- New Bitcoin whales are reshaping the market construction, driving demand whereas limiting accessible provide.

- This dynamic might gas upward worth motion within the coming months.

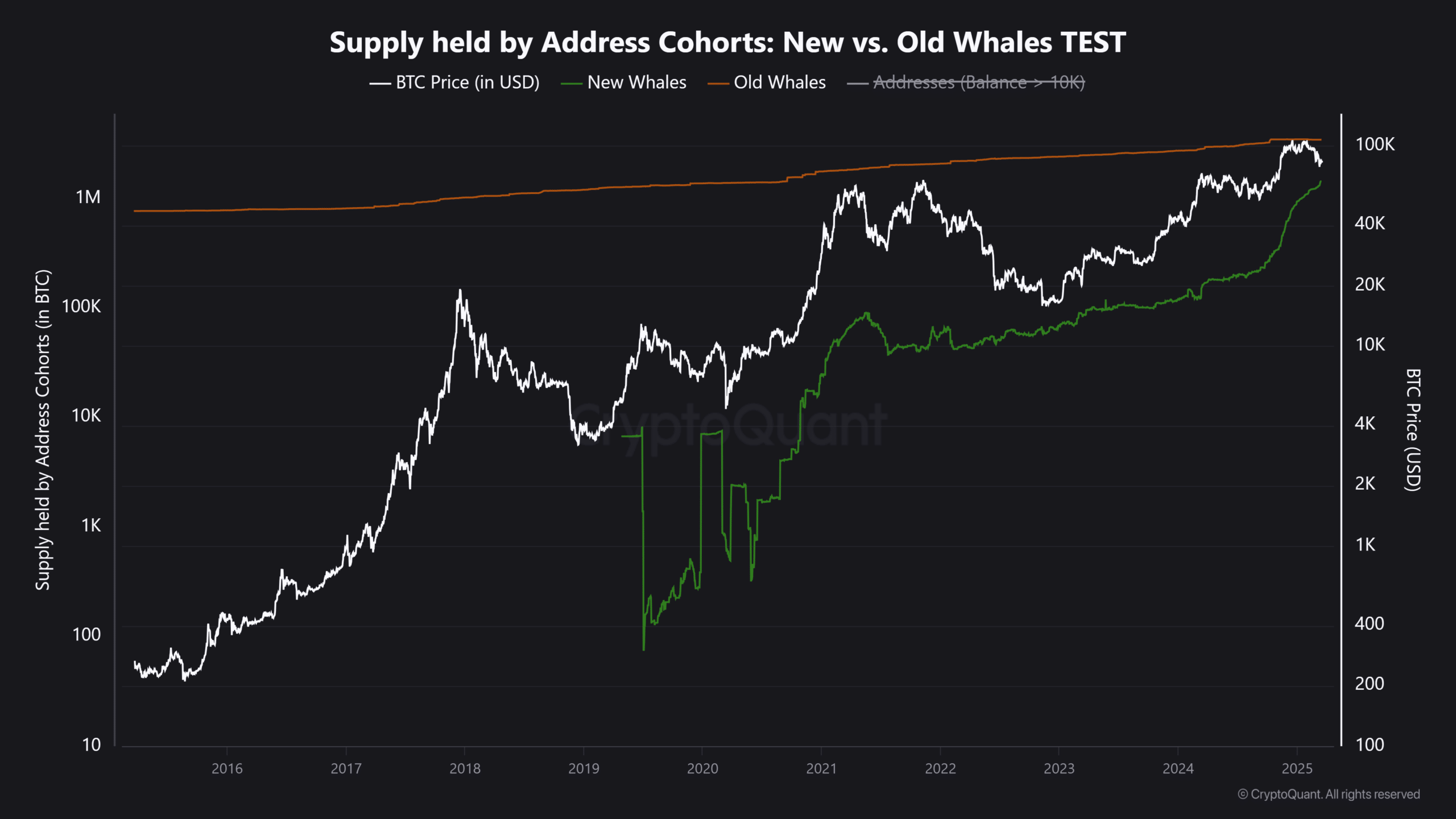

Excessive-net-worth wallets with 1,000+ Bitcoin [BTC] are accumulating quick, signaling robust confidence in Bitcoin. Since November 2024, new Bitcoin whales have added over 1 million BTC, together with 200,000 this month.

A brief holding interval (

With risk-off sentiment dominating the market, retail capital has but to return. On this local weather, the continued accumulation of latest whales might set up a robust worth flooring, reinforcing Bitcoin’s help on this cycle.

Bitcoin’s liquidity profile is shifting

The fast accumulation of latest whale addresses signifies robust inflows of contemporary capital, as mirrored within the knowledge under.

Complete holdings by these entities (1,000+ BTC,

In the meantime, long-term whale holdings (BTC held for a number of years) have declined from 3.48 million to three.45 million BTC, aligning with Bitcoin’s worth correction from its $109k all-time excessive on the twentieth of January to $96k on the sixth of February.

The sell-side liquidity from each previous whales and weak fingers have been absorbed by these new whales, whose 2,00,000 accumulation this month has prevented BTC from retracing under $78k.

New Bitcoin whales sign energy: What’s subsequent?

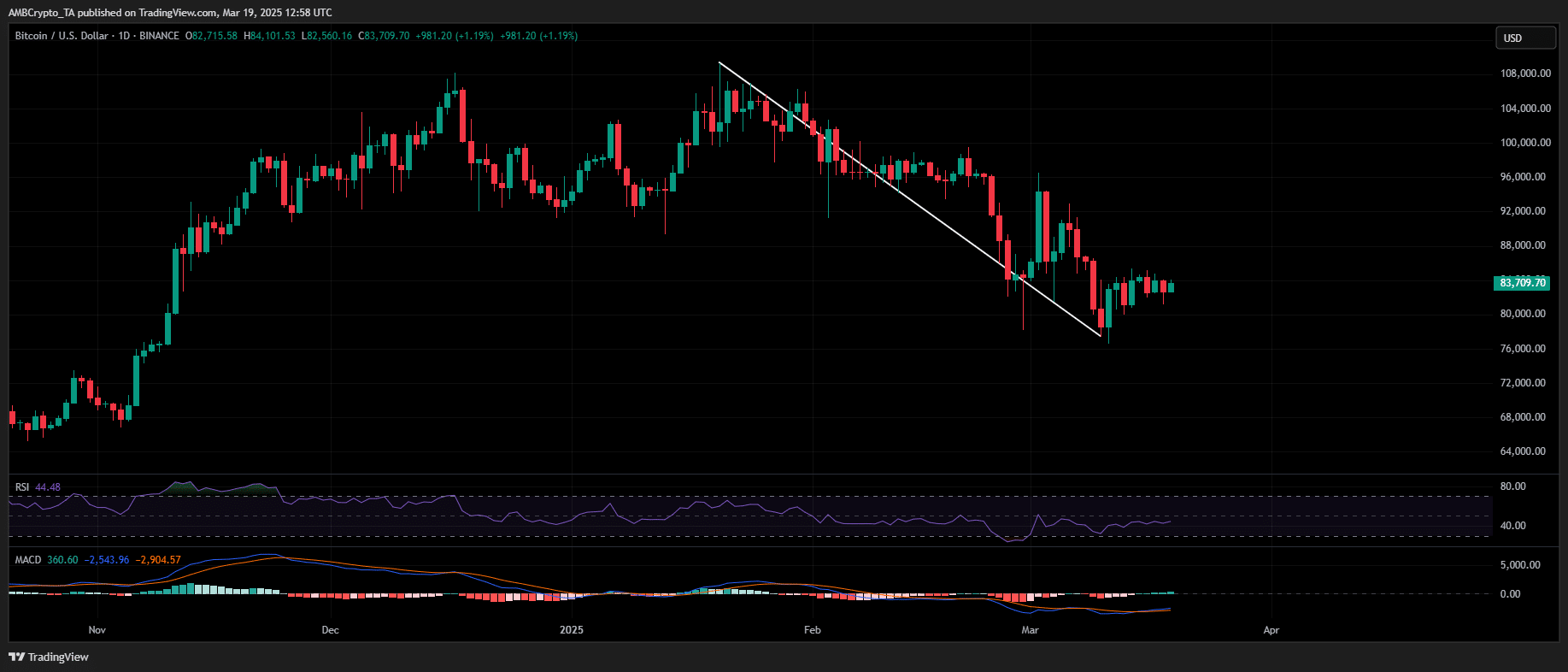

Bitcoin’s current worth swings – from its ATH of $109k to its drop under $80k– have been largely influenced by old whale distributions and macro-driven liquidity shifts.

Nevertheless, new whale inflows are reinforcing help, mitigating draw back dangers. If accumulation continues at present ranges, BTC’s chance of retesting all-time excessive will increase.

Moreover, macro components like potential price cuts, as soon as Trump’s financial reset takes impact, might additional strengthen Bitcoin’s long-term trajectory, positioning $150k–$160k as a viable long-term goal.