- Maker not too long ago reacted off a serious help zone the place a whole bunch of hundreds of items had been bought.

- Some merchants, nevertheless, are taking income—a transfer that might impression MKR’s potential market motion.

Prior to now 24 hours, consumers have shifted sentiment after beforehand promoting a big portion of the asset over the previous month. This renewed shopping for exercise has led to a 1.66% value enhance.

Giant purchase orders may set off a rally

In accordance with AMBCrypto’s evaluation, this value bounce may mark the start of an additional rally, with an extra 41% upside as Maker [MKR] goals to retest a key resistance stage at $1,800.

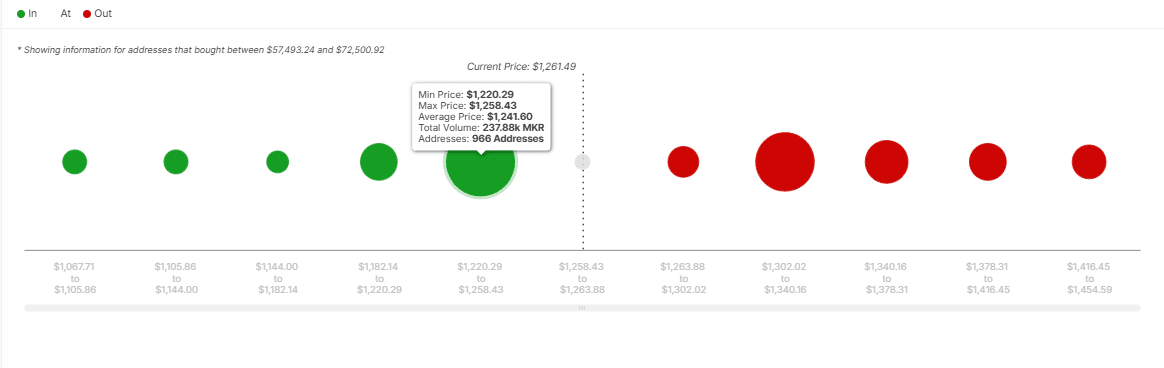

The In/Out of the Cash Round Worth (IOMAP) indicator, which helps determine potential demand and provide zones, reveals that MKR has reacted off a key demand space that might set off a serious rally.

This zone, situated between $1,220.29 and $1,258.43, noticed a file 237,880 MKR traded, value roughly $299 million—a big quantity that fueled the latest uptrend.

When such high-volume accumulation happens, a corresponding enhance in value and quantity typically alerts an impending market rally.

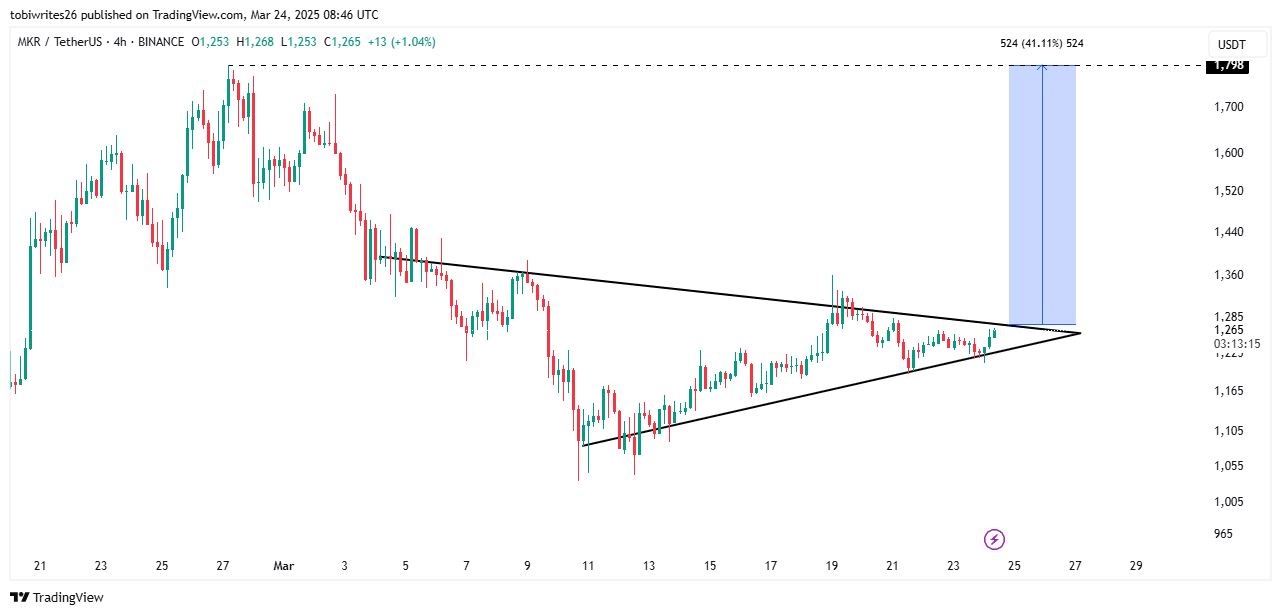

On the chart, MKR seems prepared to try a bullish breakout from a symmetrical triangle, following the massive purchase orders. Based mostly on the evaluation, if the asset breaks via this resistance, it may surge 41% to achieve $1,800.

A symmetrical triangle sample varieties when converging help and resistance traces create a consolidation part. As soon as value motion breaks out, it sometimes results in a robust directional transfer.

Derivatives merchants are going lengthy forward of the rally

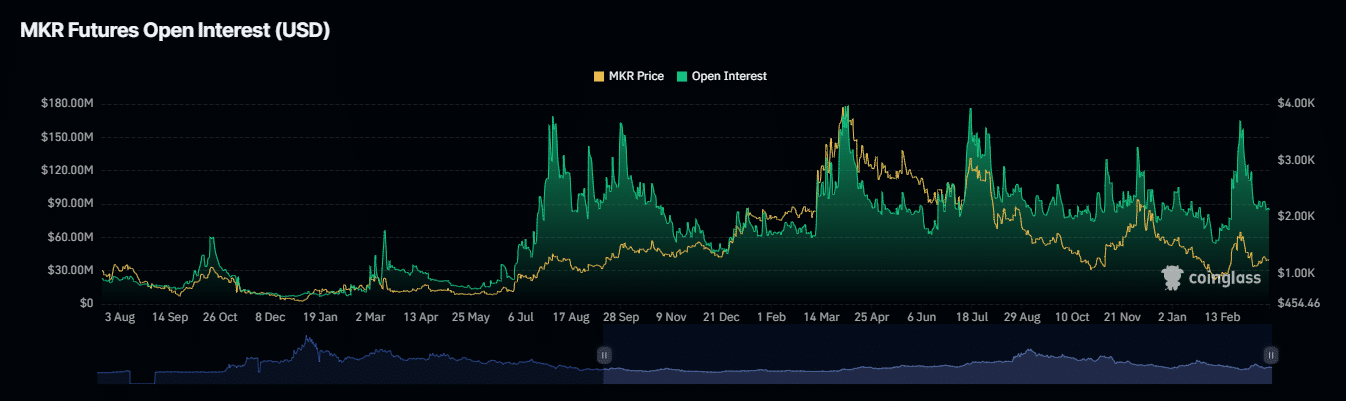

Market sentiment stays bullish, significantly within the derivatives market, the place merchants are opening extra lengthy positions in anticipation of a breakout.

Information from Coinglass reveals that MKR’s Open Curiosity (OI) has steadily risen, reaching $87.80 million up to now 24 hours. This enhance signifies extra unsettled spinoff contracts available in the market.

A research of the rising Funding Fee means that these contracts favor lengthy positions.

The aggregated Funding Fee, which climbed to 0.0088%, implies that lengthy merchants are paying a premium to brief sellers to take care of their positions—habits sometimes noticed in bullish market phases.

Revenue-taking may gradual MKR’s progress

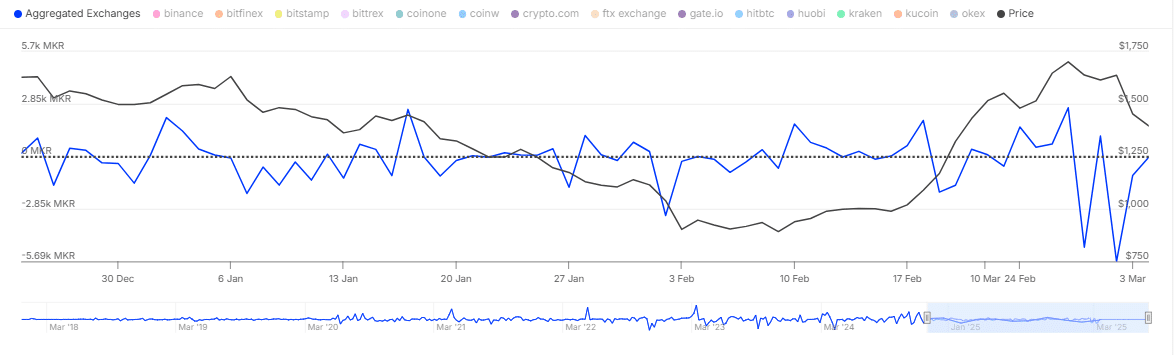

Whereas the broader market stays bullish, some spot merchants are taking income, as indicated by the change netflow turning optimistic.

The netflow metric, which tracks shopping for and promoting exercise inside a given interval, reveals that 989.63 MKR (value $1.2 million) was offered.

Nonetheless, this promoting strain is comparatively low in comparison with the earlier days’ shopping for exercise, suggesting that merchants are securing income whereas holding the vast majority of their positions intact.

It’s necessary to notice that if promoting exercise within the spot market continues and extra property are offloaded, it may point out a shift towards bearish sentiment relatively than a easy profit-taking part.

Nonetheless, for now, MKR stays largely bullish, concentrating on $1,800.