- Bitcoin miners liquidate over $27 million, sparking considerations about BTC’s potential to maintain its worth momentum.

- BTC faces key resistance at $87K whereas miner promoting stress grows—can bulls take in the affect?

Bitcoin [BTC] miners have been offloading important holdings, cashing in over $27 million in realized income. This got here at a time when BTC seemed to be adjusting inside a key worth vary.

With miners promoting aggressively, questions come up concerning the potential affect on BTC’s subsequent transfer. Will this promote stress cap Bitcoin’s upside, or is the market absorbing these liquidations?

Bitcoin miners’ income spike

Based on recent data, early Bitcoin miners have realized over $27.2 million in income as BTC hovered across the $83,000-$84,000 vary.

This marked a big liquidation part, particularly after Bitcoin’s latest pullback from its highs above $90,000.

Traditionally, such profit-taking by miners can point out a short-term cooling interval for Bitcoin’s rally, resulting in both consolidation or a possible retracement.

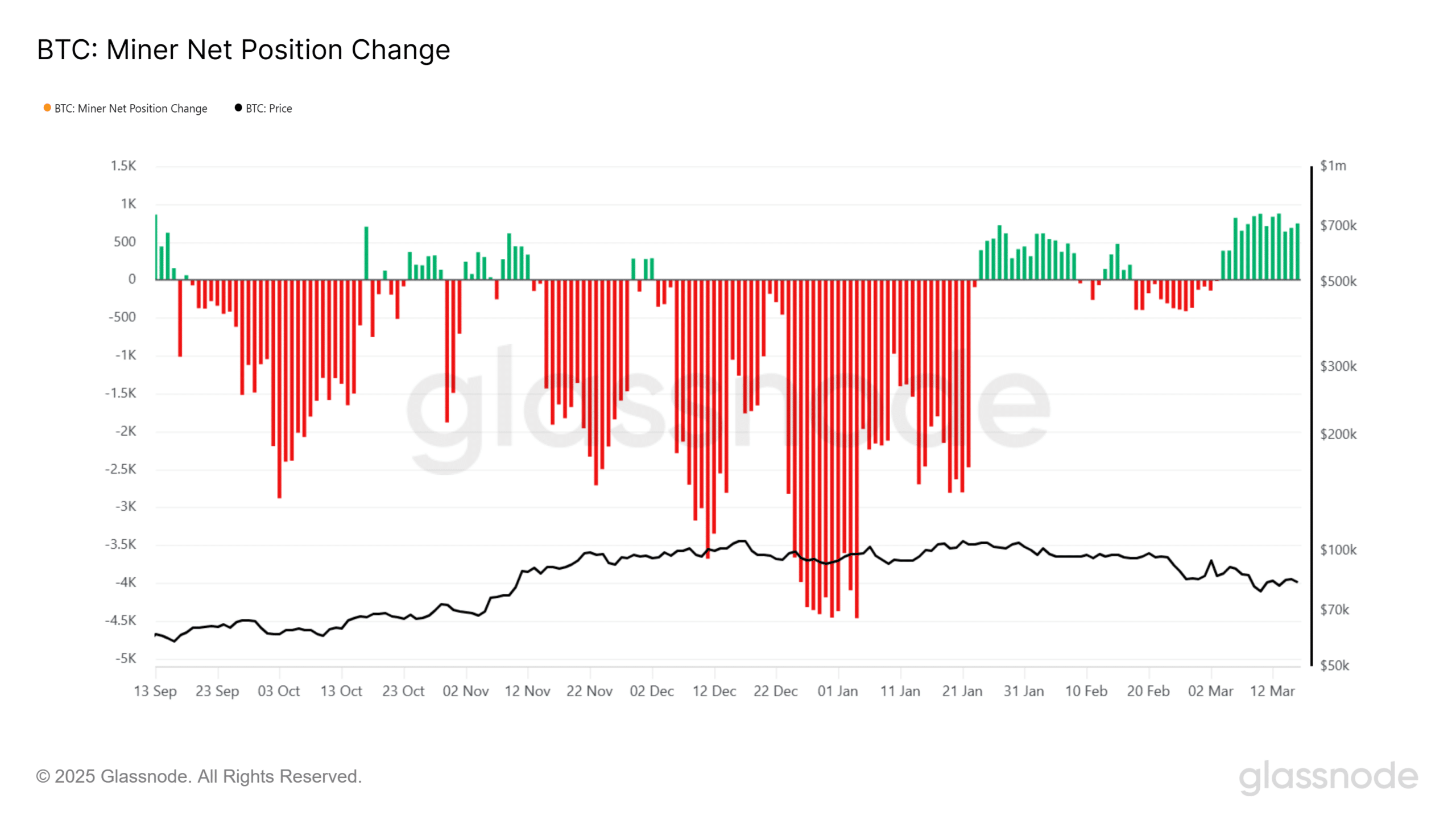

Glassnode’s miner web place change chart reveals continued promoting stress, with outflows surpassing inflows.

Miners seemed to be decreasing their holdings slightly than accumulating, reinforcing the potential for near-term worth weak spot.

How a lot BTC are miners nonetheless holding?

Regardless of the promoting spree, Bitcoin miners nonetheless retain a considerable quantity of BTC. Nonetheless, the speed at which holdings decline alerts their outlook on worth actions.

The information means that whereas some miners are securing income, others could also be holding onto BTC in anticipation of one other bullish leg.

If BTC maintains its present help ranges, a resurgence in shopping for curiosity may stabilize costs.

Alternatively, if miners proceed liquidating, Bitcoin would possibly wrestle to interrupt previous key resistance ranges, notably close to $87,000-$90,000.

Key ranges to look at

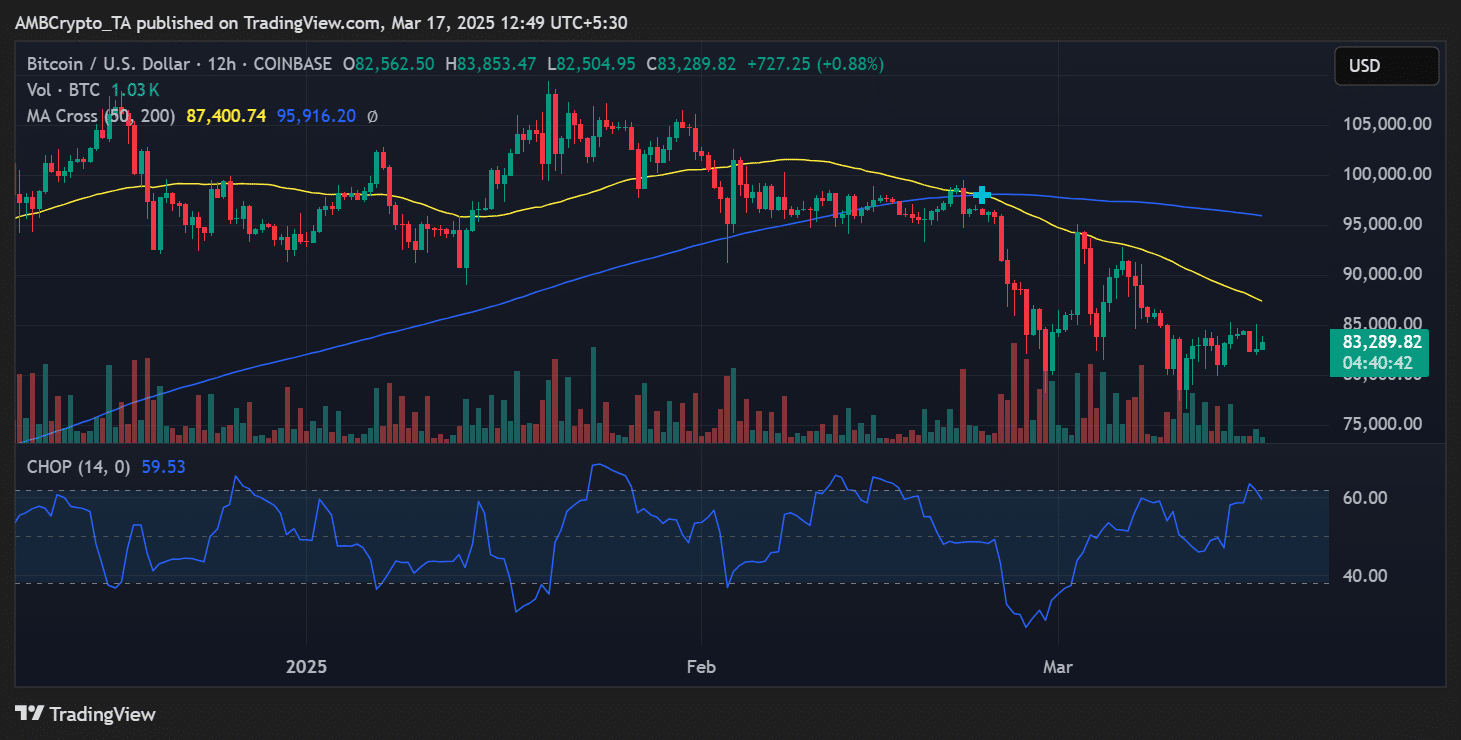

Bitcoin was buying and selling round $83,289 at press time, with the 50-day shifting common positioned at $87,400 and the 200-day shifting common close to $95,916.

These ranges function essential resistance factors that BTC must surpass to reclaim bullish momentum.

Speedy help was at $82,500. A breakdown under this degree may open the doorways to additional declines towards $80,000.

Key resistance stood at $87,000. A decisive transfer above this mark may set off renewed bullish momentum.

With miner promoting ramping up, BTC’s potential to carry its floor shall be essential in figuring out its subsequent transfer.

Merchants ought to look ahead to shifts in miner conduct, as continued sell-offs may stall Bitcoin’s upside, whereas stabilization would possibly pave the way in which for a rebound.