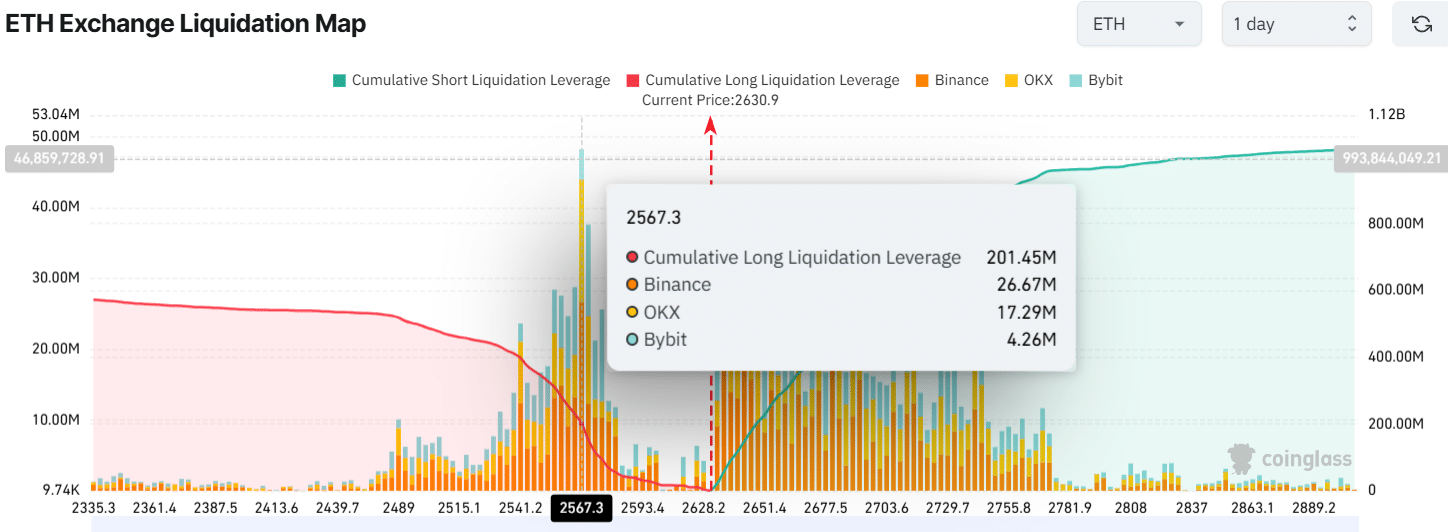

- Intraday merchants have constructed $201 million value of lengthy positions at $2,567 prior to now 24 hours.

- Ethereum may soar by 10% if it closes a four-hour candle above the $2,700 degree.

Ethereum [ETH], the world’s second-largest cryptocurrency by market cap, appears to be gaining recognition from the business’s prime crypto gamers as its value continues to fall.

Ethereum whales purchase the dip

On the twelfth of February 2025, a outstanding crypto expert posted on X (previously Twitter) that whales have bought a big 600,000 Ethereum (ETH) prior to now week.

This substantial ETH buy prior to now week highlights how whales are making the most of the current value dip, setting an ideal instance of a “Purchase the Dip” alternative.

Nevertheless, after constant accumulation, whales have been lately discovered dumping ETH tokens onto exchanges, as reported by Coinglass.

Knowledge from Spot Influx/Outflow revealed that exchanges witnessed a modest influx of $10 million value of ETH prior to now 24 hours.

Inflows consult with property shifting from long-term holders’ wallets to exchanges, creating promoting stress. Nevertheless, this influx is kind of low to have a big affect.

Merchants’ $201 million value of bets on the lengthy facet

Moreover all this, intraday merchants appear to be following the long-term holders’ strategy. At press time, merchants holding lengthy positions are over-leveraged at $2,567, with $201.5 million value of lengthy positions.

In the meantime, merchants holding brief positions are over-leveraged at $2,635, with $60 million value of brief positions.

These over-leveraged positions by intraday merchants replicate their beliefs, pursuits, and bullish sentiments. Regardless of a bullish outlook, ETH is at the moment buying and selling close to $2,630. It has skilled a value drop of over 3.25% prior to now 24 hours.

Throughout the identical interval, traders’ and merchants’ sentiment has attracted notable participation, leading to a 15% leap in buying and selling quantity.

Ethereum’s value motion and key ranges

In accordance with AMBCrypto’s technical evaluation, ETH seems to be forming a descending triangle sample within the four-hour timeframe.

It’s at the moment shifting inside a slim vary, which may result in a breakout.

Primarily based on current value motion and historic patterns, if ETH breaks out and closes a four-hour candle above $2,700, it may soar by 10% to succeed in $3,000.

Moreover, ETH is buying and selling under the 200-day Exponential Shifting Common (EMA) on the each day timeframe, indicating a downtrend.