- Regardless of SOL’s current positive factors, the altcoin remains to be down 20% over the previous month

- Buying and selling quantity appeared regular, that means merchants are ready to see what occurs earlier than making massive strikes

Solana’s value has bounced again during the last 24 hours, however merchants are nonetheless not sure about what comes subsequent. On the time of writing, SOL was buying and selling at $138 on the charts, up by 5.87%.

Regardless of its current positive factors, nonetheless, the altcoin was nonetheless down 20% for the month – An indication that the market has been shaky.

Solana’s value bounced again from $128.49, flashing some short-term power. Even so, it’s now struggling to interrupt $140 – A degree the place sellers hold pushing it down. If SOL strikes above $140 and stays there, it may imply merchants are turning extra constructive.

Solana’s market struggles – Will the rally proceed?

Whereas there have been some indicators of restoration, different metrics hinted that it could be too quickly to say something. Right here, it’s value mentioning that Solana’s buying and selling quantity shot up by 130.42% to $3.33 billion, that means extra persons are shopping for and promoting.

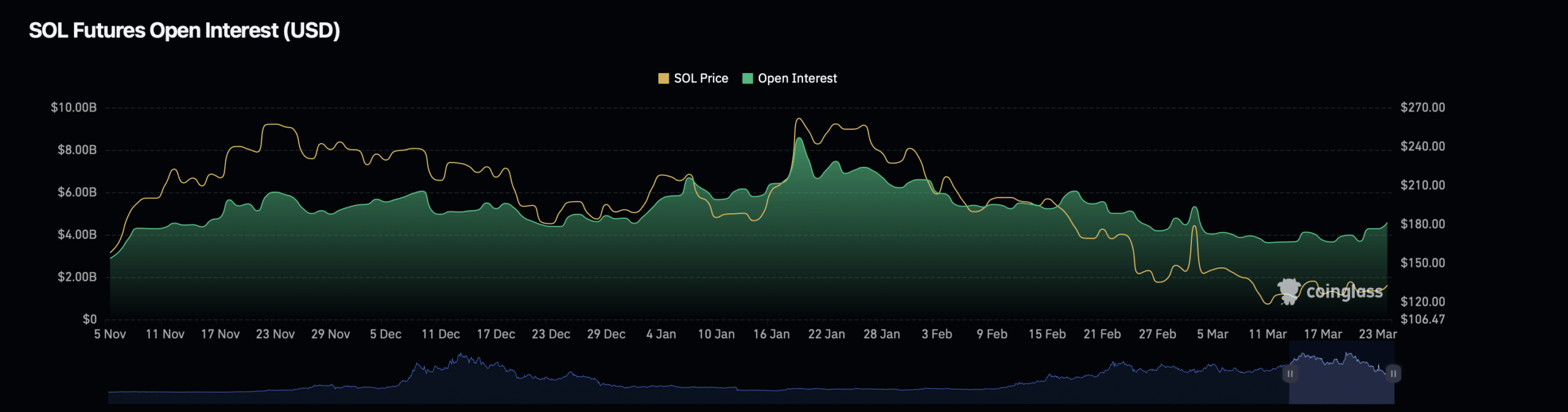

On the identical time, Coinglass data revealed that extra merchants are betting on Solana’s future value. The whole cash in Solana Futures is now $5.25 billion, up 11.01%. Which means that extra persons are taking dangers with leveraged trades.

This hike in Open Curiosity can both assist additional value development or set off sharp corrections if liquidation occasions happen.

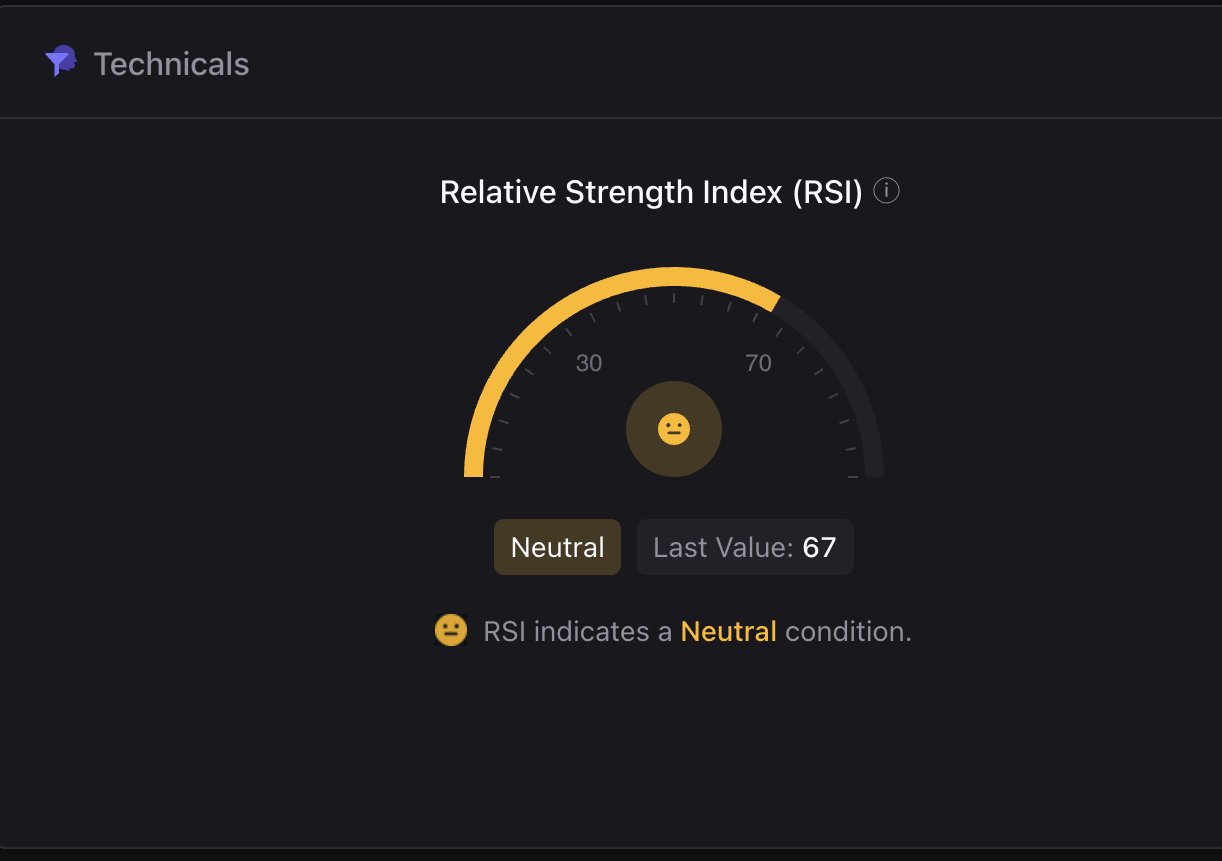

In the meantime, CryptoQuant indicated that SOL’s RSI stood at 67, putting SOL in a impartial zone. Whereas the token might not but be overbought, it has been approaching ranges the place promoting stress may improve.

If the RSI (a measure of how briskly the worth is shifting) goes over 70, it’d imply Solana is overbought, which may result in a small drop. Nevertheless, if the RSI stays the identical or strikes down, the worth would possibly simply take a break earlier than making its subsequent transfer.

Are Solana’s energetic customers supporting the worth?

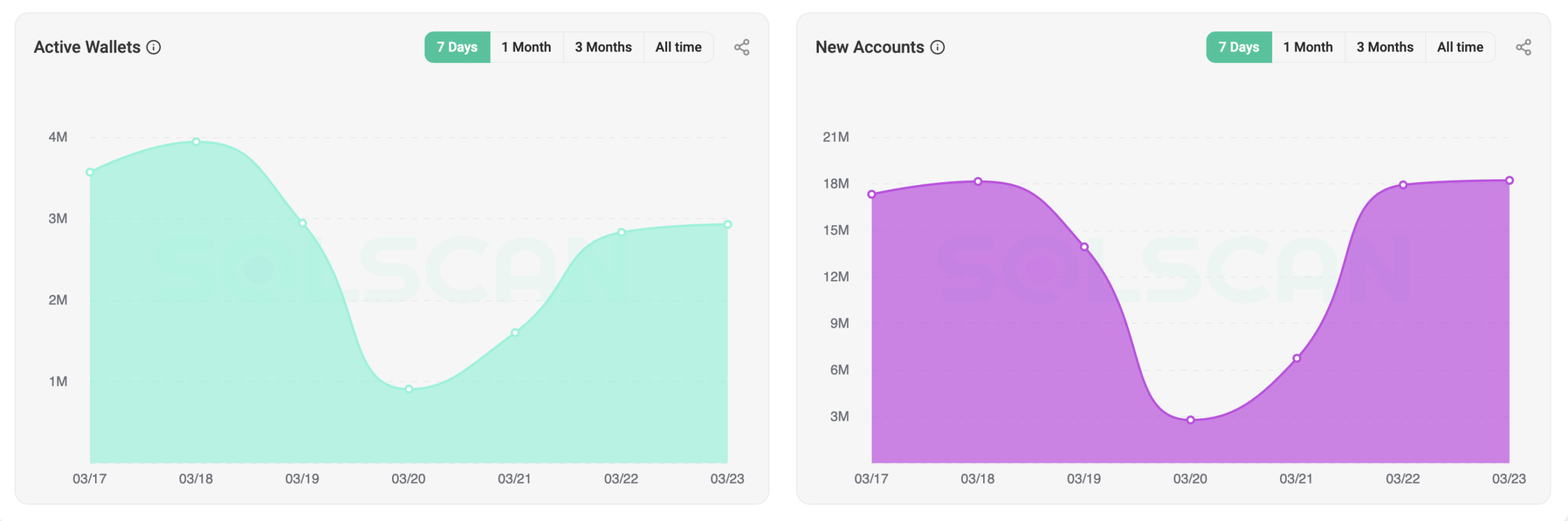

One massive think about Solana’s value is how many individuals are utilizing the community. Over the previous week, the variety of active wallets dropped to 1 million on 20 March, earlier than leaping again as much as 3 million by 23 March.

Extra customers may imply extra demand, which could assist hold the worth sturdy.

Equally, new pockets creation dropped considerably round 19-20 March, however rebounded over the previous few days.

What’s subsequent for SOL?

For Solana to maintain going up, it wants to interrupt previous $140 on the again of sturdy buying and selling quantity. The 130% bounce in buying and selling quantity is an effective signal, but when consumers decelerate, SOL would possibly battle to remain at this degree and it may drop once more.

If merchants keep energetic, the RSI retains rising, and extra individuals use Solana, the worth may hold climbing in direction of the following resistance degree.

The subsequent few days are necessary. Solana will both maintain sturdy or face promoting stress that pushes it again down.