- Toncoin maintained a bearish every day market construction.

- The excessive quantity on the current bounce gave some hope to TON bulls.

Toncoin [TON] holders weren’t doing effectively for probably the most half. Knowledge confirmed that 96% of holders have been underwater, however the token noticed a 25% value bounce previously 4 days.

But, the severity of the downtrend on the every day chart was uninterrupted.

How excessive may the present bounce go? The $3.85 resistance stage was one of many main candidates for a bearish reversal.

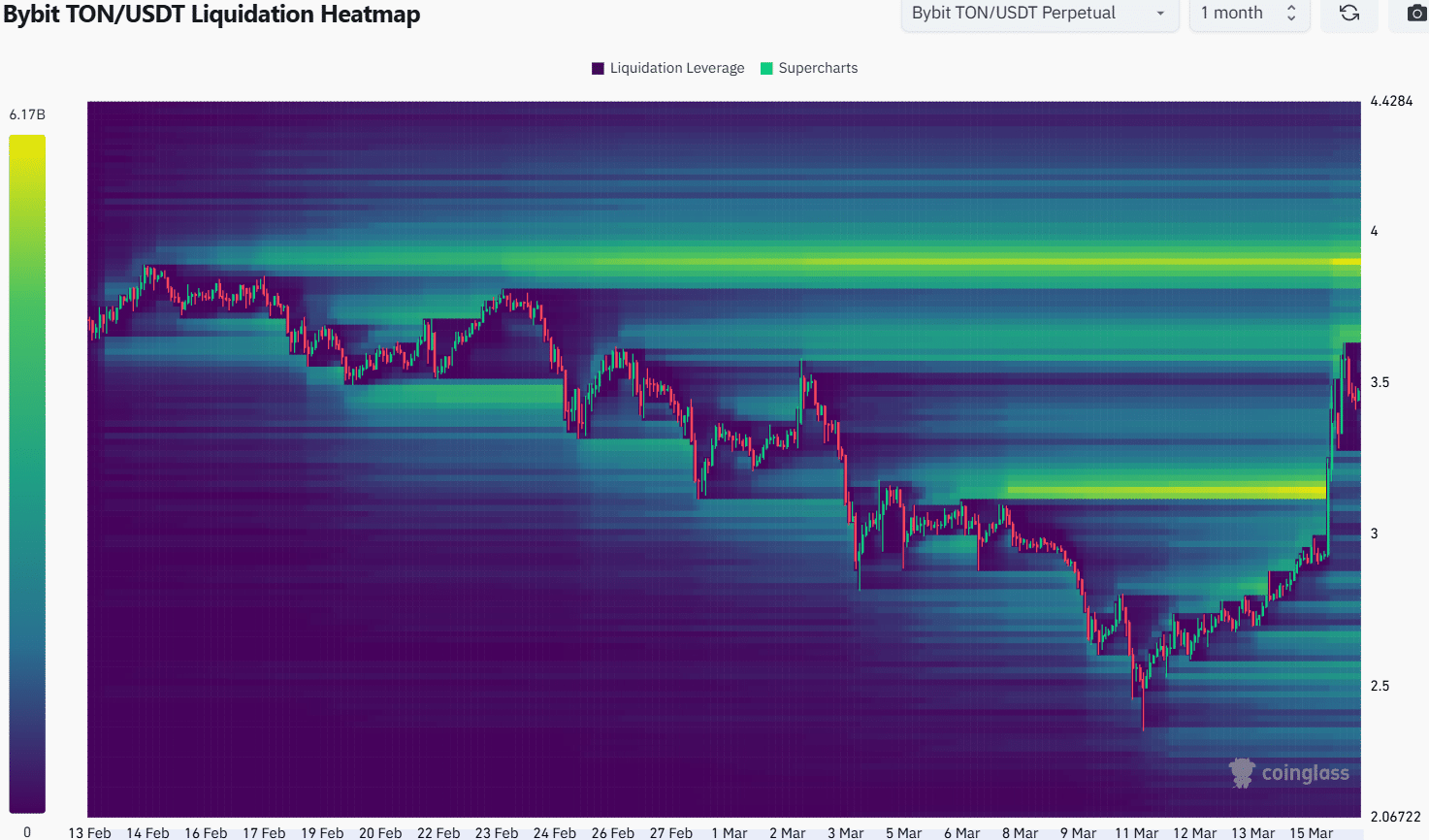

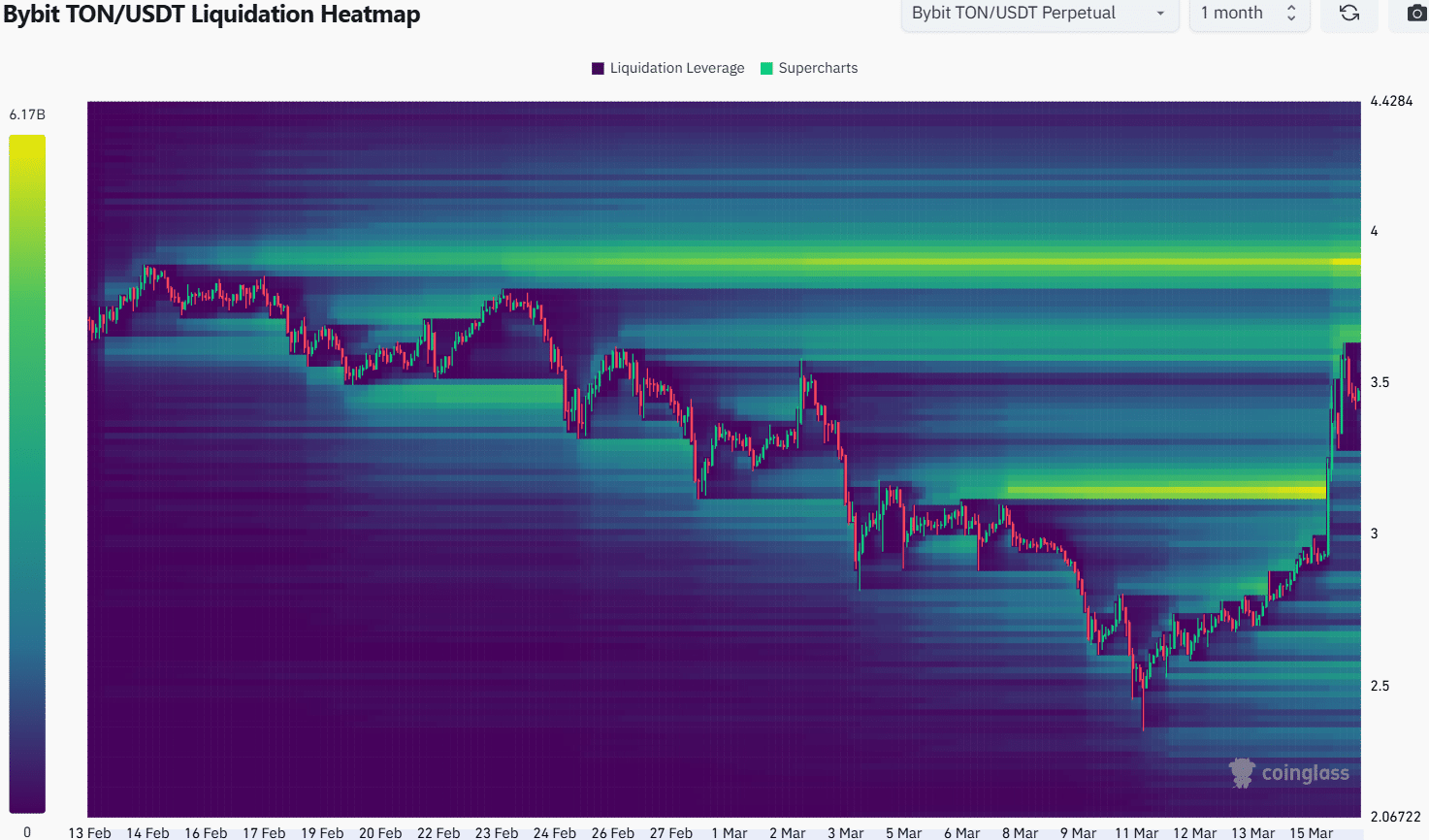

AMBCrypto examined the related liquidation heatmaps to grasp TON’s potential value strikes.

Toncoin to climb to $3.6 earlier than bearish reversal

The current decrease excessive at $3.95 from February was a possible value goal for TON within the coming days. The MACD remained beneath zero however fashioned a powerful bullish crossover.

It was in response to the short good points in current good points, however the prevalent development on this timeframe remained bearish.

Nonetheless, the excessive buying and selling quantity in current days noticed the OBV leap above the lows from December. In doing so, it sparked some hope for a bullish transfer.

The Fibonacci retracement ranges have been plotted based mostly on the rally from February to June 2024. The bounce above 78.6% was encouraging within the brief time period, however there was resistance overhead.

The $3.95 goal should be breached to impact a bullish market construction shift.

Even when this occurred, the $4.5 zone would possible act as a provide zone. General, the possibilities of a fast TON restoration have been slim.

Supply: Coinglass

The 1-month liquidation heatmap highlighted the liquidity pockets at $3.66 and $3.9. The previous stage was simply above the highs have been Saturday, and the latter marked the decrease excessive fashioned a month in the past.

Collectively, these two ranges have been the prime candidates for a bearish reversal to start at.

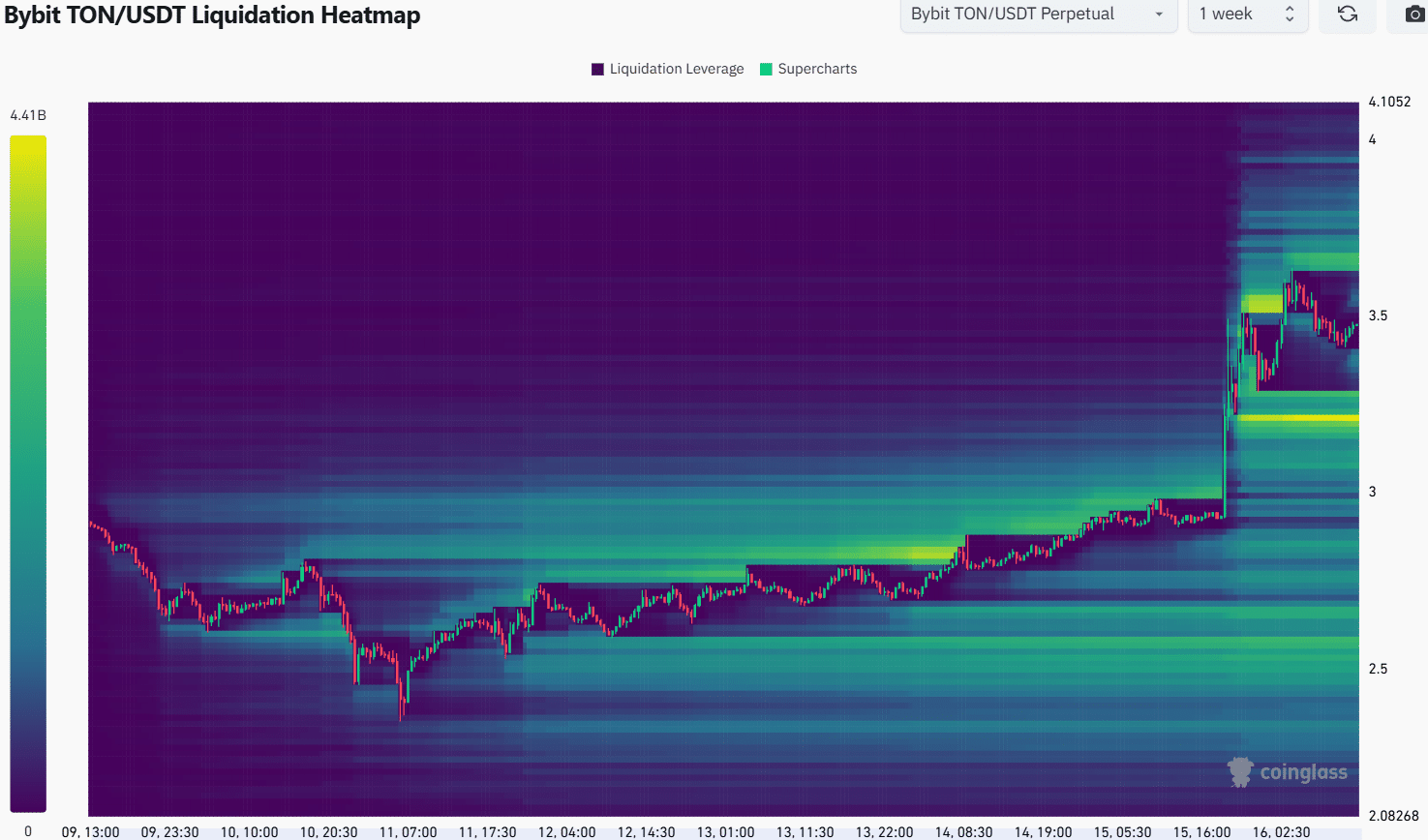

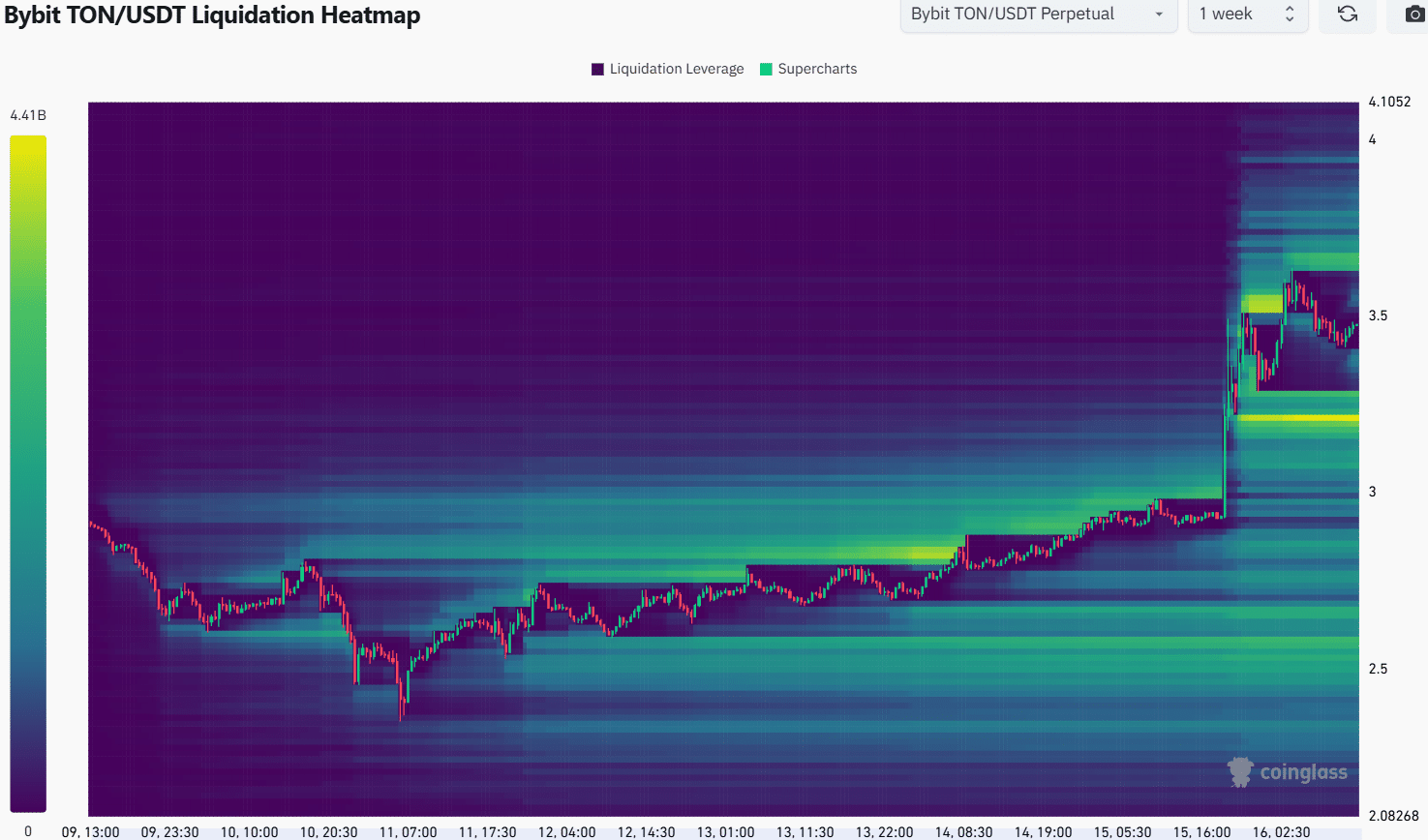

Supply: Coinglass

Zooming into the 1-week heatmap, we will see that the $3.2 and $3.67 ranges have been those to be careful for. The liquidity round $3.2 was akin to that round $3.6.

Since $3.6 was nearer, TON was extra prone to climb greater to brush the liquidity earlier than falling to $3.2.

Swing merchants can look forward to such a transfer after which search for a reversal within the decrease timeframes, focusing on a retracement of the transfer. Often, such sturdy reversals have a superb likelihood to happen on Monday.

A transfer past $3.7 would invalidate the concept of a retracement to $3.2 in the hunt for liquidity.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion