.

Additionally, a better ratio of lengthy positions relative to brief positions alerts market optimism that usually precedes a decline. This has been mirrored within the retail-driven pattern noticed within the value and Whale vs Retail delta charts.

These alerts recommend that the market is doubtlessly overbought, which may set off a downward adjustment in LSK’s value.

What lies forward for LSK?

The present information strongly suggests a continued downward value motion within the brief time period. Excessive retail dominance, coupled with the liquidation ranges and the rising quantity of lengthy positions, paints an image of a market inclined to a value correction.

– Reasonable or not, right here’s LSK market cap in BTC’s phrases

Historic patterns additional help this outlook, as retail dominance has traditionally led to market peaks adopted by declines.

The present evaluation of LSK’s market habits, primarily pushed by retail dominance, factors in direction of a cautious strategy.