Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ondo Finance is buying and selling at a pivotal second because the broader crypto market exhibits indicators of potential restoration. Whereas bullish sentiment is slowly constructing, macroeconomic uncertainty and escalating international commerce battle fears proceed to inject volatility into monetary markets. For ONDO, nonetheless, analysts are carefully looking forward to a breakout that might sign the beginning of a brand new uptrend.

Associated Studying

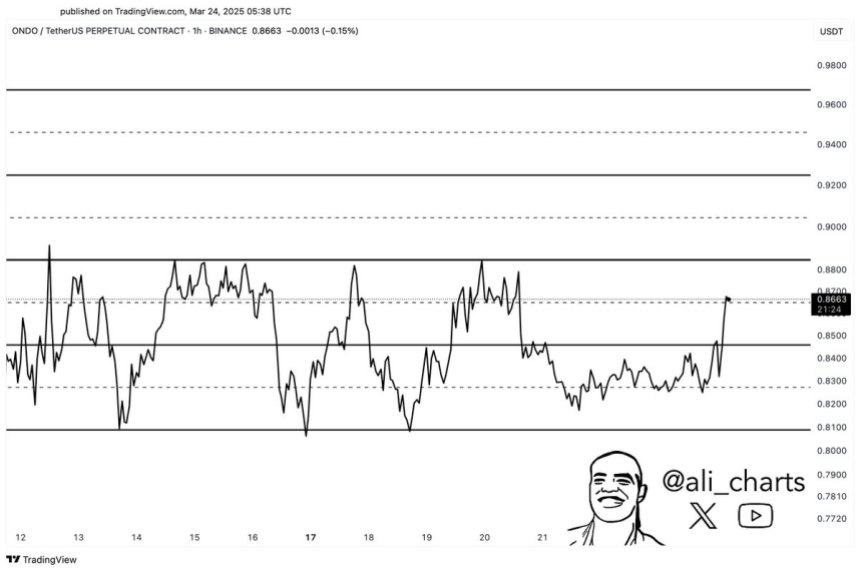

High crypto analyst Ali Martinez shared a technical outlook on X, highlighting that ONDO is at the moment buying and selling inside a slender parallel channel. In response to Martinez, a break above the higher boundary of this channel at $0.89 may set off bullish momentum, probably pushing ONDO into increased costs.

With ONDO already capturing consideration as a pacesetter within the real-world asset (RWA) sector, this technical setup may play a serious position in setting the tone for the asset’s short-term path. As buyers carefully monitor international financial developments and market sentiment, a confirmed breakout above the $0.89 resistance may solidify ONDO’s place as one of many stronger performers within the coming weeks.

ONDO Prepares For Breakout As Market Eyes RWA

Ondo Finance has emerged as some of the distinguished real-world asset (RWA) initiatives within the crypto area, securing strategic partnerships with main gamers like Ripple and World Liberty Monetary. These alliances have helped place ONDO on the forefront of tokenized finance, fueling optimism amongst buyers who anticipated robust efficiency all through 2024.

Associated Studying

Nevertheless, ONDO’s value motion has did not match the keenness. Since mid-December, ONDO has misplaced over 65% of its worth, tumbling from native highs and creating an atmosphere of worry and uncertainty. Many long-term holders stay cautious, particularly with macroeconomic volatility and ongoing commerce battle issues dragging down market sentiment.

Regardless of the sharp correction, analysts are starting to identify indicators of a possible turnaround. Martinez’s technical analysis reveals that ONDO is at the moment buying and selling inside a slender parallel channel—a sample that sometimes precedes important value actions. In response to Martinez, a breakout above the channel’s higher boundary at $0.89 may set off bullish momentum and result in a fast rally towards the $1 mark.

If ONDO can reclaim increased resistance ranges and maintain upward motion, it will reinforce its place as a pacesetter within the RWA narrative. The approaching days will likely be essential for ONDO as bulls try and flip the development and capitalize on the momentum constructing beneath the floor.

Worth Holds Close to Resistance As Bulls Eye $1.08 Breakout

ONDO is at the moment buying and selling round $0.88 after a number of days of sideways consolidation just under the $0.90 resistance degree. This slender value motion displays rising indecision available in the market as bulls try and regain momentum after weeks of heavy promoting strain. Whereas the general development stays cautious, ONDO’s proximity to key technical ranges has caught the eye of merchants looking forward to a breakout.

To verify a sustainable restoration, ONDO should break and maintain above $0.90 and push towards the 200-day transferring common (MA) and exponential transferring common (EMA), each sitting close to the $1.08 mark. Reclaiming these indicators would sign a shift in momentum and supply robust affirmation of an uptrend forming. A profitable transfer above $1.08 may open the door for a bigger rally as confidence within the RWA narrative strengthens.

Associated Studying

Nevertheless, if bulls fail to interrupt above $0.90 within the coming periods, ONDO dangers falling again into decrease assist zones. Continued rejection at this degree could set off a retest of earlier demand round $0.80 or decrease, probably extending the consolidation part. For now, ONDO stays on the sting of a breakout or deeper retrace, with the subsequent transfer doubtless defining short-term path.

Featured picture from Dall-E, chart from TradingView