- XRP’s resilience and robust dip-buying demand trace at long-term breakout potential.

- With momentum constructing, can bulls push previous resistance?

Ripple’s [XRP] third dip to $1.9925 final week, adopted by a 7.40% surge, reveals traditional dip-buying in motion. Buying and selling at $2.3855, a MACD bullish crossover bolstered the uptrend, with $2.60 resistance in sight.

In the meantime, XRP/BTC neared early March ranges, with no indicators of overextension.

Whereas XRP’s resilience alerts long-term power, short-term volatility stays, as profit-taking and risk-off sentiment may shake out weak palms. An uptick in exchange reserves suggests elevated promoting strain.

If this development continues, a retracement could also be wanted earlier than the following leg up, particularly with Bitcoin nonetheless below short-term pressure. This makes one other market-wide correction doubtless.

XRP holds sturdy fundamentals amid weak spot demand

XRP/BTC reveals power, outperforming different high-caps in dip-buying. Nonetheless, Ripple nonetheless strikes in tandem with Bitcoin, not but establishing itself as a totally impartial asset.

Whereas XRP’s fundamentals stay sturdy – with whales adding 150 million XRP up to now two days and buyers reallocating funds from BTC to XRP – promote orders within the perpetual market are rising.

With weak spot demand, lively addresses at their lowest since December, and retail distribution rising, one other lengthy squeeze may problem whale efforts. In that case, breaking $2.60 resistance received’t be straightforward.

On Binance, brief orders dominated March. Whales purchased the $1.99 dip, triggering a brief squeeze that pushed costs larger. The same transfer may occur once more, given continued whale accumulation.

Nonetheless, if Bitcoin fails to interrupt $85K and one other sell-off hits, shorting strain may squeeze lengthy holders, reversing momentum. AMBCrypto breaks down the probabilities of this enjoying out.

Navigating volatility: The place XRP stands

On its 1D chart, XRP’s value carefully follows Bitcoin. Two dips to $1.99 in three weeks matched BTC falling under $80K.

XRP’s restoration has been stronger than BTC’s, drawing investor curiosity, but when Bitcoin dips once more, the previous may nonetheless revisit key help ranges.

The chance stays excessive as main BTC stakeholders are nonetheless underwater, and demand at key accumulation zones stays weak.

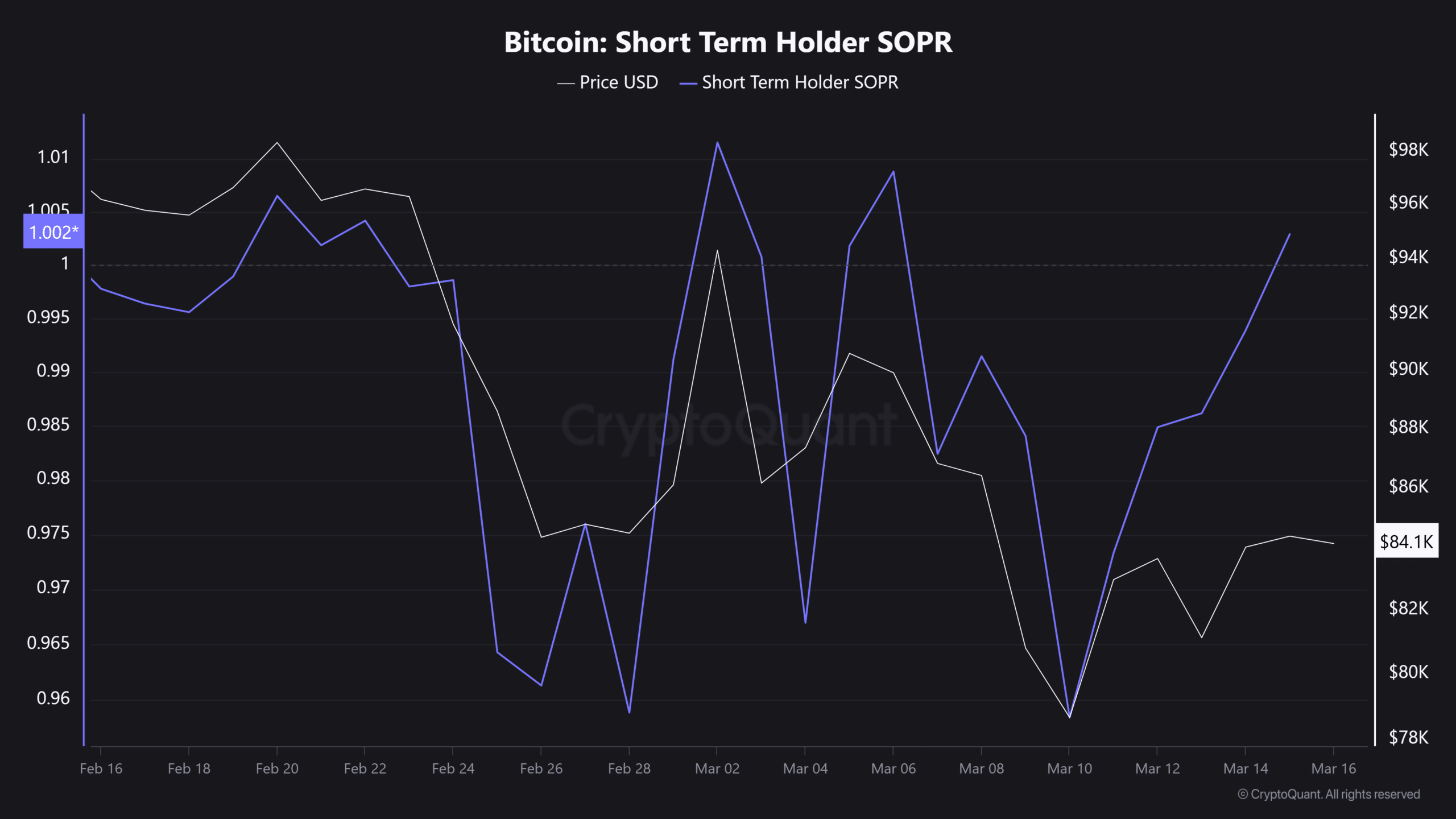

Whereas the Brief-Time period Holder SOPR reclaimed 1 as BTC bounced from $81K to $84K, low demand may make it troublesome to soak up this sell-side liquidity.

With Bitcoin dealing with resistance, XRP might retrace to $2.26 within the brief time period. Nonetheless, if BTC drops under $80K, a retest of $2 or decrease is feasible – a possibility short-sellers might capitalize on.

Regardless of sturdy fundamentals, XRP stays vulnerable to market-wide volatility, making a break above $2.60 resistance difficult except Bitcoin reclaims key resistance ranges and restores broader danger urge for food.