- SOL costs held agency above the $190 demand zone because it eyes $225 and $260 as potential targets.

- Deutsche Financial institution-backed Taurus integrates Solana for enterprise-grade custody and tokenization.

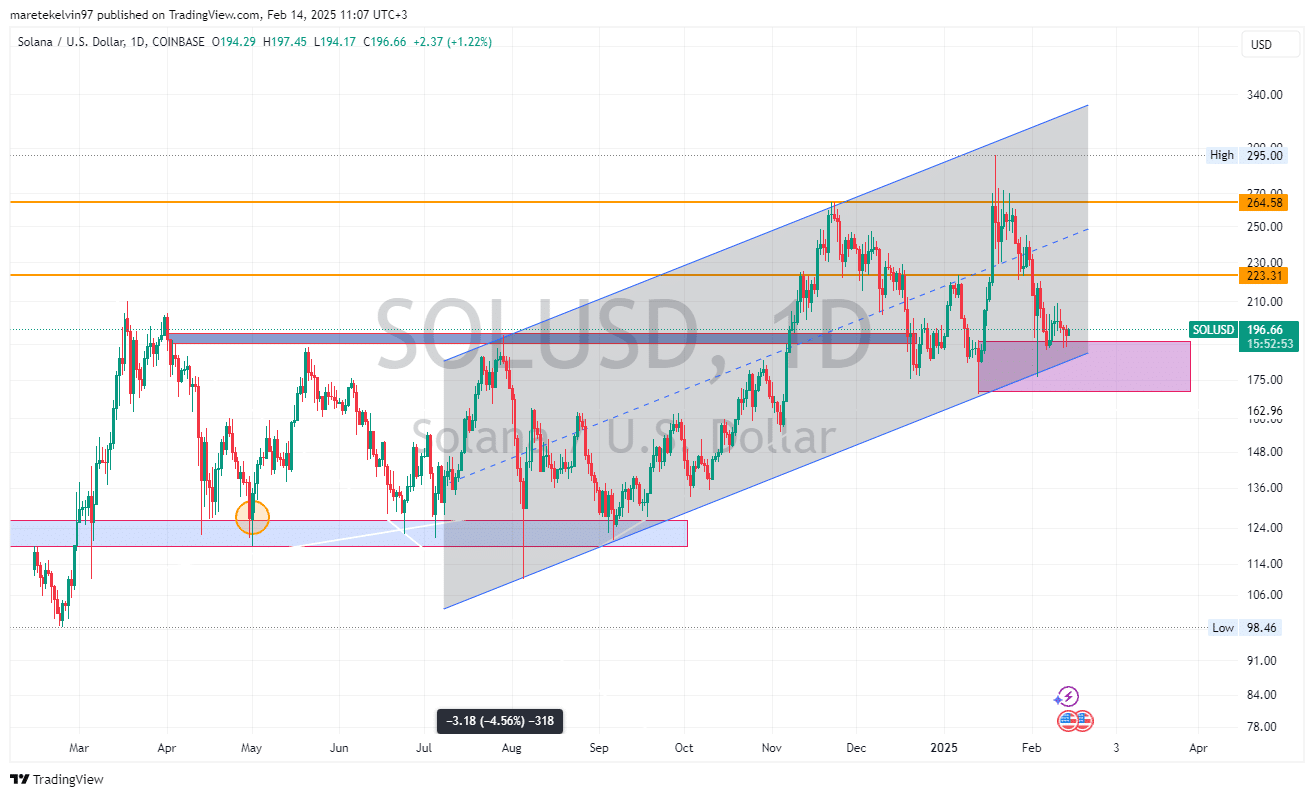

At press time, Solana [SOL] was holding agency above the crucial $190 demand zone, positioning the altcoin for a possible rally towards $225 and even $260.

Technical indicators and rising institutional adoption are fueling bullish sentiment.

With Deutsche Financial institution-backed Taurus integrating Solana for enterprise-grade custody and tokenization in response to its newest tweet, confidence within the ecosystem is rising.

Might this gas SOL’s subsequent main value surge?

Technical sentiments lean bullish

SOL’s value motion was supported by a confluence of technical elements. The altcoin was holding robust above a crucial demand zone round $190, which has beforehand acted as a springboard for upward tendencies.

On the identical time, SOL was consolidating in a flag sample, with costs bouncing off from the flag assist round $190. The confluence of assist zones cements $190 as a key degree for SOL’s subsequent trajectory.

If SOL’s bullish momentum persists, it might goal the subsequent resistance degree at $225.

A sustained rally past this value degree might push its value additional to check the $260 resistance degree, particularly if shopping for stress intensifies.

The $190 degree has proved to be a powerful assist zone, and its protection by bulls signifies a strong basis for additional features.

Institutional backing strengthens SOL’s case

Supporting SOL’s bullish case is the current integration of Solana by Taurus, a Deutsche Financial institution-backed institutional-grade custody and tokenization platform. This partnership is a milestone for Solana, because it brings institutional-grade infrastructure to the community.

Taurus will allow customers to securely custody and stake SOL-native belongings, concern programmable tokenized belongings at scale and leverage Solana’s high-speed infrastructure.

This growth not solely provides to the legitimacy of Solana but in addition provides the potential for institutional adoption, which might drive SOL demand in the long run.

Can Solana attain $260?

The mix of technical and basic indicators creates a powerful basis for SOL’s upward trajectory. The flag sample, coupled with the numerous $190 demand zone, cements a bullish sign for SOL’s potential rally.

If the altcoin maintains its bullish momentum and capitalizes on rising institutional curiosity, the $225 and $260 goal value ranges seem properly inside attain.