XRP community exercise surges regardless of worth dip

XRP’s worth could also be cooling down, however on-chain knowledge tells us a distinct story.

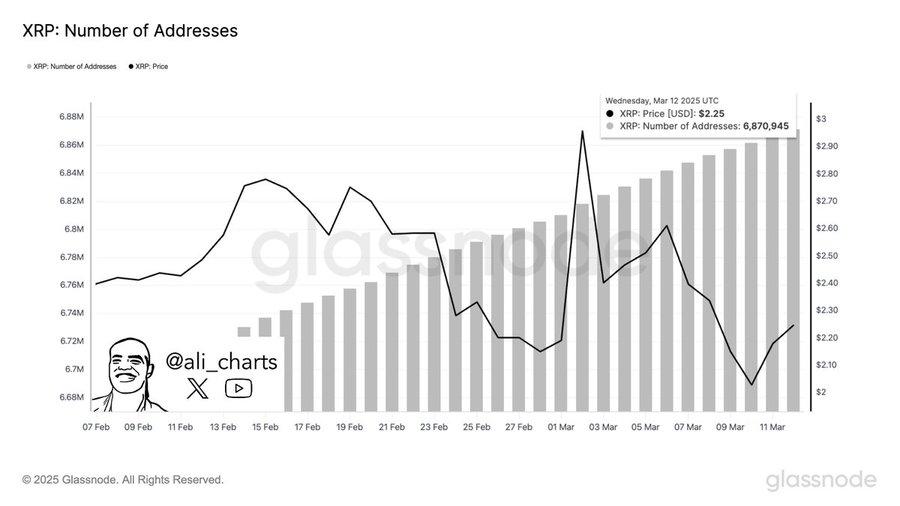

For instance – The variety of XRP addresses steadily climbed to six.87 million by 12 March, signaling rising consumer adoption. This, regardless of the worth dropping from $2.90 to $2.25.

Extra notably, Santiment’s knowledge revealed a surge in every day energetic addresses between March 1-8, peaking simply as the worth started to slip. This divergence hinted at heightened community exercise amid the sell-offs – Typically an indication of accumulation or speculative repositioning.

Sustained deal with development and energetic utilization indicated that buyers aren’t exiting. As a substitute, they’re adjusting.

If this pattern holds, XRP could possibly be setting the stage for a stronger rebound as soon as sentiment improves.

Ethereum’s precedent, Ripple’s parallels

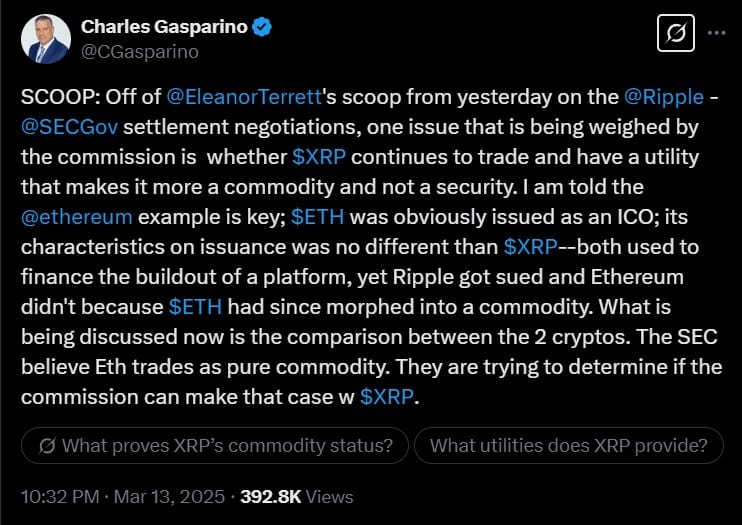

Ethereum’s transition from an ICO-funded token to a acknowledged commodity has change into a central reference in Ripple’s authorized protection. The SEC beforehand shunned prosecuting Ethereum, citing its decentralization and transformation over time.

Ripple is now pointing to this precedent, arguing that XRP has undergone an identical evolution.

In accordance with FOX Information correspondent Charles Gasparino, Ripple is emphasizing these parallels because the SEC weighs XRP’s present utility. As he famous in a 13 March publish on X, SEC officers are discussing “whether or not XRP continues to commerce and have a utility that makes it extra a commodity and never a safety.”

Each ETH and XRP have been initially used to finance platform improvement, but solely Ripple confronted authorized motion. That comparability may in the end form the SEC’s choice on learn how to classify XRP.

Ripple’s protection technique and the stakes of classification

Ripple’s authorized crew is concentrated on reframing XRP’s utility and market habits to replicate that of a commodity. Their argument facilities on the declare that XRP not will depend on Ripple Labs or any central issuer. As a substitute, they’re asserting that XRP operates independently available in the market, very similar to ETH.

As Gasparino reported, the SEC is assessing whether or not XRP’s utility has change into self-sustaining – Indifferent from its unique fundraising goal. A positive ruling would finish Ripple’s long-running authorized entanglement and probably unlock higher institutional curiosity in XRP. Nevertheless, if the SEC concludes that XRP remains to be a safety, Ripple may face contemporary restrictions. And, exchanges might re-evaluate their listings.

In reality, the implications transcend Ripple. This case may set a regulatory precedent for a way digital property are categorized in america.