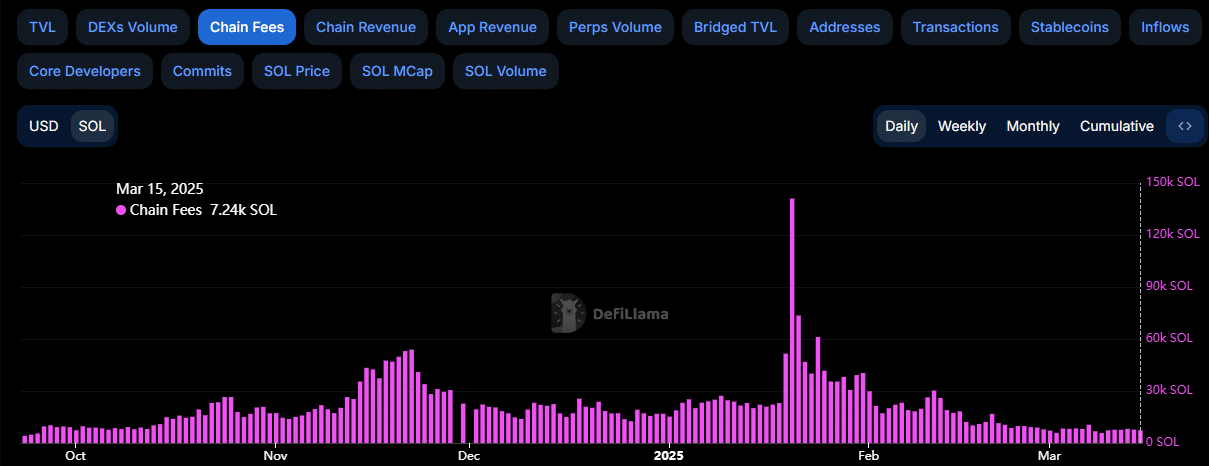

- DEX volumes dragged Solana chain charges to October 2024 ranges.

- Markets at the moment are targeted on subsequent week’s Fed assembly for potential catalysts.

Decentralized trade (DEX) buying and selling volumes throughout high chains have declined 60% from January highs, hitting Solana [SOL] the toughest, per Coinbase analysts.

In January, buying and selling DEX volumes peaked at $457.5 billion. By the tip of February, the DEX volumes dipped under $300B; as of mid-March, the month-to-month quantity was at $100B, per aggregated information from DeFiLlama by The Block.

Solana hit hardest

Solana’s high platforms, like Raydium, Meteora and Orca, drove many of the January DEX volumes, particularly following the launch of TRUMP and MELANIA meme-coins.

Sadly, Solana memecoins cooled off considerably in January, famous Coinbase (CB) analysts of their weekly market review.

“Memecoin buying and selling exercise has been notably laborious hit, mirrored in Solana’s 82% drop in DEX volumes for the reason that US presidential inauguration in January.”

In actual fact, Pump.enjoyable’s traded quantity, the important thing driver of the meme mania in Solana, dipped to October 2024 lows. In consequence, the huge decline in exercise dented Solana transaction charges, added CB analysts.

“This has had second-order results on Solana transaction charges, which reached their lowest ranges since September 2024 (denominated in SOL).”

When it comes to SOL, the chain charges dipped from 141K SOL in January to 7K SOL as of press time — a whopping 95% decline in charges.

SOL’s worth additionally tanked as speculative curiosity waned from mid-January. It dropped from $295 to a low of $112 earlier than bouncing to $134 at press time. Even so, the altcoin was nonetheless down 55% from its all-time highs.

Quite the opposite, Ethereum’s DEX volumes remained resilient per the CB report.

That stated, the decline was additionally a part of a broader market contraction, accelerated by macro uncertainty amid Trump tariff wars.

Based on CB analysts, the risk-off pattern may persist except subsequent week’s FOMC assembly stops quantitative tightening (QT) and stabilizes markets.

“We predict there’s likelihood of a pause or cease in QT as financial institution reserve ranges are approaching the 10-11% of GDP threshold generally thought of adequate for sustaining monetary stability.”