- Peter Brandt made a bearish XRP name, warning of a probable dip to $1.

- XRP was comparatively overvalued, however bullish market construction was nonetheless intact as of this writing.

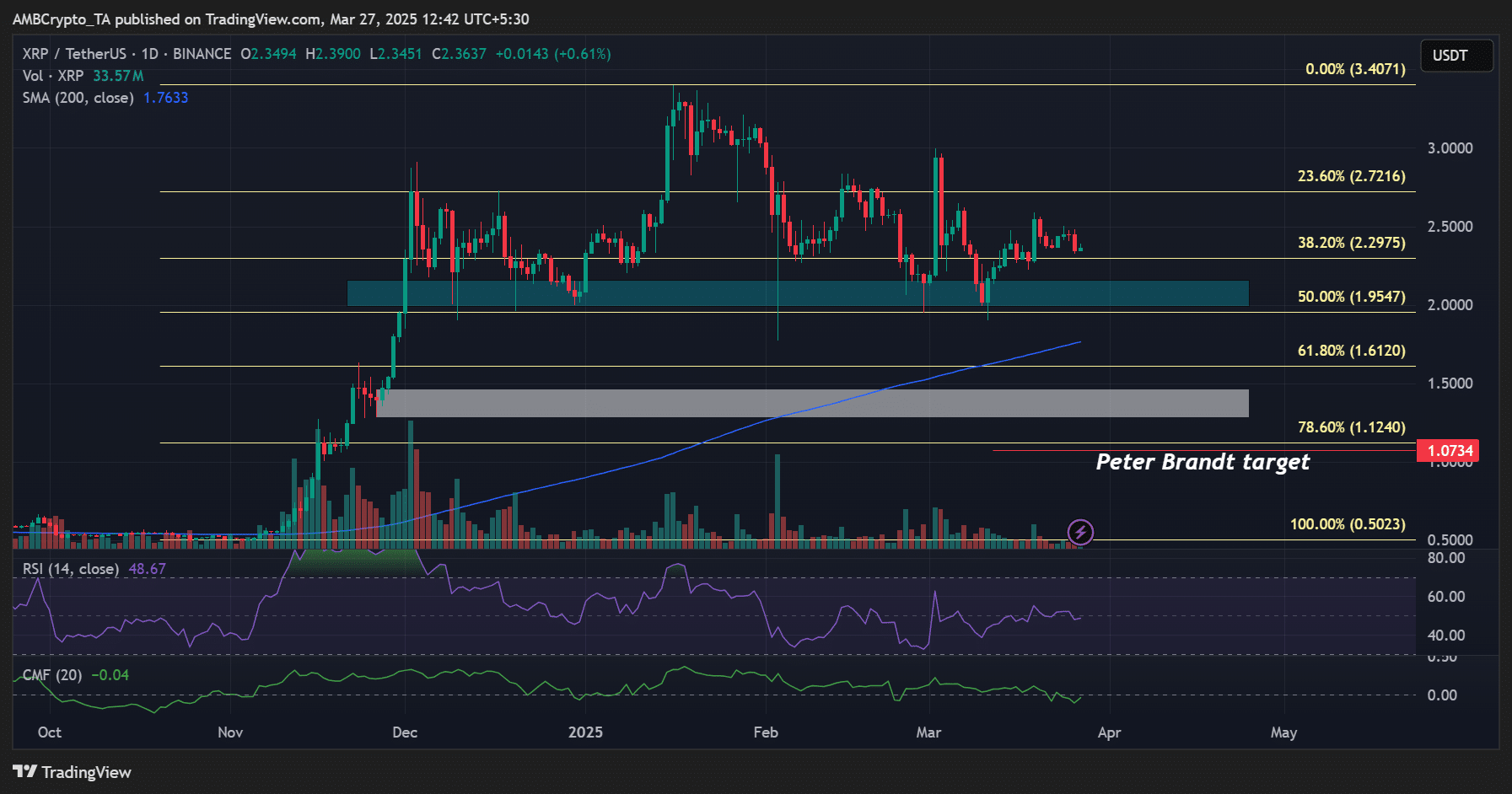

Ripple [XRP] did not decisively surge above $2.5 regardless of latest bullish updates on the SEC lawsuit entrance. It was nonetheless caught on its Q1 downtrend and had shed 30% from report highs of $3.4.

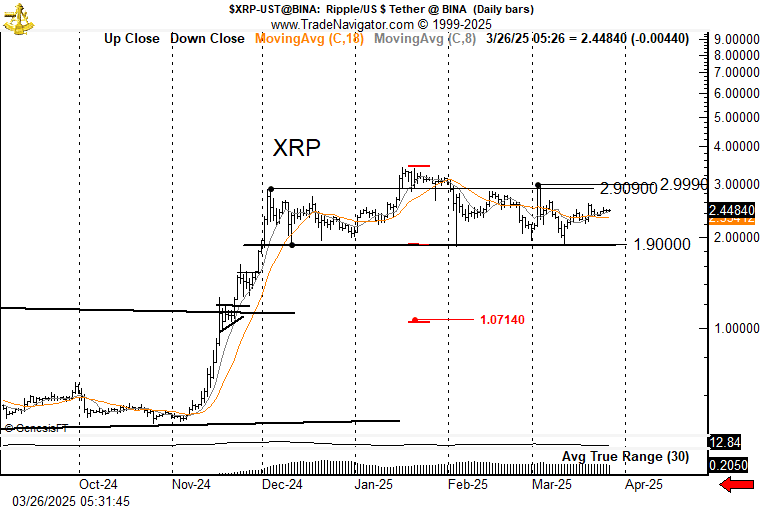

The truth is, famend value chart analyst Peter Brandt projected that the altcoin might crash 43% if it slipped beneath $1.9. He cited the bearish formation of an H&S (head and shoulder) sample, which, if validated, would goal $1.07.

“$XRP is forming a textbook H&S sample. So, we are actually range-bound. Above 3.000, I’d not need to be quick. Under 1.9, I’d not need to personal it. H&S initiatives to 1.07”

Do XRP on-chain indicators agree?

Some on-chain indicators additionally painted an identical weak outlook. On a weekly common, XRP Ledger energetic addresses declined by 62% from 74K customers on the December peak to 28K in March.

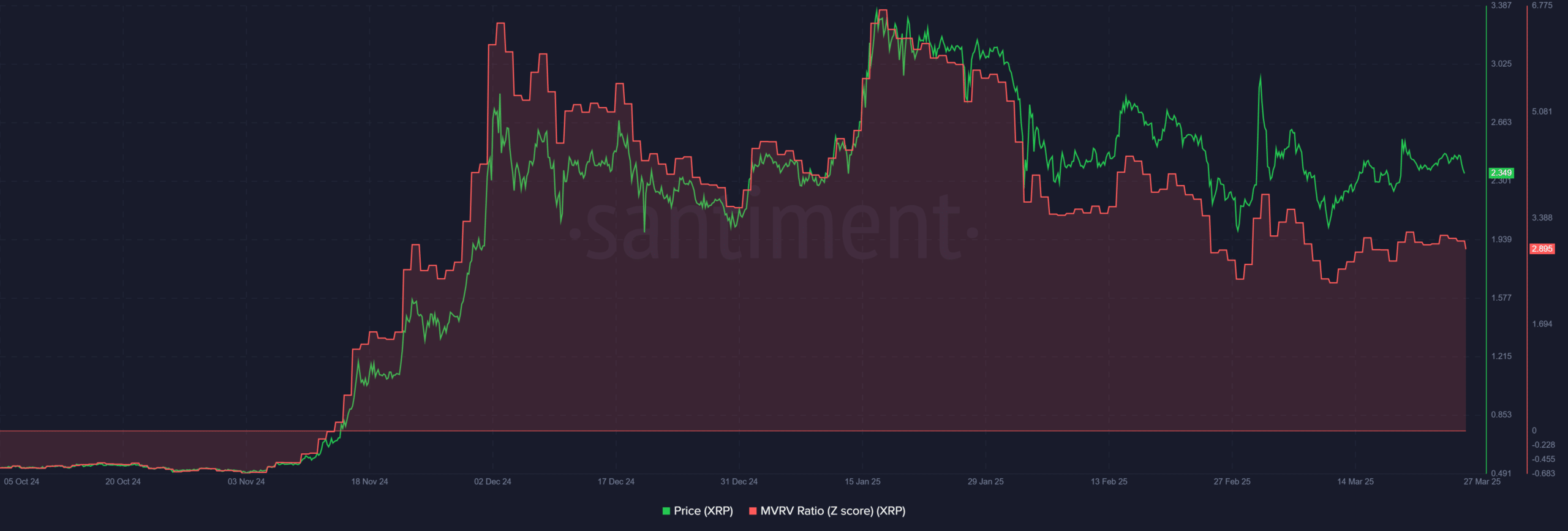

In response to Santiment’s MVRV Z rating, XRP was nonetheless comparatively overvalued at present ranges. The indicator tracks whether or not an asset is overvalued or undervalued relative to its value.

A studying above one may very well be deemed ‘overpriced’ as extra holders are in revenue and will promote. Quite the opposite, MVRV Z rating values beneath one are perceived as ‘undervalued.’

For Ripple, the metric climbed above 6 in December and was 2.8 at press time. Merely put, long-term holders had 2.8X-6X unrealized acquire and will doubtlessly e-book revenue and tank XRP.

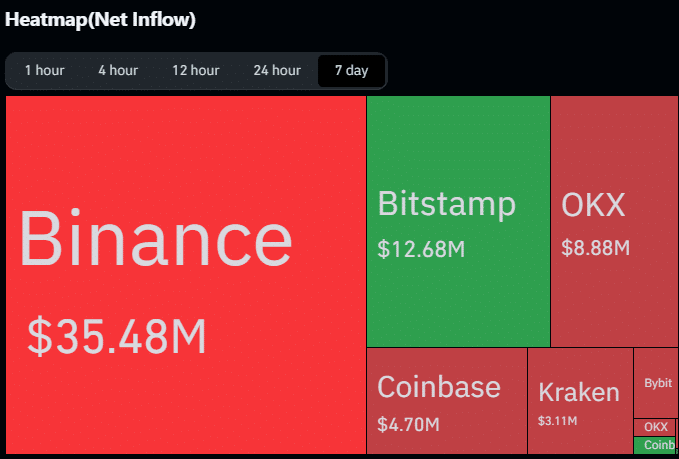

However the stage of accumulation seen previously seven buying and selling days didn’t help the bearish inclination.

Per Coinglass information, $43 million value of XRP was withdrawn from exchanges this week. General, $290 million value of XRP left exchanges in March, suggesting that some gamers anticipated an additional rally. Will their lengthy wager materialize?

From a value chart perspective, the $2 (cyan) and $1.4 (white) ranges have been key helps to observe earlier than Brandt’s goal.

As well as, the value motion was nonetheless above the 200 Each day Transferring Common (DMA) in blue, which meant that XRP’s bullish market construction was nonetheless intact, not less than as of this writing.