- Solana struggles with fading momentum, low velocity, and weakening demand, trapped under $135 resistance.

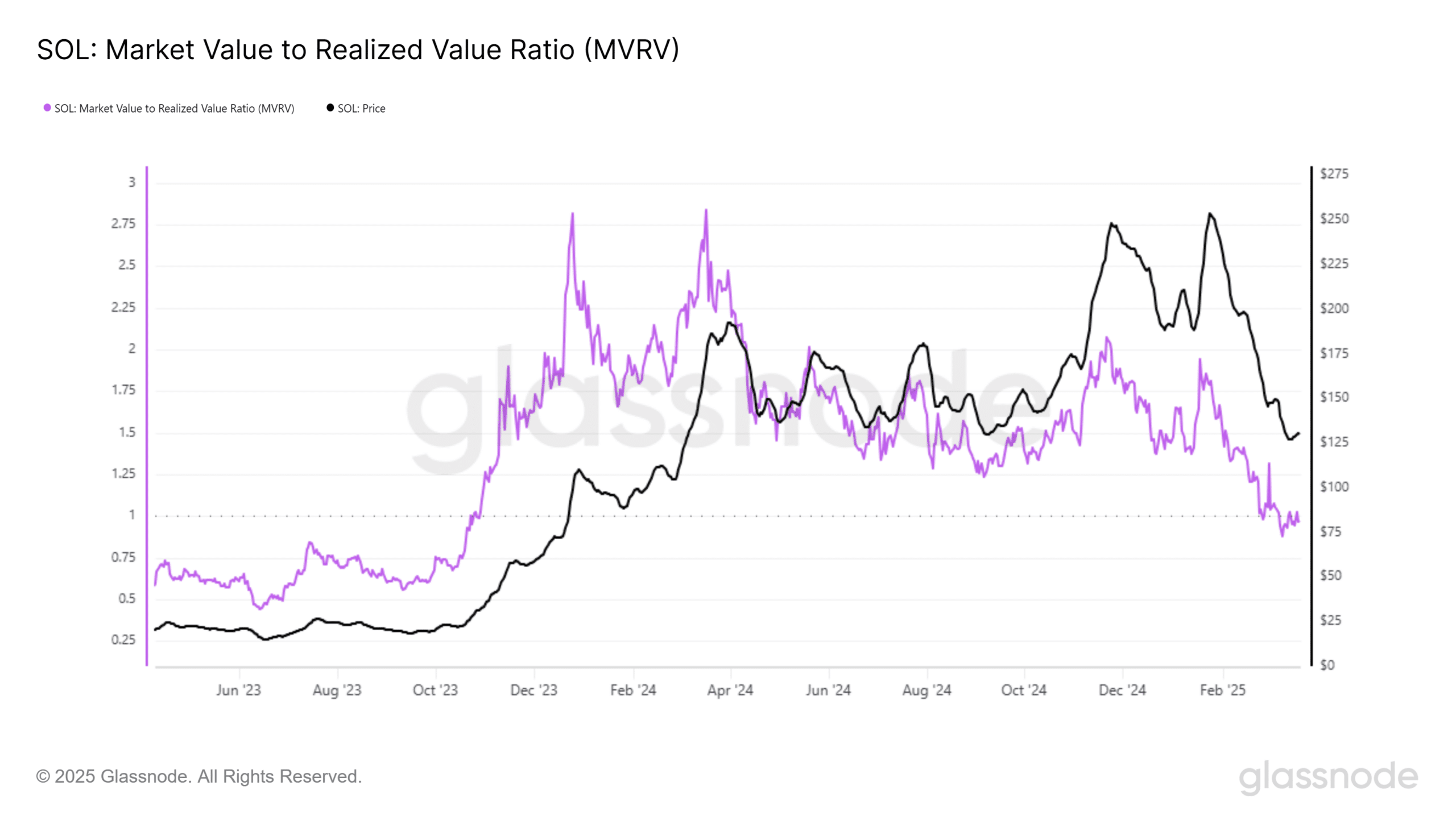

- SOL faces capitulation threat as MVRV ratio dips under zero, signaling rising bearish stress.

Is Solana [SOL] shedding steam?

After displaying early indicators of restoration, Solana is as soon as once more grappling with fading momentum and weakening demand.

Now hovering round $130, SOL stays caught under the essential $135 resistance degree — unable to construct on previous features.

With broader market situations turning cautious and threat urge for food cooling, the outlook for Solana seems more and more unsure.

As traders flip their consideration to extra resilient belongings, questions are mounting about whether or not SOL can reclaim its bullish footing or if it’s getting into a protracted consolidation section.

Solana’s MVRV ratio has dipped under the zero mark, signaling that current consumers — particularly those that entered the market throughout the final two weeks — at the moment are sitting on unrealized losses.

Because the chart exhibits, that is the bottom MVRV degree since early 2023, reinforcing the bearish development gripping SOL.

A unfavorable MVRV traditionally heightens the danger of capitulation, the place short-term holders promote to chop losses, additional driving down worth.

Until traders resolve to carry in hopes of a turnaround, this stress might deepen Solana’s stoop. For now, sentiment stays cautious, and with out a bullish catalyst, the market might battle to reverse course.

This zone of loss is a hazard zone — particularly if broader crypto situations proceed to weaken.

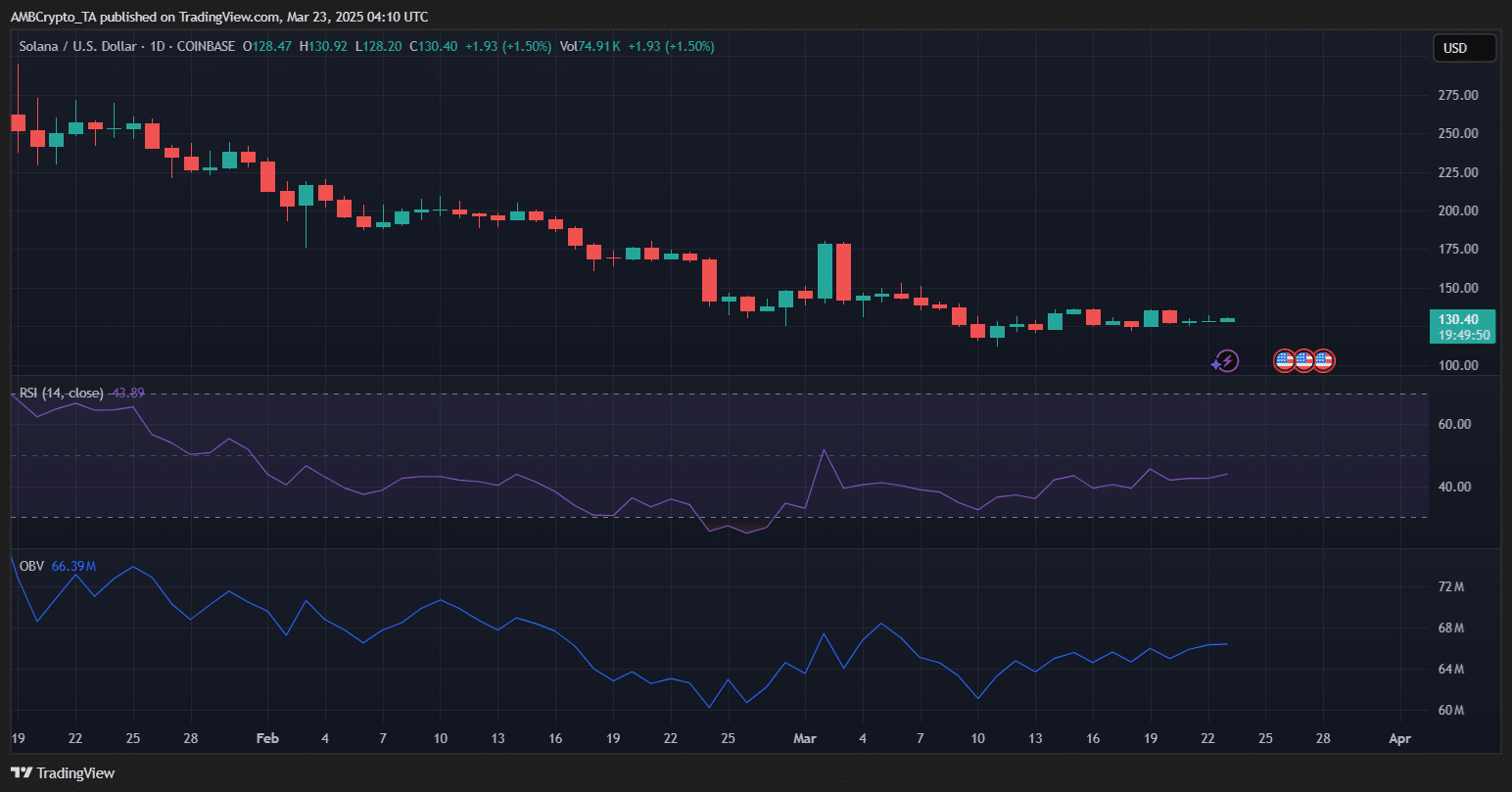

SOL stalls as momentum fades under $135

Solana was buying and selling at $130.40, displaying minor features of 1.5% on the day, however the broader development remained weak. The RSI was 43.89 — under the impartial 50 mark — indicating fading bullish momentum.

In the meantime, the OBV was comparatively flat round 66.39 million, suggesting a scarcity of robust accumulation or distribution stress.

SOL’s worth has been consolidating in a slender vary after its current correction, struggling to interrupt above the $135 resistance zone. If consumers fail to reclaim that degree, the value might revisit the $120-$125 assist band.

On the flip aspect, a decisive breakout above $135 might open the door towards $150, although present indicators level to indecision and weakening demand.