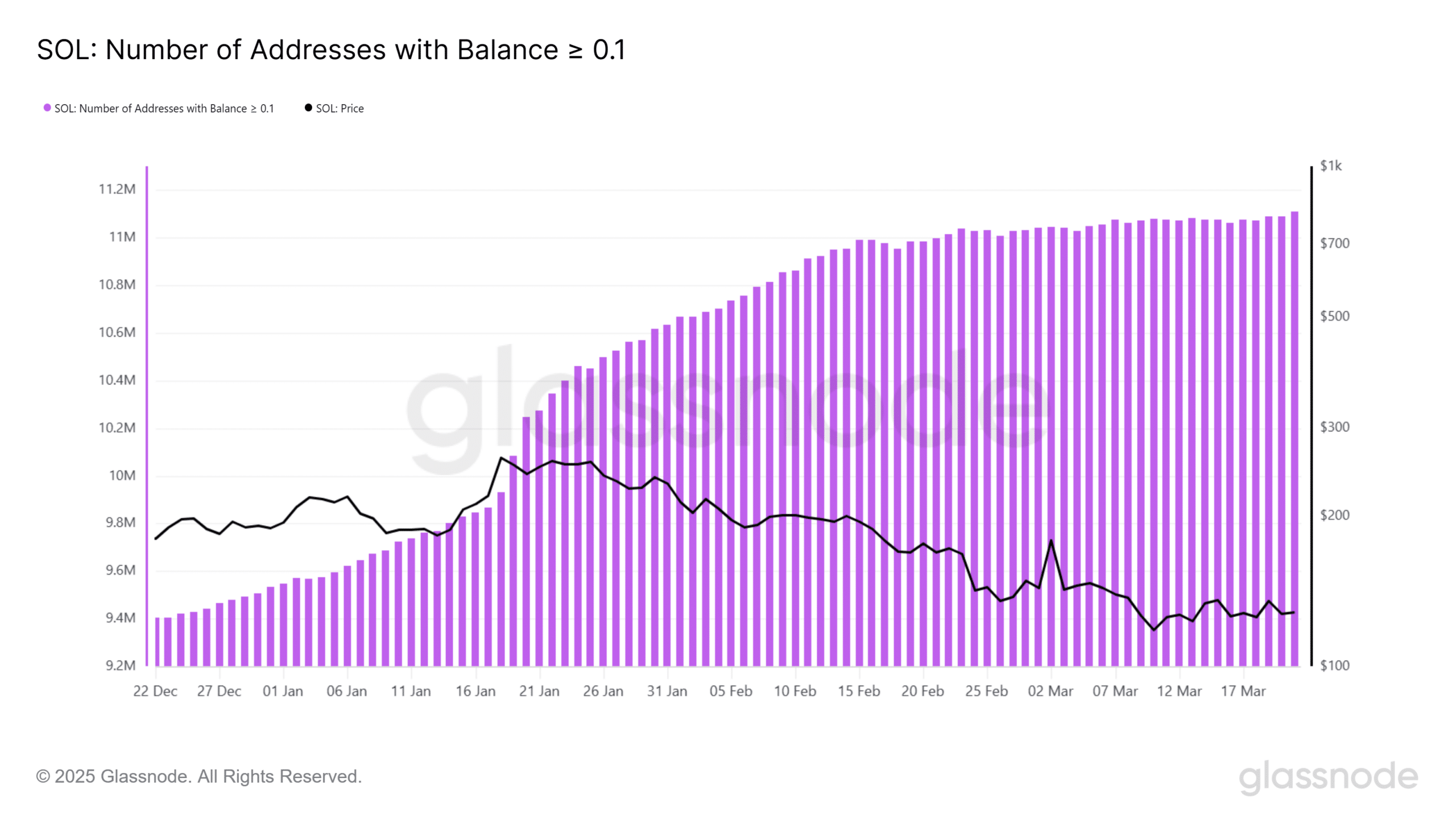

- SOL community addresses with ≥0.1 steadiness have surged previous 11.1M – Its highest degree in months

- Regardless of rising community exercise, Solana’s TVL has dropped from $11.7 billion to $6.2 billion since January

Solana [SOL] has been seeing a big uptick in community exercise these days. Particularly because the variety of addresses holding not less than 0.1 SOL hit a brand new excessive on the charts. This metric, which displays rising consumer adoption, has been climbing steadily since late December 2024. This, at the same time as the value of SOL corrected from earlier highs.

In gentle of the decoupling of community development and value motion, is the market underpricing Solana’s fundamentals?

Solana’s consumer adoption soars amid value correction

Knowledge from Glassnode indicated that the variety of addresses with 0.1 SOL or extra rose from round 9.2 million in late December to over 11 million by 21 March.

This development in consumer base could be seen as an indication of sustained curiosity within the Solana ecosystem, even because the asset’s value slipped from above $180 in January to round $129.54 at press time.

This divergence additionally advised that smaller retail members have continued to build up SOL, presumably in anticipation of longer-term positive factors.

Solana’s TVL faces stress, however holds key ranges

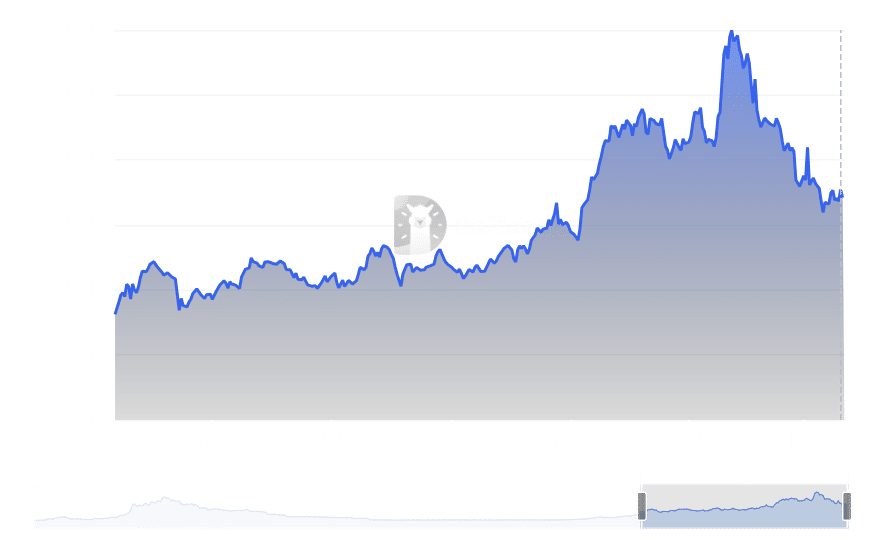

Quite the opposite, Complete Worth Locked [TVL] on Solana registered a notable pullback.

In keeping with DeFiLlama’s data, the TVL dropped from its yearly peak above $11 billion in January to only below $6.4 billion not too long ago. This decline alluded to a contraction in DeFi capital allocation, one thing that could be pushed by each macro volatility and lowered incentive packages.

Value stating, nonetheless, that the press time TVL degree was considerably greater than the pre-bull market base of 2023.

This may be interpreted to imply that Solana’s DeFi ecosystem retains significant traction throughout the board.

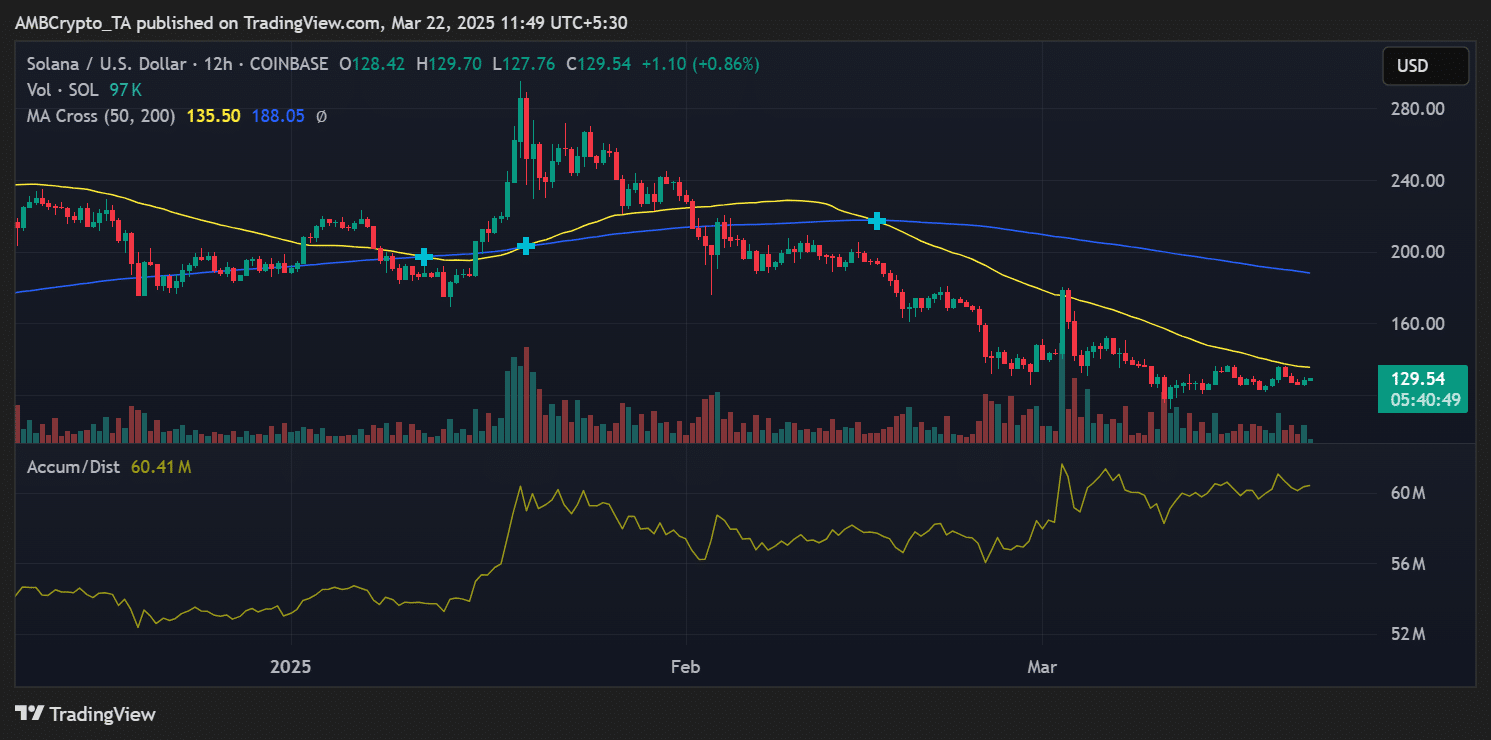

Solana’s value outlook – Rangebound, however supported by accumulation

On the time of writing, SOL was buying and selling beneath each the 50-day [$135.50] and 200-day [$188.05] transferring averages.

This hinted at a broader bearish construction. Nevertheless, the Accumulation/Distribution Line highlighted constant upward motion – An indication that sensible cash may be getting into at press time ranges.

With comparatively low quantity and resistance round $135, value motion might stay rangebound within the quick time period. Nevertheless, sustained on-chain development might act as a tailwind for future rallies.

Solana has been exhibiting robust foundational demand, regardless of speculative capital pulling again. If the value ultimately aligns with community energy, SOL could gear up for an additional rally on the charts.