- Solana is perhaps mirroring Ethereum’s 2024 breakout

- Solana’s double backside sample on the each day chart might be a precursor to a possible uptrend

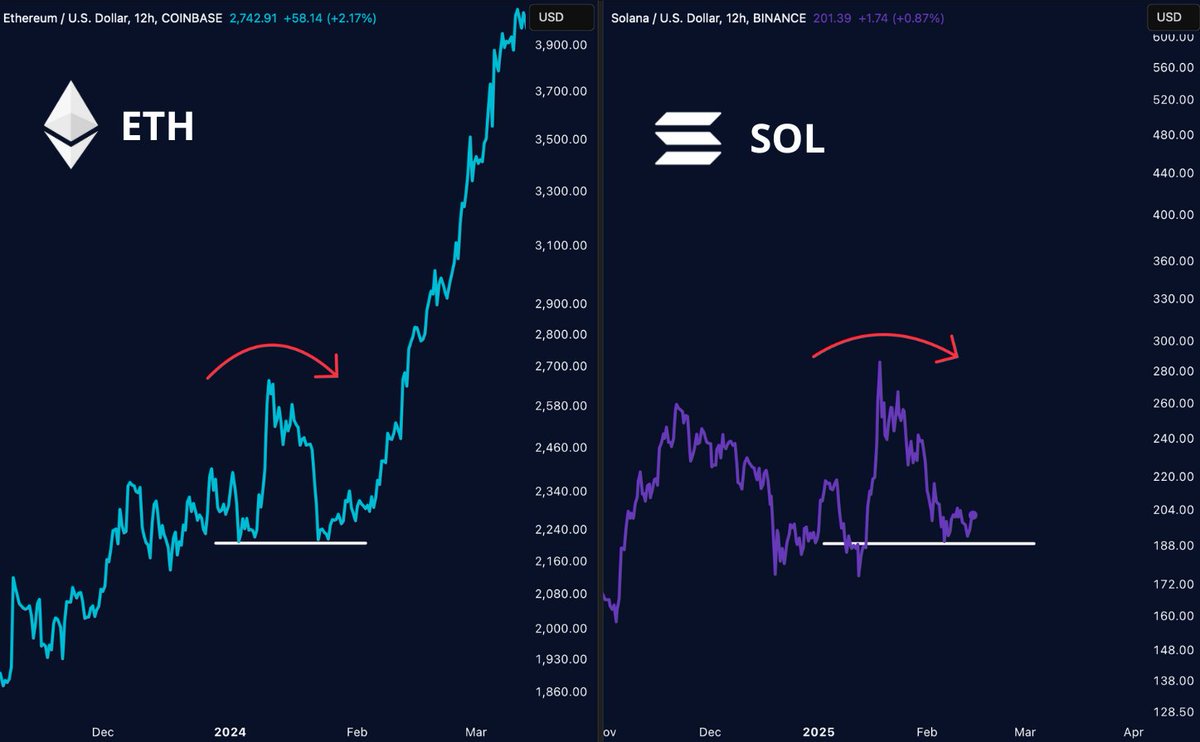

AMBCrypto’s evaluation of Solana’s (SOL) prevailing value construction has revealed a compelling parallel with Ethereum’s 2024 surge. Again then, Ethereum went on a strong upward trajectory, one marked by a rally from $2,500 in December to $3,700 in March.

This motion highlighted a bullish restoration after the formation of a double backside on the charts between mid-January to early February. On the time, key value ranges have been set at $2,400 and $2,800. Equally, Solana could also be exhibiting a possible bottoming sample, with its value stabilizing above the $190-level at press time.

SOL’s chart indicated that its value motion might be mirroring ETH’s earlier breakout sample. By extension, like in Ethereum’s case, upside might be incoming for Solana too. If it actually follows ETH’s trajectory and hikes by 80% because it did, SOL might go as excessive as $340.

Right here, it’s necessary to notice, nonetheless, that whereas historic parallels present a bullish outlook for Solana, divergent market dynamics or broader financial elements might mood this trajectory. These might result in fluctuations or a extra reasonable or reasonable hike.

The correlation proven right here underlines the potential for vital actions. Even so, market contributors also needs to take into account the potential for divergences attributable to distinctive elements affecting every cryptocurrency.

Double backside indicators potential reversal

A deeper look into the basic double backside sample, recognized by two distinct lows across the $190-level, signaled potential reversal factors for SOL. This technical formation, usually interpreted as a bullish indicator, appeared to suggest that SOL might have discovered robust help at this value vary after a interval of decline.

The sample’s neckline, represented by the resistance line round $210, is essential for confirming the development reversal. If SOL efficiently breaches this neckline, it might provoke a rally and goal larger resistance ranges close to the $230-mark.

Conversely, failure to surpass the neckline may lead to SOL retesting the help ranges, with a threat of additional declines if these ranges fail to carry. A hike in volumes might verify the breakout energy.

A sustained transfer above the $210-resistance would verify this bullish situation. Quite the opposite, a drop under the $190 help may point out bearish continuation.

Solana’s mainstream adoption

Concurrently, the Crypto Activity Power‘s collaboration with Jito Labs and Multicoin Capital to discover staking inside Alternate Traded Merchandise (ETPs) might democratize entry to yield technology on Solana.

This transfer might appeal to institutional buyers, offering them with a well-known funding car (ETPs) whereas leveraging the excessive yield alternatives of staking on Solana. This may improve liquidity and stability, additional propelling Solana in direction of mainstream monetary programs.