- The primary-ever SOL ETF monitoring Futures will debut on twentieth March.

- Bloomberg’s analyst Eric Balchunas cautioned that spot ETF approval might have an effect on the Futures ETFs.

The primary-ever U.S.-based Solana [SOL] ETF (exchange-traded funds) is about to be launched by way of the Nasdaq change on the twentieth of March, additional bolstering the percentages of spot ETF approval.

In accordance with a Bloomberg report, Volatility Shares LLC plans to launch two funds monitoring SOL Futures markets.

The primary fund, Volatility Shares Solana ETF (SOLZ), will observe SOL Futures, whereas Volatility Shares 2X Solana ETF (SOLT) will provide a twice-leveraged publicity to the crypto asset.

Futures markets enable members to invest on SOL’s future worth with out proudly owning the bodily SOL asset.

Is spot Solana ETF subsequent?

Right here, it’s value noting that Bitcoin [BTC] and Ethereum [ETH] adopted the Futures market pathway earlier than being authorised for spot ETF. Nevertheless, Bloomberg senior analyst Eric Balchunas cautioned that the merchandise might face ‘some points’ if spot ETFs are authorised.

“It’s the primary altcoin after Ether to be authorised. However historical past has proven that ETF buyers crave holding the bodily asset as a lot as potential…It might have some points when spot is authorised.”

For his half, Nate Geraci noted that spot SOL ETF might launch quickly, drawing a comparability to the ETH ETF pathway.

“Lower than a 12 months in the past, just about *everybody* thought spot ETH ETFs have been a pipe dream. Now, we’ll have SOL futures ETFs. Spot SOL ETFs received’t be far behind IMO.”

In accordance with the prediction site Polymarket, the market priced in an 88% likelihood of spot SOL ETF approval in 2025. Merely put, the market was extremely optimistic of the result this 12 months.

That mentioned, SOL wasn’t the one altcoin ETF with excessive market hypothesis. Potential issuers have filed for varied ETFs, together with Cardano, HBAR, Polkadot, Aptos, and Sui.

In reality, on the seventeenth of March, Canary Capital filed a registration statement with the SEC for an SUI ETF. Put otherwise, the altcoin ETF race has heated up below the Trump-era SEC.

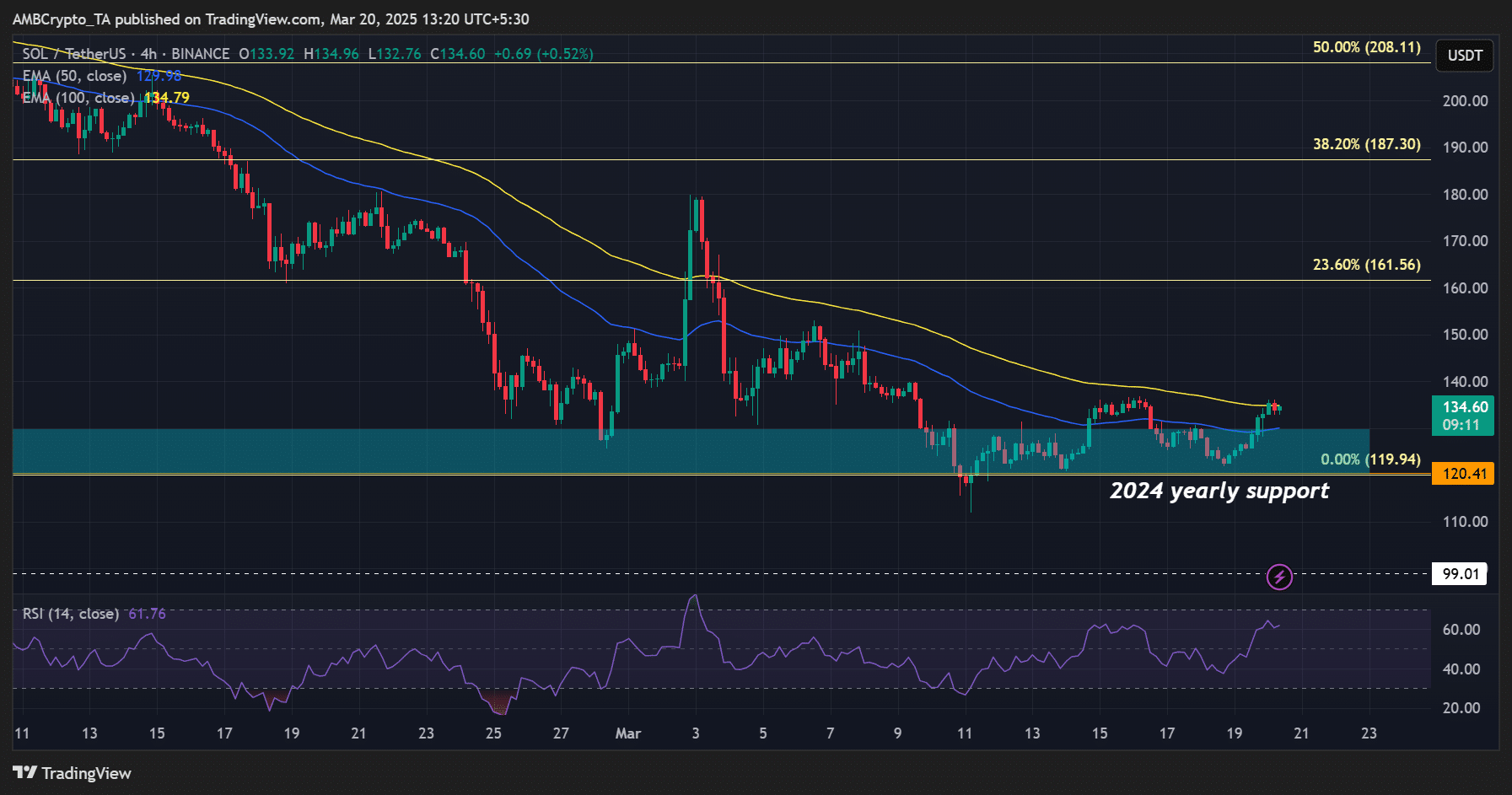

That mentioned, SOL was up 10% up to now 24 hours however consolidated on the 4-hour chart’s 100- Exponential Transferring Common (EMA) in yellow, on the time of writing.

Solely a agency reclaim above the Transferring Common might reinforce the sting for SOL’s prolonged restoration.