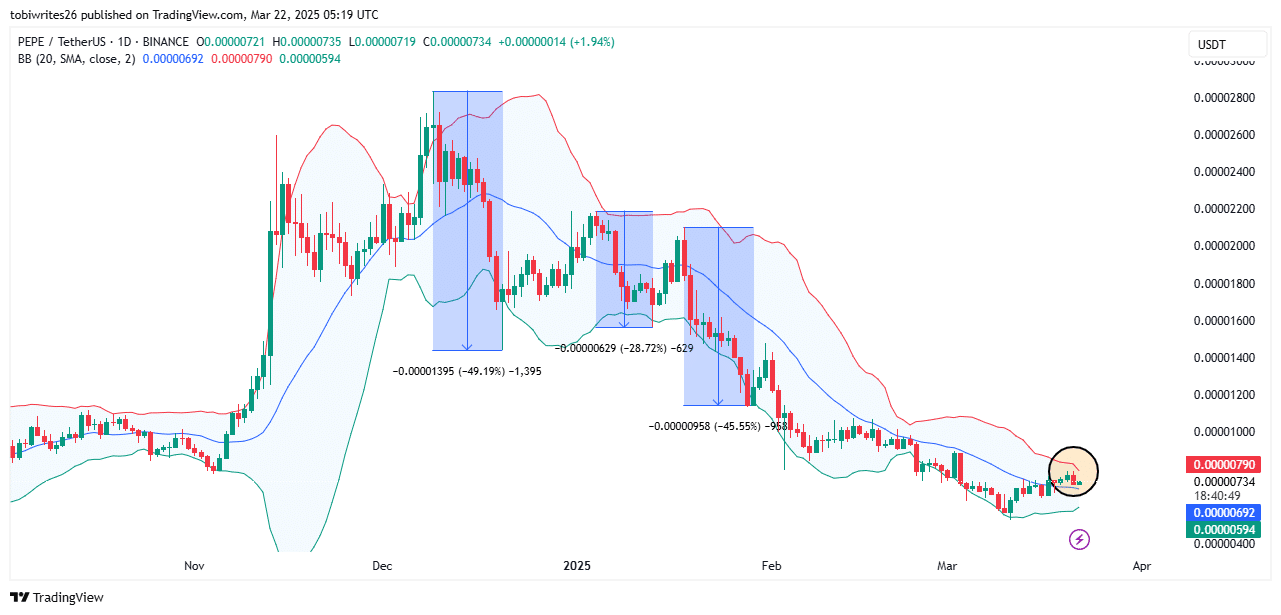

- PEPE hit the higher band of the Bollinger Bands it has been buying and selling inside

- Some individuals gave the impression to be aligned with a drop, whereas the market maintained its bullish construction

During the last 24 hours, PEPE has been on a downtrend, with a minimal lack of 1.06%. Analyzing the memecoin’s worth motion revealed that whereas spot merchants have been accumulating, derivatives merchants have been targeted on promoting PEPE. Particularly as brief contracts rose throughout the market.

The truth is, AMBCrypto’s evaluation prompt that the market might go both manner. Price mentioning, nonetheless, that two technical indicators prompt that the bulls might overturn the bears and acquire momentum.

A historic bearish confluence

A latest evaluation of the Bollinger Bands on the every day chart revealed that the asset has been buying and selling near its higher band. This degree is understood to accommodate main promoting strain, one which forces a decline within the altcoin’s worth.

Traditionally, PEPE at this degree has recorded main worth drops, shedding 49%, 28%, and 46% within the final three cases when the worth hit this degree.

If this development repeats itself, PEPE might see a major decline, probably resulting in a double-digit share drop.

If this occurs, the crypto-asset will return to buying and selling beneath its descending line – A degree it beforehand breached.

When the worth crosses above this descending line, it sometimes alerts the beginning of a rally and is adopted by a high-momentum transfer. Nonetheless, on this case, the worth has been shifting sluggishly, struggling to ascertain a rally. This indicated {that a} decline is, in truth, nonetheless doable.

AMBCrypto additionally discovered that derivatives and spot merchants stay divided on the altcoin’s subsequent worth course.

Spinoff and spot merchants stay on completely different pages

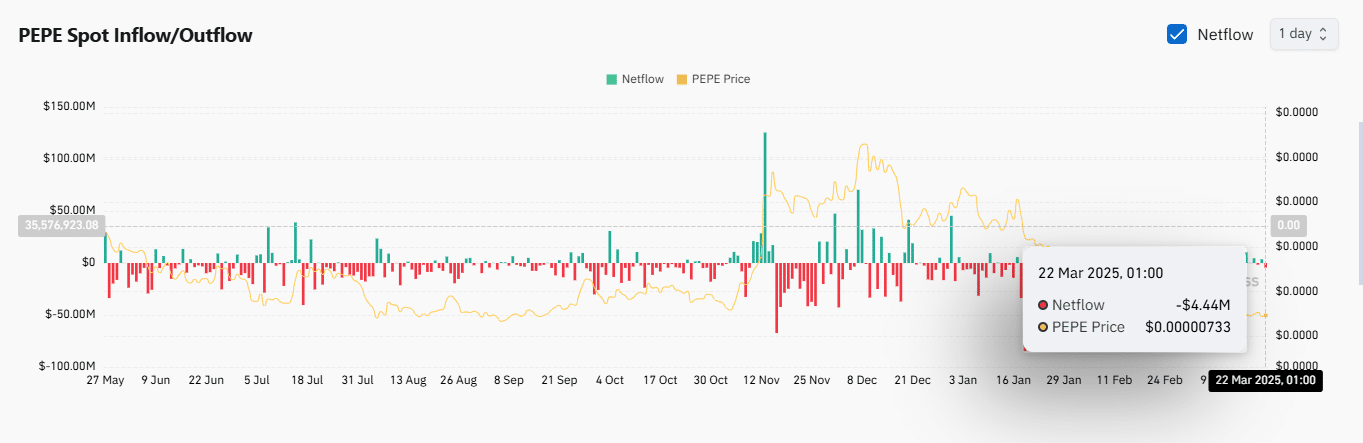

During the last 24 hours, derivatives and spot merchants have taken opposing positions on the worth motion entrance. Whereas spinoff merchants have been betting on a worth decline, spot merchants have been accumulating, regardless of the dip.

Within the derivatives market, Open Curiosity and Quantity concurrently fell by 1.65% and 39.46%, respectively. Such a drop implies that the market is presently dominated by brief merchants and that momentum is weakening. On the time of writing, the worth of unsettled contracts out there stood at $233.96 million.

This downward strain from derivatives brief merchants might play a major position in conserving PEPE’s worth low or driving it even decrease.

Nonetheless, spot merchants are taking a special method by accumulating PEPE. Within the final 24 hours, this cohort has bought $4.4 million value of the asset, stopping additional worth depreciation.

A big buy from the spot market sometimes hints at sturdy bullish conviction. This might soak up promoting strain and result in a worth rebound on the charts.

The place is PEPE heading?

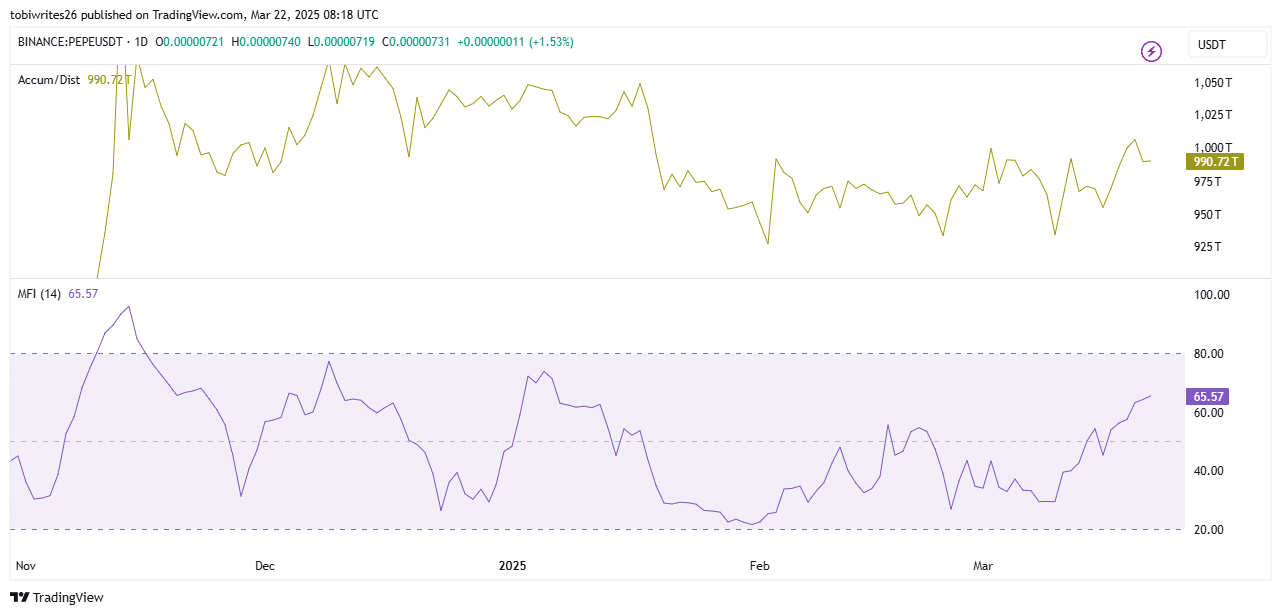

Lastly, AMBCrypto analyzed different technical indicators to find out PEPE’s likely price action. Our analysts found ongoing accumulation and liquidity inflows into the asset – Suggesting a rally could also be on the horizon.

The Accumulation/Distribution indicator’s studying was optimistic, with the identical implying that the market has been in an accumulation part.

The Cash Circulation Index (MFI), which tracks liquidity inflows and outflows over a selected interval, confirmed that liquidity is flowing into PEPE. Such inflows additional confirmed the presence of patrons out there.

At this juncture, PEPE might defy its historic bearish development and set up a brand new excessive, notably as spot merchants proceed accumulating.