- Information reveals an enormous 440% surge in CAKE whale exercise this week, hinting at a possible market backside.

- CAKE may soar by 40%, reaching the $4.25 degree, if it breaches and closes a day by day candle above $3.

Amid the continued market uncertainty, CAKE, the native token of PancakeSwap, has garnered vital consideration from crypto whales and was now on the verge of large upside momentum.

CAKE whale exercise spikes by 440%

Information from the on-chain analytics agency Santiment revealed that whale exercise in CAKE has soared by 439.70% previously week, indicating a possible backside for the asset and a super shopping for alternative.

This substantial surge in whale exercise can create shopping for strain and drive additional upside momentum.

Information from CoinMarketCap reveals that this elevated whale exercise has already pushed CAKE up by 38% previously week, bringing it to a vital degree.

PancakeSwap technical evaluation and worth prediction

With this substantial upside momentum over the previous week, the asset has reached a vital resistance degree, which has a robust historical past of promoting strain and subsequent worth declines.

Nevertheless, this time, sentiment seemed to be shifting in CAKE on account of rising whale exercise.

Based on skilled technical evaluation, CAKE regarded bullish because it approached the essential resistance degree of $3.

If whale exercise stays robust and the value breaches this resistance, there’s a excessive chance that the asset may soar by 40%, reaching the $4.25 degree within the coming days.

As of press time, CAKE was buying and selling above the 200 Exponential Shifting Common (EMA) on the day by day timeframe, indicating an uptrend.

The altcoin was buying and selling close to $2.62, registering a modest worth surge of 0.65% previously 24 hours.

Nevertheless, throughout the identical interval, its buying and selling quantity dropped by 55%, indicating decrease participation from merchants and traders in comparison with the day before today.

This decline in buying and selling quantity probably outcomes from excessive volatility within the asset’s worth throughout the crypto market.

Merchants’ over-leveraged ranges

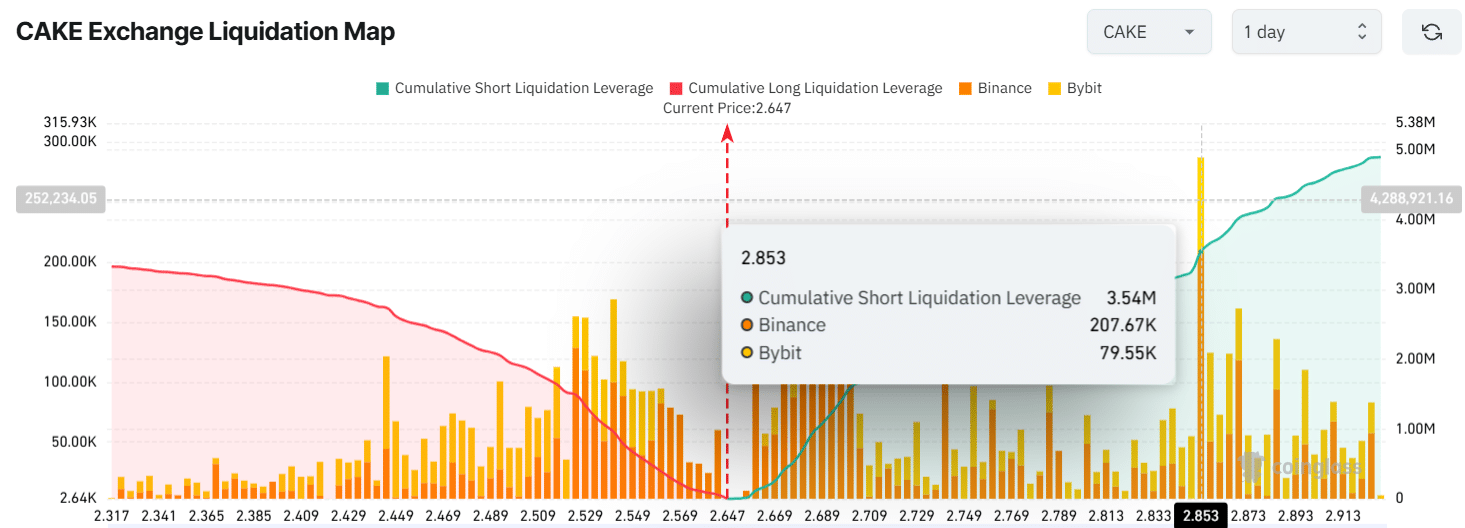

Regardless of the bullish sentiment and worth motion, intraday merchants seem to have a bearish outlook, as they’re betting on the draw back.

Information from the on-chain analytics agency Coinglass revealed that merchants had been over-leveraged at $2.445 on the decrease facet, with $2.75 million value of lengthy positions.

In the meantime, $2.85 is one other over-leveraged degree the place bears have constructed positions, presently holding $3.55 million value of quick positions.

This means that bears are dominating and consider the asset’s worth won’t surpass the $2.85 mark.