Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

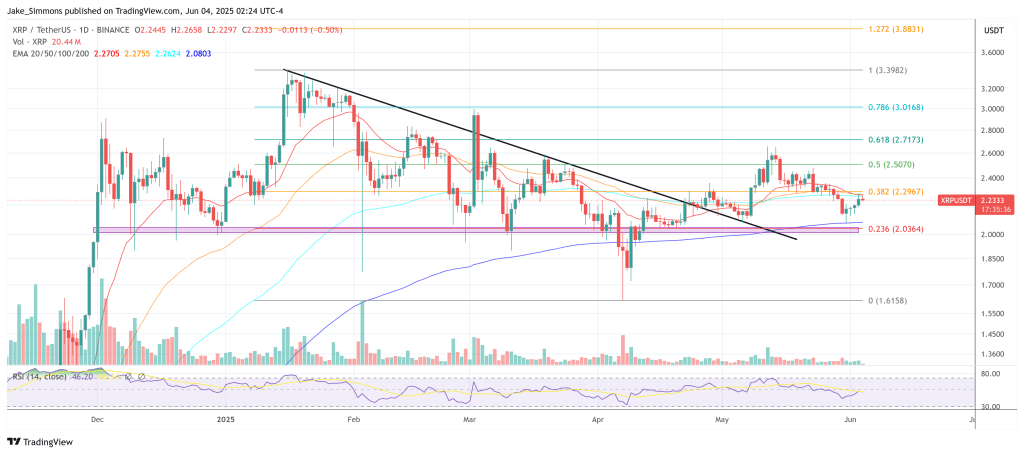

XRP’s weekly construction has seldom regarded as compressed because it does within the chart revealed this morning by unbiased analyst Maelius. The view pulls information from the BITSTAMP feed and applies a 50-period exponential transferring common (EMA) in blue, presently monitoring at roughly $1.78.

This XRP Chart Screams 2017

Worth is perched above that dynamic assist zone at $2.25, including 3.33% to date within the current weekly candle, and has spent the previous 4 months knitting out what the analyst calls a “giga bull flag.” The flag is outlined by a sequence of progressively decrease weekly highs that cease simply in need of the $3.40 line and better swing-lows that backside close to $1.61, making a converging wedge whose decrease edge and the rising EMA50 now coincide.

Maelius overlays the 2017 XRP advance—scaled to the present log axis—for example why the sample issues. Within the previous cycle the token erupted vertically as soon as the flag was resolved, blasting from sub-dollar costs to a peak above $3.00 in a matter of weeks.

Associated Studying

The black schematic sketched on the right-hand margin recreates that transfer and tasks it ahead: as soon as consolidation ends, the fractal implies a breakout first by means of the $4 shelf and finally into the double-digit territory. The label “XRP 2017” is pinned to the $19 mark, the extent the place the composite hint tops out on this overlay.

Momentum information beneath the chart reinforce the comparability. The weekly Relative Power Index (RSI) printed two pronounced peaks within the 2017 run, separated by a flat plateau; Maelius has marked these crests “1” and “2” on each the historic part and the present vary.

Associated Studying

The primary modern-cycle surge despatched RSI briefly into the high-80s earlier this yr and has since cooled again towards the mid-40s, a zone the analyst shades “FLAT.” An arrow then extends towards the mid-90s, signalling that Maelius expects at the least another momentum pulse earlier than the construction is exhausted.

From a purely technical perspective probably the most quick ranges to look at are the higher flag boundary close to $2.50 and the EMA-anchored assist round $1.80. A weekly shut above the previous would full the flag and open the way in which to the $4.40 and $6.00 horizontals seen on the worth scale, whereas a decisive break under $1.80 would invalidate the sample and go away the market leaning on the $1.30 cluster the place the EMA turned increased final yr.

Crucially, the analyst frames his outlook in risk-aware phrases: even the “worst-case” situation he sketches nonetheless consists of one remaining impulse wave. “Worst case is there’s only one impulse left. Bearish, proper?!” he writes.

As at all times, merchants will likely be on the lookout for affirmation from quantity and broader market sentiment earlier than treating the fractal as greater than an instructive historic rhyme, however the chart makes clear {that a} single weekly candle settling above the $2.50 deal with could possibly be all it takes to remind individuals of how shortly XRP has moved up to now.

At press time, XRP traded at $2.23.

Featured picture created with DALLE, chart from TradingView.com