- If SOL fails to carry the $136 degree, it may drop by 12% to achieve $120.

- Solana’s bearish outlook may doubtlessly shift if it surges and closes a day by day candle above the $146 degree.

Solana [SOL] seems to be making ready for a value decline because it has fashioned a bearish value motion sample.

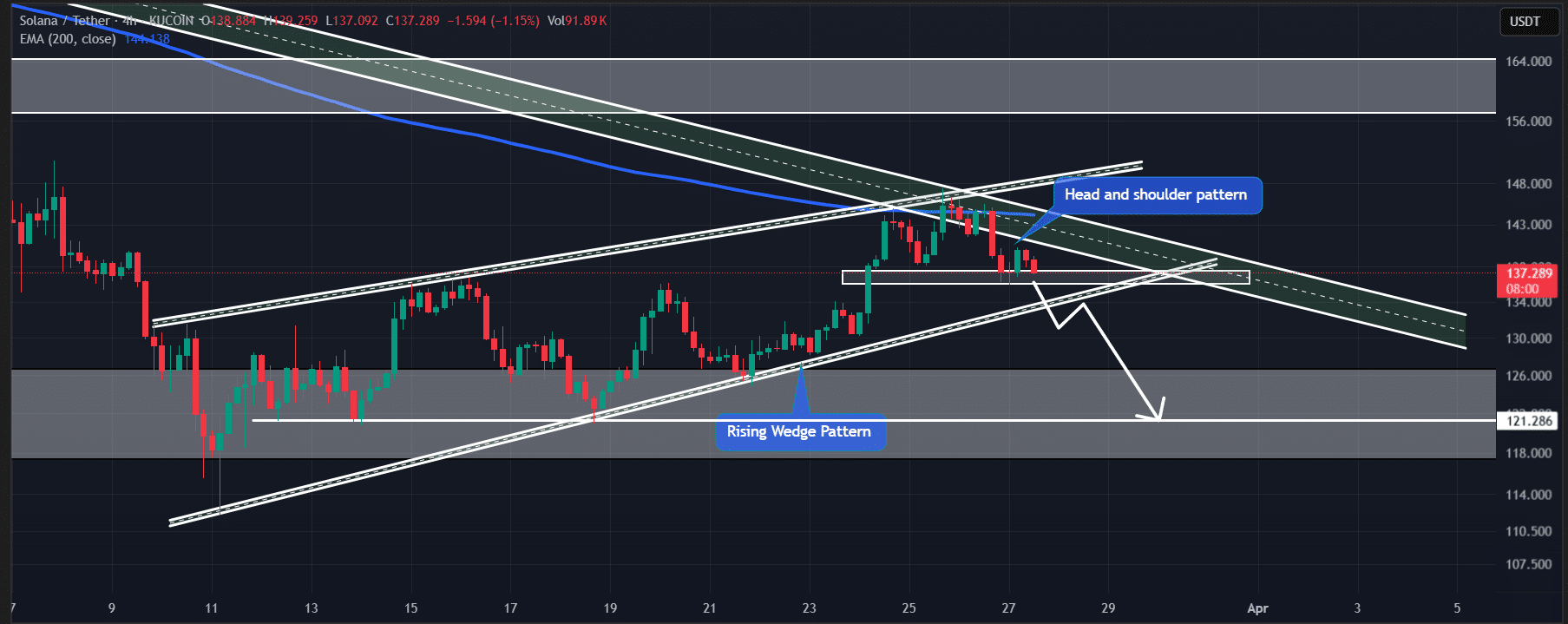

Whereas the broader market recovers, Solana has fashioned a bearish falling wedge sample on the four-hour timeframe, just like Bitcoin [BTC].

Solana’s technical evaluation and value motion

At press time, SOL was buying and selling close to $137.5, reflecting a 4.76% value drop prior to now 24 hours.

Its buying and selling quantity fell by 10% throughout this era, indicating decreased dealer and investor participation in comparison with the day before today.

The value drop has introduced SOL to the neckline of a bearish head and shoulders sample on the four-hour timeframe, situated inside a rising wedge, with $136 because the neckline.

AMBCrypto’s technical evaluation means that if SOL closes a four-hour candle under $136, it may drop by 12%, reaching $120 within the coming days.

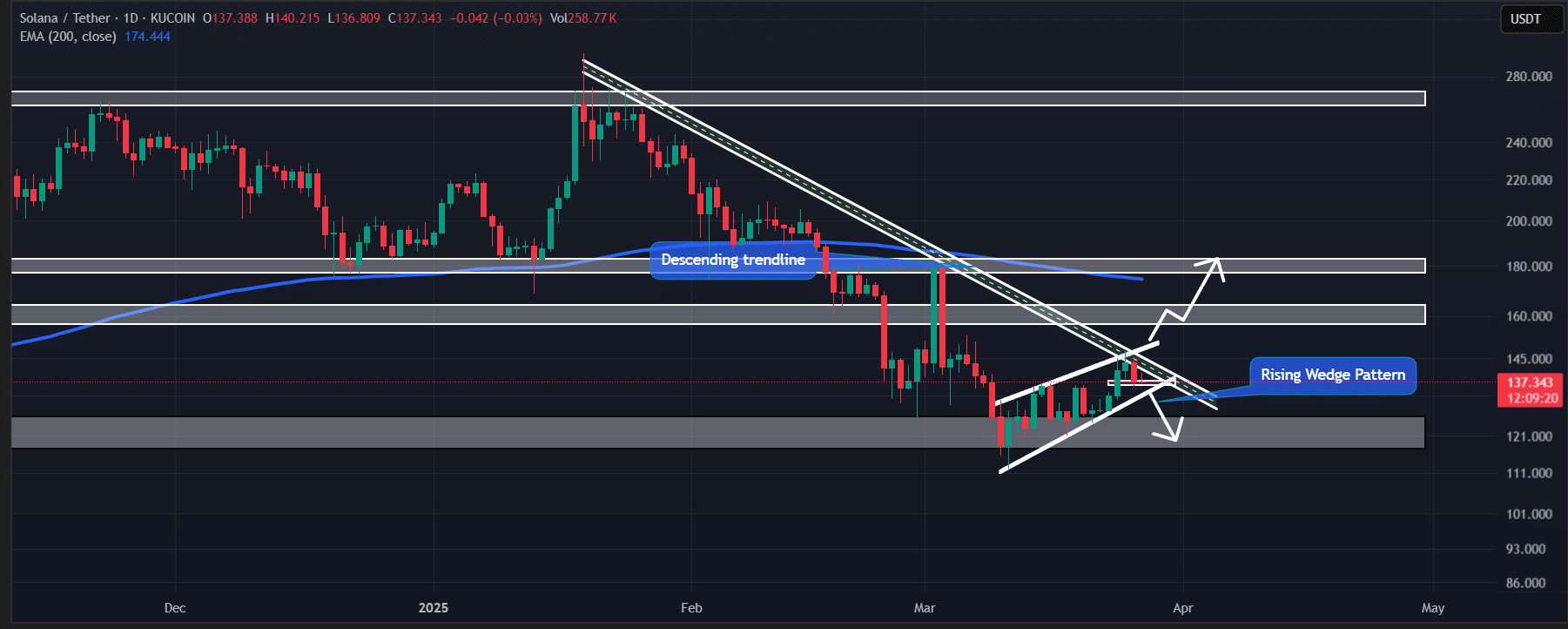

Along with these bearish patterns, SOL has confronted rejection from a descending trendline that has acted as a resistance degree since January 2025.

This rejection, mixed with the formation of a bearish engulfing candlestick sample, strengthens the bearish outlook.

Nonetheless, the bearish sentiment may change if Solana breaks the descending trendline and closes a day by day candle above $147.50. If this happens, SOL may doubtlessly rise by 22% to achieve $180 sooner or later.

Indicator flashing sell-signal, says analyst

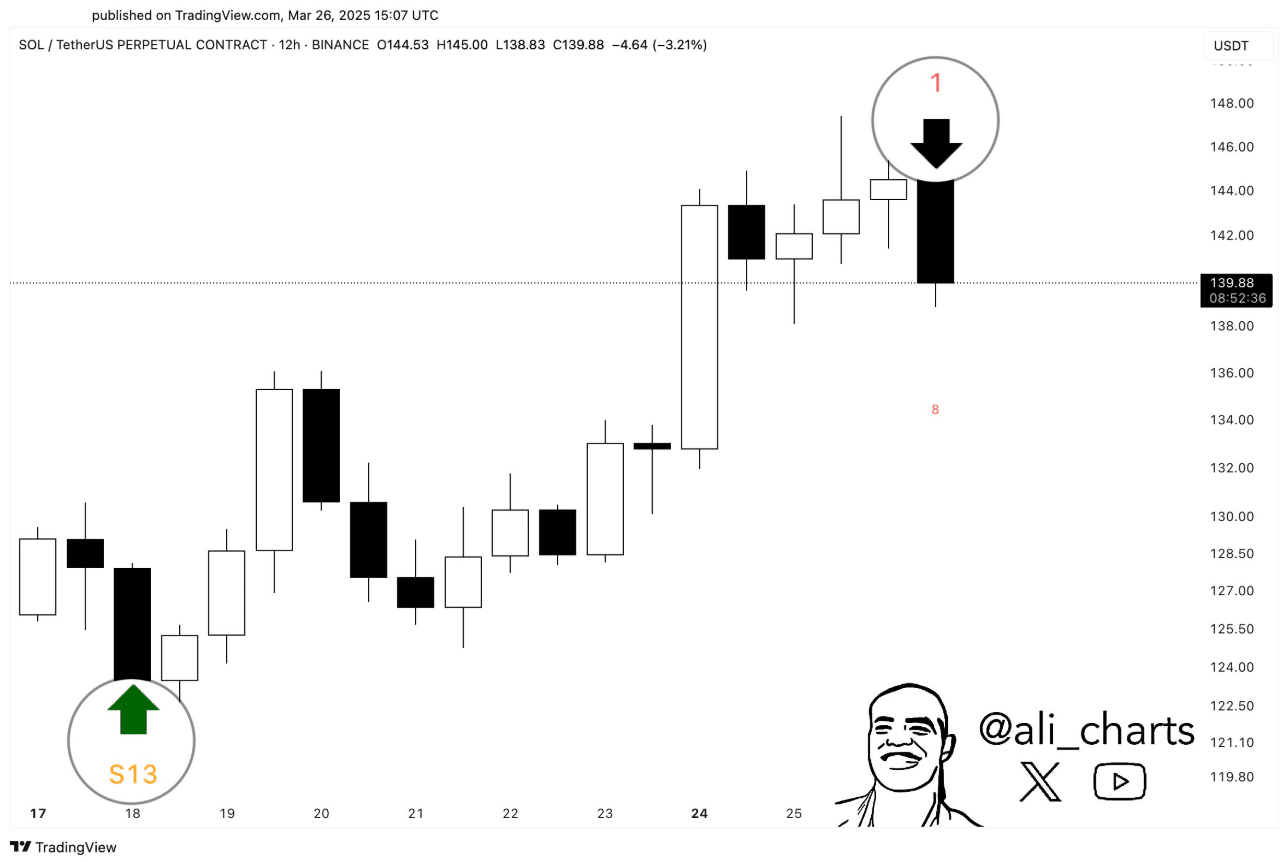

A notable crypto skilled on X (previously Twitter) has reinforced the bearish outlook for Solana.

The skilled highlighted that the TD Sequential indicator, which beforehand signaled a purchase forward of SOL’s 22% rally, now exhibits a promote sign.

This raises questions on whether or not the worth will proceed to say no, or if the indicator is merely a sign.

Merchants bullish view for Solana

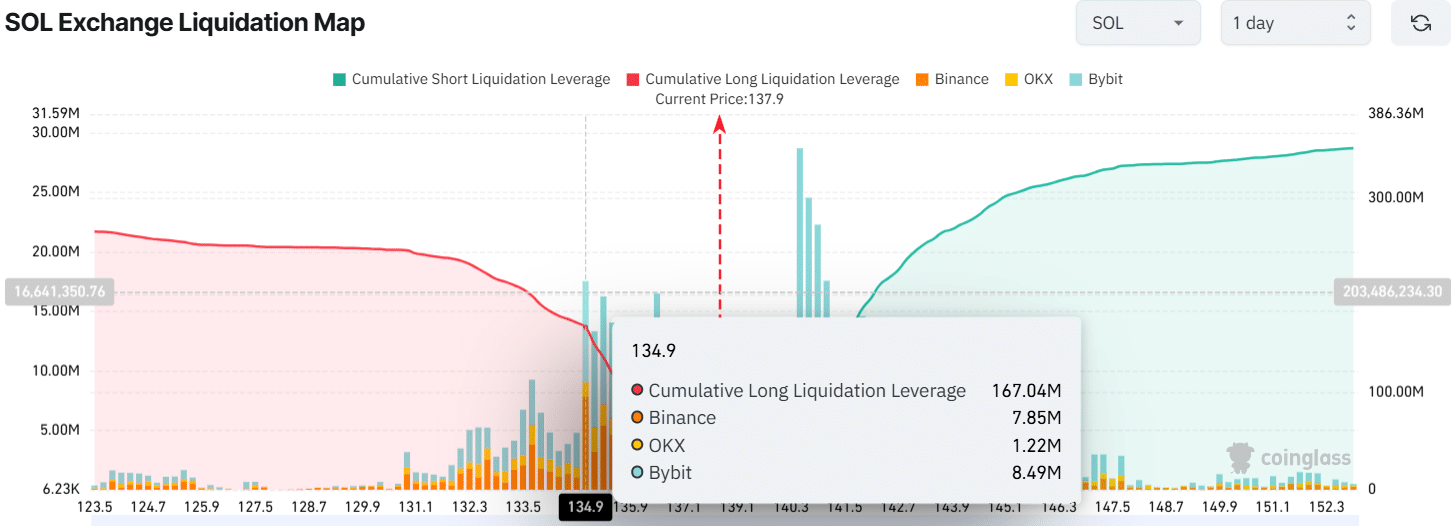

Nonetheless, intraday merchants seem like performing opposite to the general market sentiment, as they’re strongly betting on the lengthy aspect.

Knowledge from the on-chain analytics agency Coinglass revealed that merchants are at the moment over-leveraged at $135 on the decrease aspect, holding $167 million value of lengthy positions.

In the meantime, $140 is one other overleveraged degree the place intraday merchants have constructed $83 million value of quick positions.

This highlights that bulls are at the moment dominating regardless of the bearish outlook, which is stopping SOL from falling additional.